Dubai, UAE — Foreign Direct Investment into the Gulf Cooperation Council countries has been fluctuating over the years, peaking in 2006, when it reached $120 billion. However, FDI inflows have declined in recent years, due to a number of factors, including the global financial crisis, the decline in oil prices, and political instability in the region. Despite the decline in FDI inflows, the GCC region remains an attractive destination for foreign investors. The region has a young and growing population, a large domestic market, and a strategic location. The GCC countries are also taking steps to improve the business climate and attract more foreign investment.

According to 2023 Kearney FDI Confidence Index, the Middle East and North Africa (MENA) region remains optimistic about Foreign Direct Investment (FDI) inflows for 2023 and beyond. The optimism stems from strong economic growth, which is expected by IMF to reach 3.6% in 2023, higher than the global average of 3.3%, especially in the GCC region that will continue to witness a strong demand for oil and gas products, as well as by government-led diversification efforts.

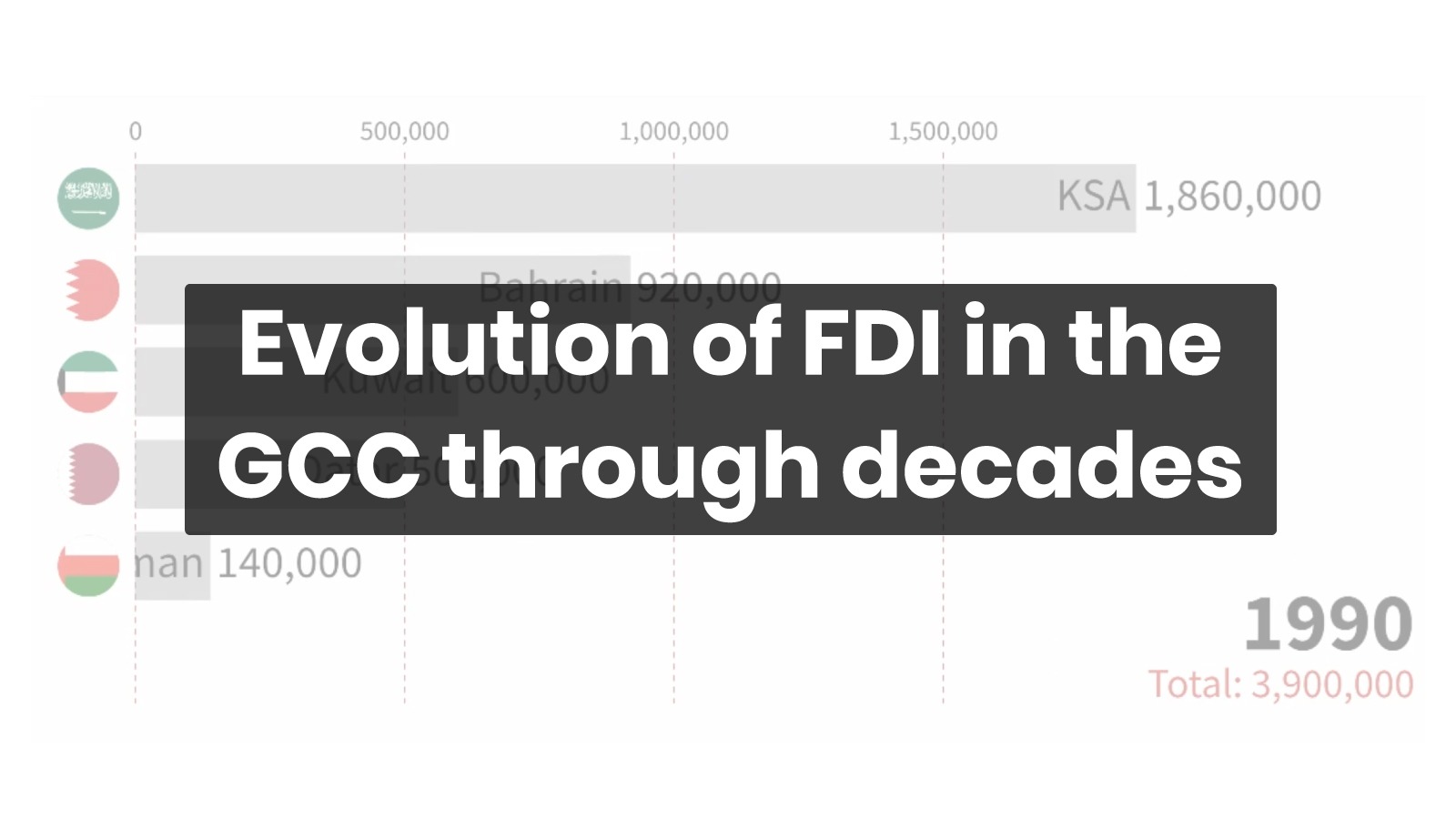

TRENDS takes a look at the FDI patterns during the past few decades: