The relations between the Arab world and China have touched new highs particularly after China launched the Belt & Road Initiative (BRI) project in September 2013.

This relationship strengthened further as China entered into strategic partnerships with Algeria, Egypt, Iran, Saudi Arabia, and the UAE. In addition, China signed similar agreements with Qatar, Jordan, Iraq, Morocco, Sudan, Oman, and Kuwait for economic cooperation.

Chinese President Xi Jinping proposed cooperation in the fields such as energy, construction and infrastructure, trade and investment and nuclear energy, aerospace, and new energy frameworks in 2014.

He also encouraged economic cooperation initiatives to increase from US$240bn in 2013 to US$600bn in 2023.

BRI Project

The BRI project is being implemented in more than 60 countries whose combined GDP is around 40 percent of the global GDP and covers two-thirds of world population.

The BRI is also known as Maritime Silk Road, entails developing advanced infrastructure, including ports, roads, railways, and industrial parks. The project spans three continents, Asia, Europe, and Africa, and is organized into key regions, expansion areas, and sub-regions.

The project is divided into the land-based Silk Road Economic Belt and the sea-based Maritime Silk Road. The Maritime Silk Road connects the Chinese coast to the Mediterranean via Singapore and India.

The initiative’s land component includes six corridors, the most notable of which is the China – Central Asia – Western Asia corridor, which connects western China to Turkey via the Arab countries.

This initiative was founded on the ruins of the ancient Silk Road, which dates to the second century BC. The Silk Road was a network of land and sea routes that connected China and Europe via the Middle East, covering more than 10,000 km. China intends to use the new path to expedite the transportation of its products to the global markets, including Asia, Europe, Africa, and South and Central America.

Chinese firms working overtime

Dozens of Chinese construction companies such as the state-owned China State Construction Engineering Corporation (CSCEC) are working overtime in many Arab countries including those in the Maghreb region developing the infrastructure, utilities and other projects in the region. Some of the major projects being developed with the assistance of these companies include building Egypt’s US$58bn New Administrative Capital city, part of the UAE’s Etihad Rail project costing US$11bn, US$10.7bn industrial park at Duqm in Oman, being built by Wanfang, a consortium of six private Chinese firms.

In the MENA and Maghreb region, the Chinese companies have been executing infrastructure projects worth over US$40bn in Libya, Iraq, Tunisia and Algeria. CSCEC is developing many projects in Tunisia and notable among them are the University Hospital at Sfax and a Diplomatic Academy in Tunis.

In Algeria, the Chinese consortium, comprising Metallurgical Corporation of China, China International Water and Electric Corporation and Hunan Heyday Solar Corporation, are working on the exploitation of Gara Djebilet iron ore deposits.

China’s engagement in the Gulf region appears predominantly positive for the Arab states. The BRI is expected to be worth US$1.2trn to US$1.3trn by 2027 and helps the GCC countries in transforming their economies by implementing their diversification plans including renewable energy.

Speaking at the fifth China-Arab States Expo which opened on August 19 in China, Chinese Vice Commerce Minister Qian Keming said that China, as the Arab states’ largest trading partner, has the confidence to further expand cooperation with these countries in the digital economy, new energy, artificial intelligence and other emerging fields.

According to China’s Commerce Ministry’s statistics, China-Arab trade volume reached US$239.4bn in 2020, during which China imported 250 million metric tons of crude oil from Arab states or half of the country’s total crude oil imports last year. Arab states’ imports from China reached US$122.9bn last year, up by 2.1 percent year-on-year, Qian said.

In April, Chinese Foreign Minister Wang Yi embarked on a six-nation Middle Eastern tour to Saudi Arabia, Turkey, Iran, the UAE, Bahrain and Oman and held discussions with the leaders about the BRI project, economic development and the COVID pandemic.

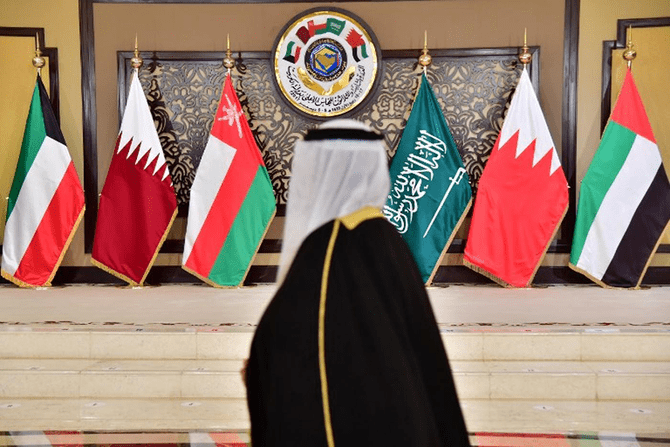

Trade with GCC

According to data released by the United Nations Conference on Trade and Development, bilateral trade between China and the GCC countries increased from US$68bn in 2009 to $US190bn in 2019, an increase of 180 percent.

GCC countries export goods worth US$111bn, with oil and fuel accounting for 80 percent of exports and petrochemical and chemical products accounting for 20 percent while importing US$79bn in industrial goods, electronic devices, machinery, equipment, automobiles, and spare parts.

Gulf imports from China totaled US$10bn in clothing, textiles, and fabrics, accounting for 66 percent of Arab trade with China and ranking as China’s seventh-largest trading partner, the UNCTAD report said.

