The Abu Dhabi Ports Group has tied up with France-based CMA CGM Group to sign of a 35-year concession agreement for a new terminal at the Khalifa Port in Abu Dhabi, AD Ports has said in a statement.

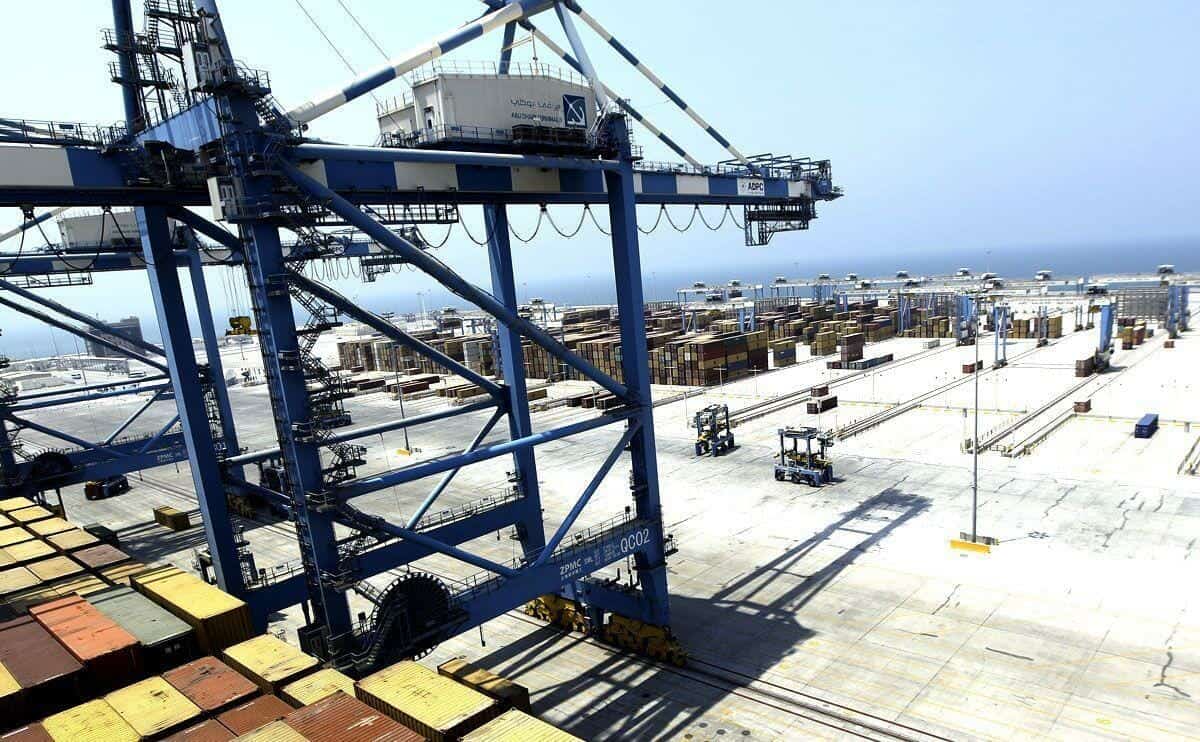

Under the terms of the agreement, a new terminal will be established in Khalifa Port, which is the first semi-automated container port in the GCC region.

The terminal will reportedly be managed by a joint venture owned by CMA CGM’s subsidiary CMA Terminals (with a 70 percent stake) and AD Ports Group (30 percent stake).

The partners are expected to commit approximately AED 570 million ($154 million) to the project.

With construction starting in 2021, the new terminal is set to be handed over in 2024, with an initial quay length of 800 meters and an estimated annual capacity of 1.8 million TEUs in phase 1.

AD Ports Group will reportedly be responsible for developing a wide range of supporting marine works and infrastructure.

This includes up to a total of 1,200 meters of quay wall, a 3,800-meter breakwater, a fully built-out rail platform, and 700,000 sq m of terminal yard.