TAIPEI, TAIWAN – Taiwanese semiconductor giant TSMC posted better-than-expected third-quarter profits on Friday as rivals warn that demand for consumer electronics is being hit by the global economic downturn.

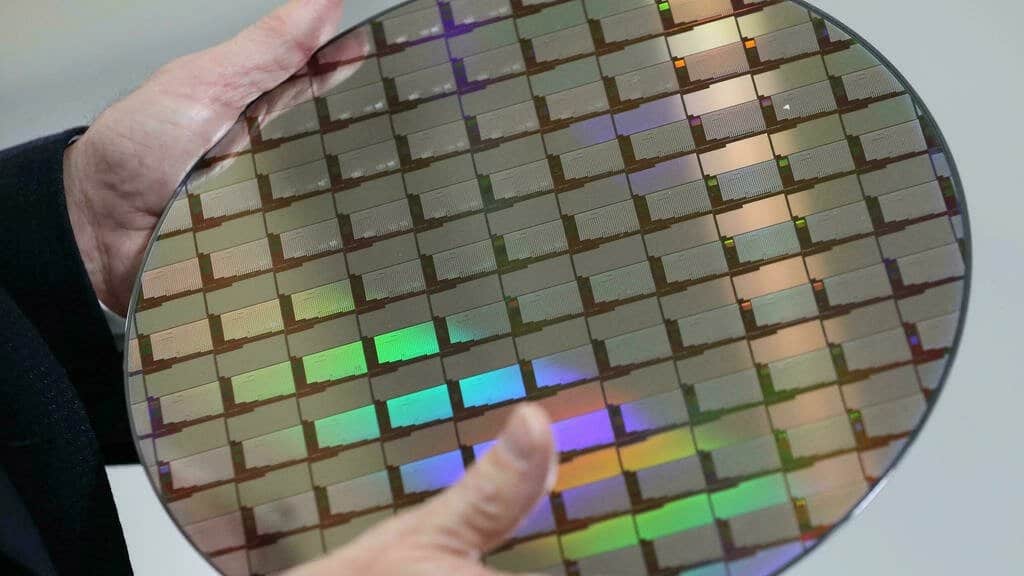

Taiwan Semiconductor Manufacturing Company operates the world’s largest silicon wafer factories and produces some of the most advanced microchips used in everything from smartphones and cars to missiles.

Revenue for September was approximately US$6.6 billion (TW$208.25 billion), down 4.5 percent from the month before but an increase of 36 percent from September last year.

Third-quarter revenue at the world’s largest contract chipmaker also rose 48 percent on-year to about $19.4 billion (TW$613 billion), according to Bloomberg News calculations.

TSMC’s results came the same day biggest rival Samsung Electronics warned it expects operating profits in the third quarter to fall 32 percent.

They also came as preliminary third-quarter sales at US chipmaker Advanced Micro Devices (AMD) missed projections by more than $1 billion.

TSMC’s results did not contain a forecast but the company is more shielded from a downturn in part because it produces some of the most advanced and smallest chips which are still highly sought after and in short supply.

The Taiwanese firm controls more than half of global foundry output, with clients including Apple and Qualcomm.