Chinese investments

China’s relations with Middle Eastern countries have improved significantly due to BRI with China emerging as a significant import and export partner for the region. Bilateral trade between China and Arab countries reached approximately US$240bn in 2020, accompanied by a 2.1 percent year-on-year increase in Arab countries’ imports from China, despite the impact of the COVID-19 pandemic.

On the other hand, the GCC countries see the BRI as an opportunity to advance their new economic strategies, including diversifying their economies away from oil and transforming themselves into international trade and tourism hubs.

In the last few years, China’s largest trading partner in the region has been the UAE, with US$53bn of bilateral trade in 2018, expected to increase to beyond US$70bn in 2020, according to Jamal Saif Al Jarwan, secretary-general of the UAE International Investors Council.

The UAE is attractive because it also acts as an entry for Chinese to access regional markets. In 2021, the UAE plans to host the first Asian Infrastructure Investment Bank meeting in the Middle East, confirming its preferred status.

Chinese investments in the Gulf have included US$11bn in the Duqm Special Economic Zone Authority in Oman, US$4bn investment in a petrochemical plant in Jazan City for Primary and Downstream Industries in Saudi Arabia and a US$1bn investment in Khalifa Industrial Zone in Abu Dhabi in 2018, with the possibility of another US$10bn from the East Hope Group.

Saudi Crown Prince visits China

During Crown Prince Mohammed bin Salman’s visit to Beijing in 2019, the Saudis concluded US$28bn of deals between the two countries including a US$10bn project to build a Saudi-financed refinery in the Chinese coastal city of Panjin.

During his visit, the two countries signed 12 agreements and memorandums of understanding in renewable energy, maritime transportation, intellectual property, cybercrime, commercial and developmental crimes, and others.

Because of COVID-19, Saudi’s trade surplus decreased 63.9 percent to US$10.93bn with China in 2020, compared to an excess of US$30.33bn in 2019.

According to World Bank data, China and Saudi Arabia exchange approximately US$63.3bn in trade, exports to China total US$45.8 bn, and imports from China totaling about US$17.5bn.

For the Saudi Crown Prince, BRI aligns with his own “Vision 2030,” which aims at reducing the Kingdom’s dependence on oil and the diversification of the country’s economy. This is one area where both countries can work together.

One should not forget that Saudi Arabia accounts for 16.8 percent of China’s crude oil imports followed by Iraq (9.9 percent), Oman (6.9 percent) and Kuwait (4.5 percent). Overall, the region supplied 41.1 percent of China’s oil imports in 2019.

Coming to Qatar-China bilateral relationship, the two nations signed a 10-year LNG deal and also amended the agreement for avoidance of Double Taxation and prevent financial evasions concerning income taxes.

Over 200 Chinese companies are working in Qatar on different mega projects in construction, tourism, oil and gas among others. In April 2015, Qatar opened the Middle East’s first center for clearing transactions in the Chinese Yuan. In 2020, bilateral trade volume between the two countries recorded as US$10.9bn.

China’s “Serbia Model” may have a disproportionate impact on national and human security, through the sale of Artificial Intelligence (AI) technology to the Gulf states that estimates suggest could be worth up to US$320bn by 2030, primarily to Saudi Arabia, Qatar, Bahrain and the UAE.

Bahrain is assessing the BRI in light of Bahrain’s Economic Vision 2030 and places a high premium on the initiative to realize its economic vision. For instance, in December 2019, Bahrain began constructing the city east of Sitra for the Chinese Engineering Machinery Company.

According to World Bank data, China-Bahrain trade is worth approximately US$1.25bn, while exports to China are worth US$150m, and imports from China are worth about US$1.1bn.

Following the announcement of “Vision 2035,” a plan to wean Kuwait away from oil exports and transform it into a regional financial and cultural hub, the Chinese Vice President paid a visit to the country expressing his country’s support for the Kuwaiti vision and pointing out that it is broadly consistent with the Silk Initiative.

China-Kuwait relations have advanced to the level of “strategic partnership” due to the initiative, resulting in the expansion of cooperation in energy, infrastructure, security, and counterterrorism.

According to World Bank data, China and Kuwait exchange approximately US$18.6 bn in trade, with Kuwait exporting US$15.3bn to China and importing roughly US$3.3bn from China.

Acquisitions and JVs

A consortium of Chinese investors led by a unit of China Three Gorges Corp has acquired Alcazar Energy Partners, a renewable energy firm backed by Abu Dhabi’s wealth fund Mubadala Investment Company.

The deal will give China Three Gorges South Asia Investment Ltd an entry into the renewable energy market in the MENA region, Alcazar said in a statement without disclosing financial details.

The seven-year-old Alcazar Energy owns and operates a portfolio of wind energy projects in Egypt and Jordan, with an onstream capacity of 411 MW. The company is based out of the Dubai International Financial Centre and has offices in Jordan and Egypt.

Riyadh-based global chemical company SABIC has formed a joint venture with China’s Fujian Petrochemical Industrial Group Co., Ltd (FJPEC) to build a world-class mega petrochemical complex in China. With a total investment of USS6.18bn, the complex will be built at Gulei Industrial Park in Zhangzhou city, east China’s Fujian Province.