DUBAI: An international real estate company has noted growing confidence in the resilient UAE real estate market, which they highlight is increasingly drawing interest from institutional investors. According to Jay French, CEO of Matthews Southwest, a private real estate development company, this shift is driven by a compelling narrative of future growth, bolstering confidence not only among investors but also individuals and families.

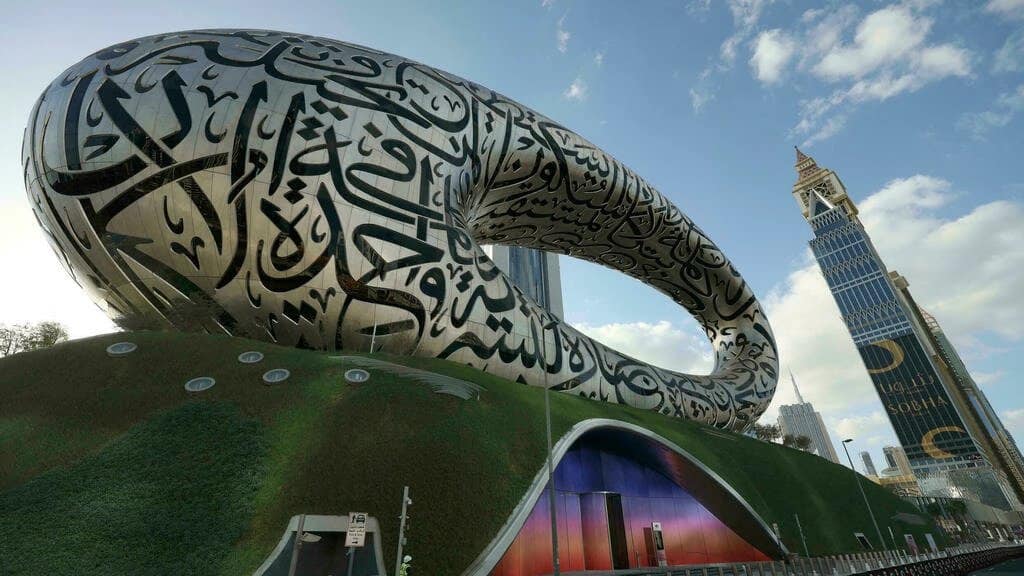

With its headquarters in Dallas (Texas), Matthews Southwest (MSW) EMEA was set up in Dubai in 2014 but had foundations laid in Canada over 30 years ago. MSW EMEA has been looking after EMEA projects that have ranged from La Mer to Dubai’s iconic project: The Museum of the Future.

Drawing from their extensive international experience across North America, Europe, and Asia, in an interview with TRENDS, French highlighted the UAE’s emergence as a dynamic market offering great potential.

Q: Drawing on your international experience across the UK, US, Canada, Singapore, and the Middle East, how would you compare the UAE’s real estate market to others in terms of innovation, opportunities and growth?

French: Definitely, UAE is on the map. It wasn’t particularly on the map, let’s say, about ten, fifteen years ago. But in the last five years, especially post-COVID, it has become much more of an interesting, I would say, emerging market still in its infancy compared to the history and the longevity of many of the other places you just mentioned… Singapore, Hong Kong, London, the UK. Even New York, Toronto, and LA have been around for a lot longer. That’s an advantage and a disadvantage to Dubai. But right now, it’s focusing more on it as an advantage. And we’re seeing a lot more robustness in the market from legal regulations and standards. From an institutional investor-based viewpoint, it’s becoming of interest more now than it ever has been. And that’s a credit to what they’ve been able to build from a critical mass point of view, what the storytelling of the future it’s been able to portray to the world, the confidence it’s been able to give to not just investors, but to individuals and families. You used to say it about America: “where you’d have a dollar and a dream”. And I think if you have a Dirham and a dream, you can get things done in the UAE. That’s exciting for a lot of the world right now, given a lot of the headwinds that we’re seeing and the geopolitical issues that we’re seeing in Europe, the UK, and also in America with the uncertainty of what’s happening with the new Trump administration. So, the UAE has positioned itself very strategically as a hub as well. The Emirates has been a great success story for that. You can reach 5 million population within a five-hour flight. So, the UAE is blessed that way with seaports. From a trading location, it’s always had a great history. Now it’s just multiplying and multiplying and multiplying and building success on success.

Q: What strategies have you used in a way to manage a portfolio of 4 billion dirhams worth of projects effectively? Are you reconsidering your business model of not investing? Would the potential here change your initial plans for the region in the short and long term?

