RIYADH, SAUDI ARABIA — Many indicators highlight Saudi Arabia’s progress in the essential mining industries, which are set to position the country as a key player in this sector. This development is driven by its vast mineral reserves, most notably copper.

Despite being one of the wealthiest countries in terms of mineral wealth, the Kingdom is the world’s fourth-largest importer of minerals, a fact that encourages it to focus on mining.

The past two years have seen significant strides in exploiting the vast quantities of copper discovered in several locations across the Kingdom. The most recent development occurred on June 7, 2023, when the Saudi Ministry of Investment and Indian company Vedanta signed a memorandum of understanding to develop and localize copper industries in Saudi Arabia.

The Kingdom’s Ministry of Investment states that this memorandum is part of its broader efforts to explore investment opportunities in copper value chains.

Saudi Arabia is confident that it can produce enough copper to ease a looming shortage as the world transitions to clean energy. However, the Kingdom must overcome hurdles that established mining nations have already addressed.

The Kingdom boasts untapped mineral reserves valued at $1.3 trillion. Consequently, the Saudi Arabian Mining Company (Maaden) inked a series of agreements last January to enhance its exploration and mining capabilities within Saudi Arabia.

Maaden aims to acquire 9.9% of Ivanhoe Mines’ shares for $126.4 million as part of the agreement.

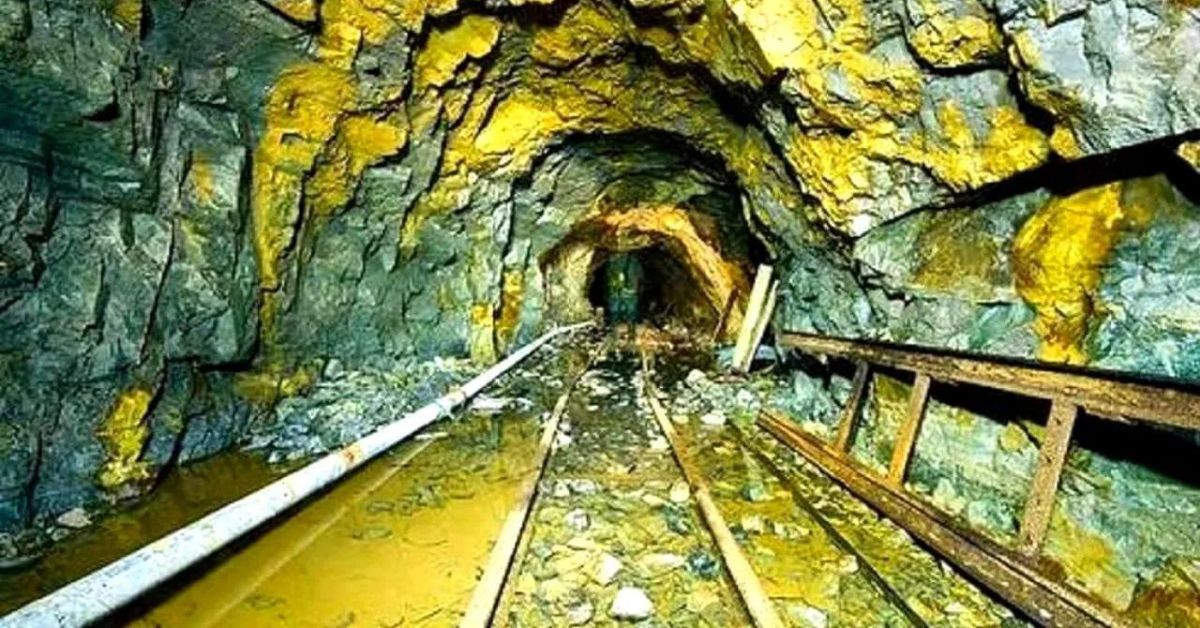

The agreement also involves using the cutting-edge “Typhoon” technology to speed up exploration operations while reducing risks and costs. This initiative targets sulfur minerals, which contain various metals, including copper.

Maaden has also agreed to form a joint venture with the Saudi Public Investment Fund to create a company that will invest in global mining assets to secure strategic minerals. The new company’s initial strategy will focus on mineral investments, notably copper ore.

Despite these opportunities, Saudi Arabia also faces significant challenges. The Kingdom identifies five mineral-rich sites, four of which are rich in copper.

The Ministry of Industry and Mineral Resources launched the pre-qualification stage of the competition for these five sites in February. These sites include “Muhdad,” “Umm Hadid,” “Al-Rudainiyah,” “Amaq Well,” and “Mount Al-Sahaiba.”

Despite the challenges, the Kingdom continues to invest heavily in copper production. It aims to mitigate the global copper shortage by releasing enough copper to meet an expected worldwide deficiency as current mines are nearing depletion.

However, according to a report by the US “Bloomberg” economic agency, Saudi Arabia faces challenges in unlocking its $1.3 trillion mineral wealth, most notably in providing logistical services and water at mining sites.

Saudi Minister of Industry and Mineral Resources Bandar Al-Khorayef noted the need for large-scale infrastructure, including roads, railways, and ports, to transport resources for processing and shipping.

The most challenging hurdle may be providing the water required to extract minerals from open or underground mines, especially given the country’s significant desert coverage.

Geological studies suggest that Saudi Arabia has vast quantities of high-quality copper resources. However, the challenges in copper production necessitate international companies specializing in overcoming these obstacles.

These challenges include mining and ore processing technology, where Saudi Arabia must leverage advanced technology and expertise.

Saudi Arabia’s collaboration with international companies in the mining industry, including copper production, contributes to expanding knowledge and technical competence. This cooperation aids in developing processes to enhance production quality and competitiveness.