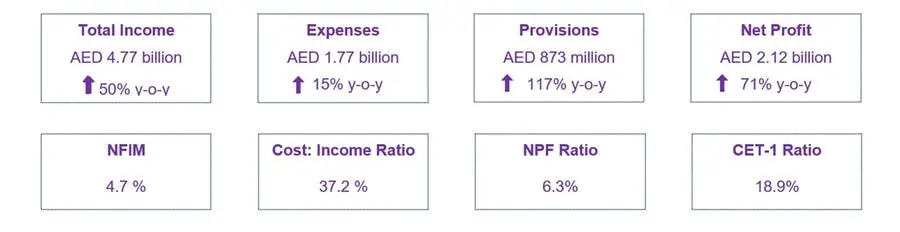

Dubai, UAE – Emirates Islamic achieved an impressive 71% increase in net profit, reaching an unprecedented high of AED 2.12 billion ($576.82 million).

The remarkable growth can be attributed to the upward trajectory of both funded and non-funded income, indicating enhanced business sentiment. In the fourth quarter of 2023, the Bank’s total income reached AED 1.2 billion ($326.69 million), marking a noteworthy 24% year-on-year growth.

These exceptional results reflect the strength of the regional economy and the Bank’s expertise in identifying and addressing the market demand for Islamic banking. The expertise has enabled Emirates Islamic to offer a broader range of innovative services, resulting in a robust 82% growth in operating profit.

The strong balance sheet, low-cost funding base, and digital architecture form a strong platform for greater achievements in the future. Emirates Islamic delivered its highest-ever net profit of AED 2.12 billion in 2023, marking a substantial 71% increase compared to 2022. The Bank reported a total income growth of 50% over 2022 with customer deposits growing by 9% over the same period ($1.30 billion).