French: What we do is we’re in a lucky position where we’re very long-term. So, we like to take our time and choose our projects and our partners wisely and, hopefully, successfully. And we have not failed on a project in over 30 years. So, we have a good track record of getting the right approach and the right feel. Being in the right place at the right time has been something we’ve been lucky or smart, depending on how you want to describe it. For Dubai, we continue on the course of being selective, but yet open to opportunities. I think we’re more confident now in Dubai and the projects that we’ve delivered in our portfolio. Our next step here would be bringing our investment and equity ownership into a joint venture project or our project ourselves. We’re looking to make that next stage or next leap because of the confidence and the fact we’ve understood the market now on the ground with a very complex life project, with very important people and great firms that will make that next step. We’re also keeping one eye on Europe as well because when you do see some softening in markets for real estate developers, that always provides opportunity.

It’s not just building the boom times, but it’s also being selective and looking at what model and our track record, our partners and our capabilities would work very well in Europe. So that’s another angle where we would have more of an EMEA footprint with a strong foothold in Dubai, but also an opportunistic view into Europe.

Q: What trends do you predict or shape the future of real estate in the region? And where would the ESG fit across the whole landscape? You have expertise in mixed-use projects globally with retail, residential and a community component. Is this going to grow more?

French: We are a social developer in some ways. We border between capitalistic and social developer. We’re very much family-first, and our values are such that the community means a lot to us. In terms of what trends we would like to see that not only incorporate our values but incorporate what we think is in demand and undersupplied and touches all of our DNA. This would be the replication, for example, of our tribute development in Dallas – an award-winning Community of the Year in a Dallas–Fort Worth metroplex, which is a wonderful, curated, beautifully architectural, family-led community with lifestyle amenities, a real sense of pride of ownership. We believe that the market needs to shift here from building just concrete boxes. Architecturally, all the villas here are literally the same, whereas ours blends a little bit more of a European-North American with an Arabic historical additive to it, where it’s built out of steel frame. This is the next move that Dubai needs to regulate to accept international practices when it comes to residential steel frame housing. Basically, you completely remove the concrete, if not, 90%, 95% of any concrete, which has a massive carbon footprint.

You jump immediately to a LEED gold community. Then further with a few different tweaks and ingredients from an ESG point of view, you can get to LEED platinum quite easily. Then you’ve got not only a wonderful architectural entertainment house with a great flow and a front yard, and backyard with great amenities all around it, but you’ve also got a sense of pride of ownership. You’ve got a sustainability performance house post-COVID as well, too, with fantastic air filtering, which is much needed here because of the air quality. I think that we would like to be on top of that trend. And that’s something where I think if we were able to find the right land partner to do that with, I think we would be an example, I believe, of the communities of the future. And so going from Museum of the Future to Community of the Future would be a nice story for us to tell.

Q: What was the vision behind the Museum of the Future project and how does it mirror Dubai’s ambitions for innovation and sustainability, and how has this been incorporated into the overall development process?

French: The Museum of the Future was envisioned as a beacon of possibility, a place, a location, a physical manifestation where innovation, sustainability, and imagination converge. It’s always reflected Dubai’s ambition, where it’s positioned and wants to be – a position of a leader in shaping the future. And that could be through cutting-edge technology or sustainability solutions or cultural explorations. So the Museum of the Future was a really bold statement by the Prime Minister’s office to show locally and regionally as well as globally the world, what it stood for and that it’s a forward, positive, future-looking, glass half-fold type of society and government that wants to push positivity forward and show that the future is full of opportunities rather than being reactive. It’s a symbol of being proactive. And it’s architecturally a piece of jewelry, as I would like to describe it, that embodies a lot of storytelling. And that’s what I think differentiates a lot of, I would say, iconic buildings versus a typical building or an attractive building.

An iconic building embodies a lot more artistic understanding, and interpretation, and presents a story to not just one story, but a lot of people get different stories from some of the world’s best icons.

Q: How do you see it shaping perceptions of the UAE as a global hub for innovation and culture?

French: It’s a positive statement of intent. It’s providing a hub of innovation and looking at risk-taking calculated decisions, using it as an incubation. And really, it’s a symbol of Dubai in a way that Dubai really is an incubator for the world. If you look at it metaphorically, so many different nationalities are coming here, with so many different ideas, thought processes, and experiences. And Dubai is a city incubator. This is a manifestation of that incubator in physical form and a meeting place of minds and people to give hope and to give insight into what the possibilities are and to showcase all the different potentials that are happening on a global scale, but also on a regional scale, and to give that real sense of pride to Dubai.