Although the last several months have been hard for listed businesses in the Middle East, yet many have defied the dire predictions to dominate capital markets.

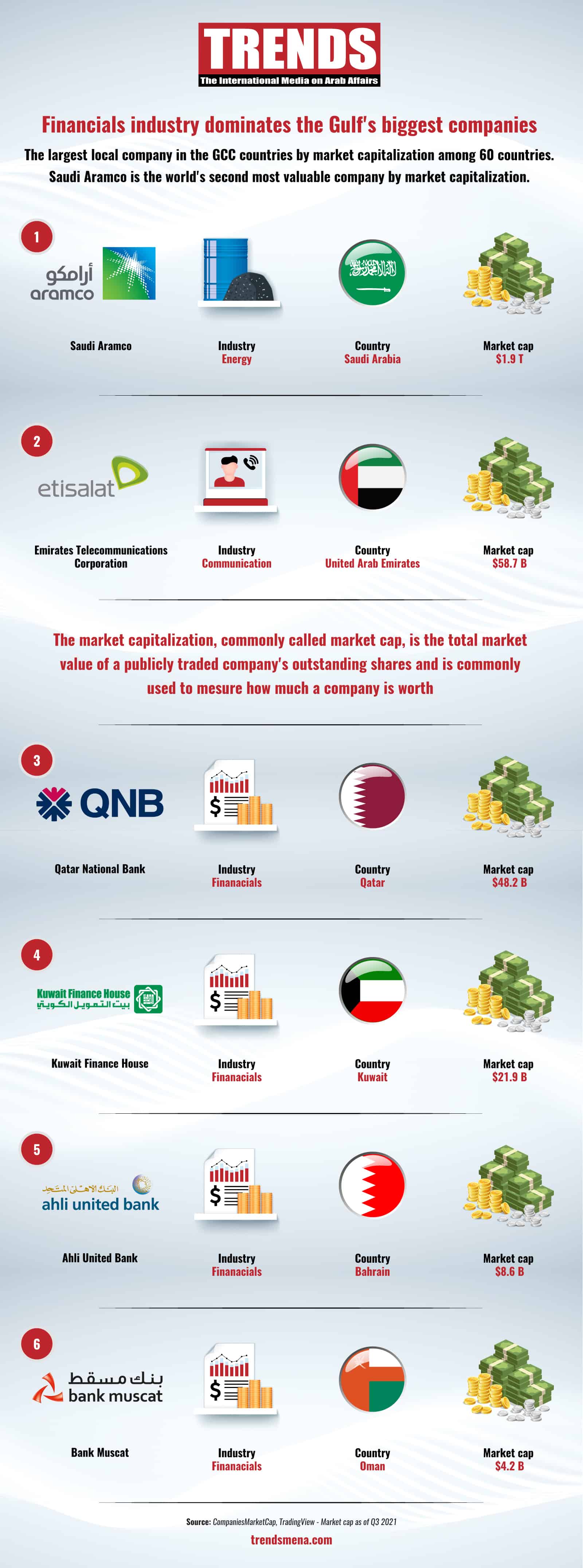

The banking and financial services sector has seen its worth grow much more than other sectors. Leading banks in the GCC have seen their businesses grow, reflected by their soaring market capitalization.

Still, individual companies like Aramco of Saudi Arabia and Etisalat of UAE are by far the most valuable companies in the region.

Aramco has surprised markets with its potential to grow and become the world’s most valuable company. Its market capitalization now stands close to $2 trillion. Growing on the back of high oil prices, the company posted an almost 82 percent rise in first-quarter net profit this month. The company posted a net income of $39.5 billion for the quarter to March 31 from $21.7 billion a year earlier.