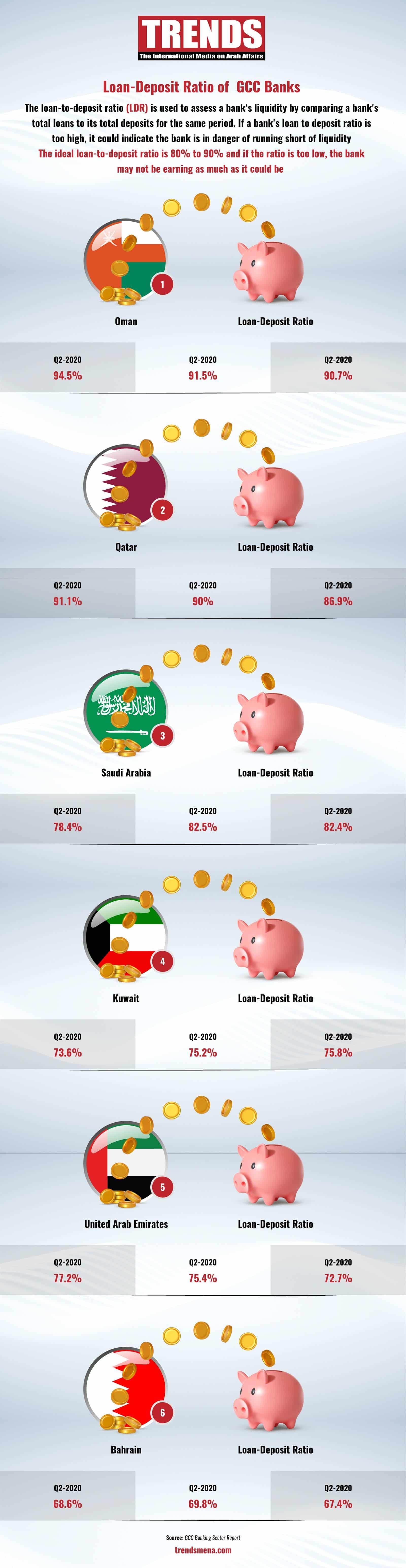

Dubai, UAE–The loan-to-deposit ratio (LDR) is used to assess a bank’s liquidity by comparing a bank’s total loans to its total deposits for the same period. The ideal loan-to-deposit ratio is 80- 90 percent. A loan-to-deposit ratio of 100 percent means a bank loaned one dollar to customers for every dollar received in deposits it received. TRENDS takes a look at the LDR of GCC banks in this infographic:

Oman’s Loan-to-Deposit ratio best in GCC

- The loan-to-deposit ratio dropped below 80 percent for the first time in seven quarters in August.

- A drop in LDR means increased level of liquidity, which in turn indicates that banks are more capable of dealing with unforeseen events like loan losses.

Today's Headlines

By signing up you agree to our Terms of Use and Privacy Policy

Most Read

Dubai, UAE — TRENDS’ yearly Special Issue is out. This year’s edition, titled Future of Humanity, explores key global shifts and brings together expert insights on old and new forces…

Some world leaders like Turkey's President Erdogan use the term genocide to describe Israeli actions in Gaza. Israel has also been accused of war crimes by rights organizations.

Abu Dhabi, UAE — Researchers at NYU Abu Dhabi (NYUAD) have developed an ingestible device that uses light to activate neurons in the gut. This new technology, called ICOPS (Ingestible…

The confirmation of an increased participation of women in workplace comes months after the TOP CEO Conference held in May 2022 had highlighted its economic justifications.