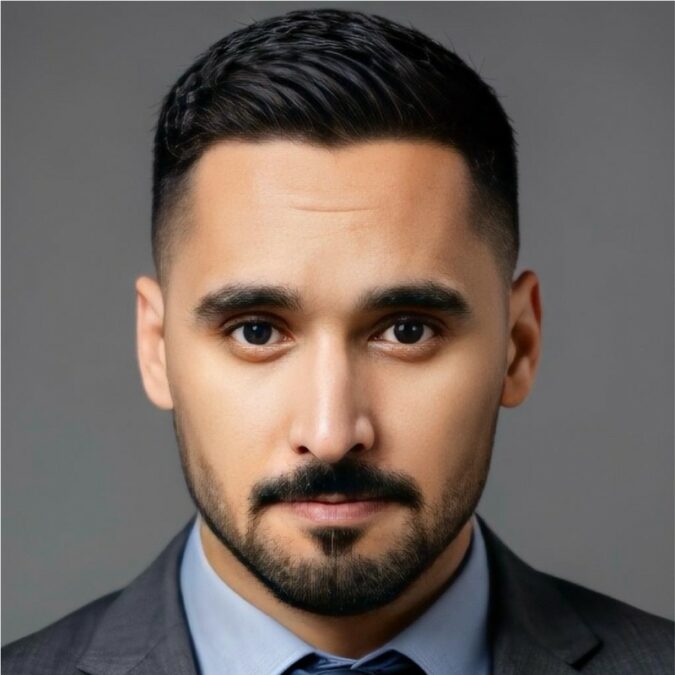

DAVOS, Switzerland — Bilel Al Souaied is an entrepreneur and venture capitalist. He is the COO of Cytomate, a leading provider of security posture management and threat intelligence products. Bilel is attending Davos with the Global Shavers Community, a World Economic Forum initiative and the only youth delegation participating in the Davos summit. Each of the 50 people in the delegation advocates a certain cause, a certain mission. In an exclusive interview, Souaied shared his insights with TRENDS.

What is your mission?

My mission is more about increasing my understanding, and my learning curve this week. I want to understand the macroeconomic landscape further, especially after Trump took office. Where the interest rates are heading, the redirection of capital, and certain asset classes. I want to broaden my understanding a little bit about the initiatives I am not very familiar with, like safeguarding the planet and other green initiatives. But one way or the other, the most important pillar that gets my attention is reimagining growth.

The demographic landscape in the Middle East is shaped by the fact that nearly 60 percent of the population is below 30. Do you see any difference in the way reimagining growth would be applied here in the GCC when it comes to reimagining growth with technology and innovation at the forefront?

I absolutely agree. First, in the next five to 10 years, we’re going to be witnessing a lot of wealth transfer from baby boomers to millennials. We’ve been looking at the generational field in terms of capital deployment. Historically, in GCC we have been investing and capitalizing on traditional asset classes. But if we look at global competition and foster our own innovation hubs, we’re going to reconsider what it means to invest in innovation and how to redirect capital so that it contributes to the G2B in a better manner. Since the discovery of hydrocarbons, GCC has been experiencing several economic models. Some of them proved to be working, some not. I think the evidence lies in how some of the GCC economies turned out. We have a variety of economic instruments that are being implemented within the GCC ecosystem that can be reflected both on the macroeconomic scale, on fiscal policy, monetary policy as well the regulatory landscape.

But one way or another, the growth in the next 10 to 20 years is going to be in the MENA region. Qatar, Saudi, and UAE are the three key economies, at least from the GCC perspective, which are expected to be leading that transformation. Saudi is going through a transformative era due to the top-down changes that have been with us lately, which is something that is going to be echoing across the region.

You mentioned something about the innovation hubs and investment in innovation in the region. At the same time, there’s so much more interest from the West now looking eastward to support and work together. What is needed to make it an attractive destination for investors?

Building an innovation ecosystem is not easy. It is an entire ecosystem that has to be built from scratch. That system has a formula. One, we are talking about a regulatory landscape. There should be an ease of how businesses should be conducted in terms of formulating businesses, legal infrastructure, licensing of certain industries, and licensing of certain initiatives. Second, access to capital, both the investment side and the financing side, for tech and innovation, which we still do not see very much. But we do have one of the most advanced educational ecosystems. Qatar is leading the way in terms of that. We have the Qatar Foundation which is home to more than a dozen leading world institutions contributing tremendously to creating a skilled labor force in Qatar. UAE and Saudi are also moving down that direction. We do have capital, and the talent is being skilled properly. The regulatory infrastructure is being revised constantly to ensure fair competitiveness with the European Union, Southeast Asia, and even America. Capital needs to be redirected. We have to understand better what financing innovation means and how can it be consolidated with the wider GDP formula.

Where do you see investment opportunities?

If you look into the history of most successful companies, they are a wave of business models that have been tried in America first, North America first, Europe second, and now the wave is hitting the GCC region. A second wave is coming for businesses as soon as the ecosystem matures a bit, where they will be solving problems that have already been solved in North America and Europe. As a venture capitalist, I would say that they will invest in predictable business models due to predictable macroeconomics because not every innovation falls within a VC asset class.