Beijing, China – Chinese internet giant Baidu has said it was canceling the planned multi-billion-dollar purchase of livestreaming platform YY Live, partly blaming its inability to get government approval.

Baidu, the country’s top search engine company, agreed in 2020 to buy JOYY Inc’s Chinese live video business YY Live for $3.6 billion.

Baidu founder Robin Li said at the time the deal would “catapult Baidu into a leading platform for live streaming and diversify our revenue source”.

But Baidu said in a Hong Kong stock exchange filing on Monday that it would terminate the purchase agreement.

It explained that “the closing of the proposed acquisition is subject to certain conditions including, among others, obtaining necessary regulatory approvals from governmental authorities”.

As of December 31, 2023, it said, those conditions had not been reached.

The deal was originally expected to be completed by 2021.

Livestreaming is a multimillion-dollar business in China, generating huge profits for e-commerce giants and popular influencers.

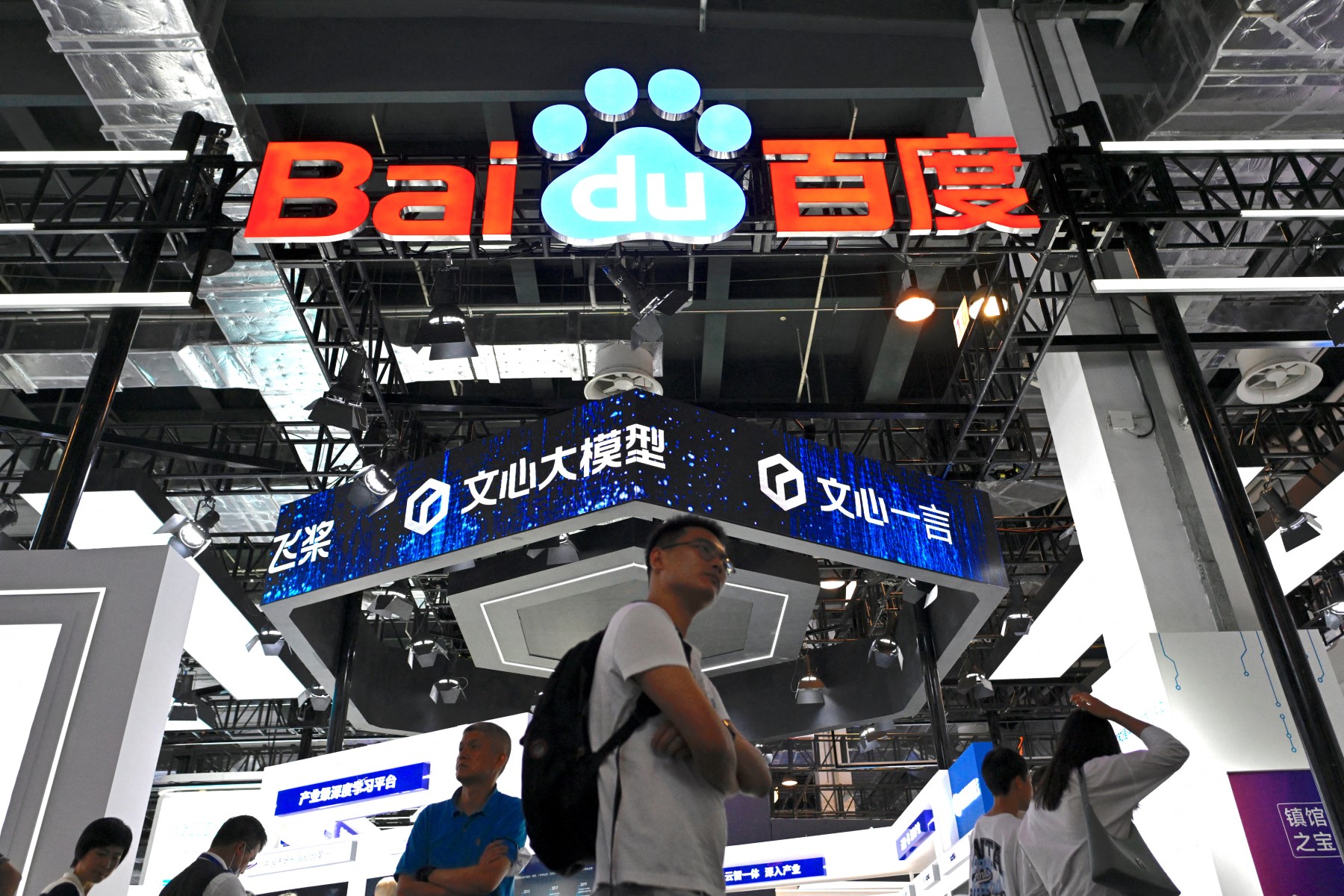

Baidu has faced increased competition in recent years from domestic rivals including Tencent — which operates the WeChat messaging platform — and ByteDance, which owns short-video app TikTok and its mainland Chinese equivalent, Douyin.

The company has sought to diversify into cloud computing, autonomous driving, artificial intelligence (AI) and other sectors — with mixed results.

Baidu’s shares fell in March after investors were unimpressed by the company’s ChatGPT-like AI software, “Ernie Bot”.

The company in November announced modest year-on-year revenue growth of 6.0 percent for the third quarter of 2023.