KUWAIT CITY — GCC equity markets fell for the third consecutive month as the conflict in Gaza intensified, leading investors to reduce their exposure to the region.

Trading reports indicated that foreign investors were net sellers in GCC markets, signaling concerns about geopolitical instability potentially affecting the broader area.

A recent report by Kamco Invest reveals that the downturn was widespread across the GCC, with all markets showing losses in October 2023. Qatar experienced the steepest drop, with a 7.1 percent decline, followed by Dubai and Kuwait, which saw decreases of 6.9 percent and 5.2 percent, respectively.

The downturn also impacted the aggregate MSCI GCC index, which fell by 4.4 percent during the month, marking the most significant drop in eight months.

This decline further deepened the year-to-date (YTD) 2023 downturn to 7.2 percent, with four out of seven exchanges showing losses. Dubai, Bahrain, and Saudi Arabia managed to maintain positive YTD 2023 performances, while Qatar and Kuwait faced double-digit declines.

In terms of monthly sector performance in the GCC, nearly all sectors ended in the red except for healthcare, which saw a slight increase.

The pharmaceuticals & biotechnology index suffered the most, plunging by 15.9 percent, with the consumer durables & apparel and real estate sectors also experiencing double-digit losses of 13.6 percent and 10.1 percent, respectively.

The decline in the GCC real estate index mirrored the drop in most large-cap names in the region, as rising interest rates impacted lending in the sector, compounded by geopolitical concerns.

Global equity markets also demonstrated weakness, with nearly all key markets ending in the red, following a hawkish stance from central banks. This trend suggests persistently high interest rates that could hamper economic growth worldwide.

The MSCI World index also recorded a decline for the third straight month, falling by 3.0 percent in October 2023 and underscoring a broad-based downturn across global markets.

Saudi Tadawul

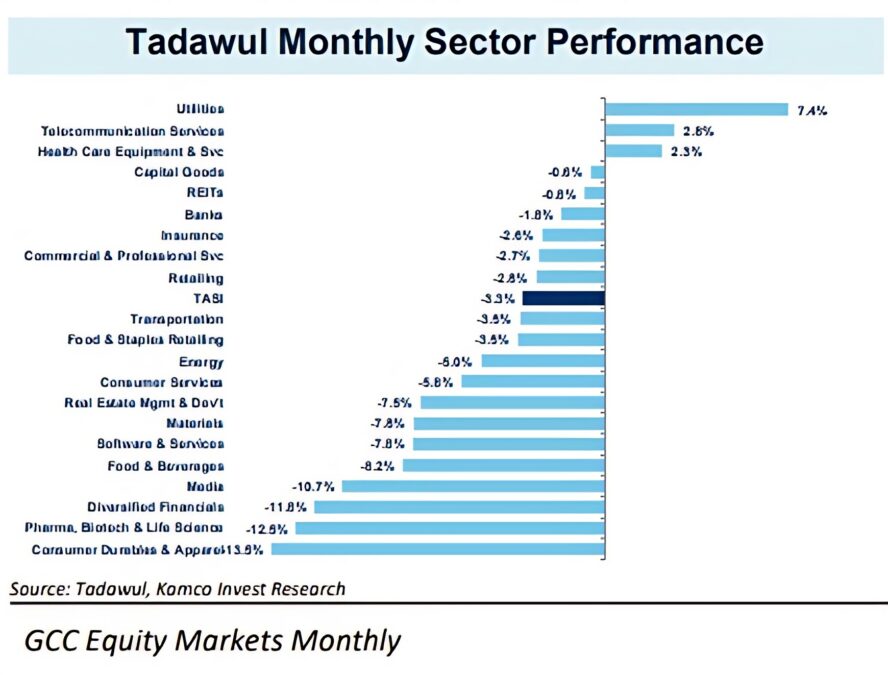

The Saudi Stock Exchange also experienced a downturn in October 2023, triggered by regional tensions stemming from the conflict in Gaza, alongside persistent concerns about interest rates and global inflation.

The Saudi bourse hit its lowest closing level in nearly nine months on October 23, 2023, at 10,293.19 points. However, consistent gains in the final trading sessions lifted the index above the 10,500 mark to close at 10,690.1 points, marking a monthly decline of 3.3 percent—its largest since March 2023. Despite this, Saudi Arabia’s year-to-date (YTD) performance for 2023 still recorded a gain of 2.0 percent.

Sector performance for the month was predominantly negative. In the banking sector, nine out of ten stocks fell, with Bank Albilad leading the downturn at -12.1 percent, whereas Saudi National Bank saw a gain of 2.3 percent, buoyed by strong earnings. Major sectors like energy reported monthly declines of 5.0 percent, with shares of Aramco in the red, dropping by 4.9 percent during October 2023.

Boursa Kuwait

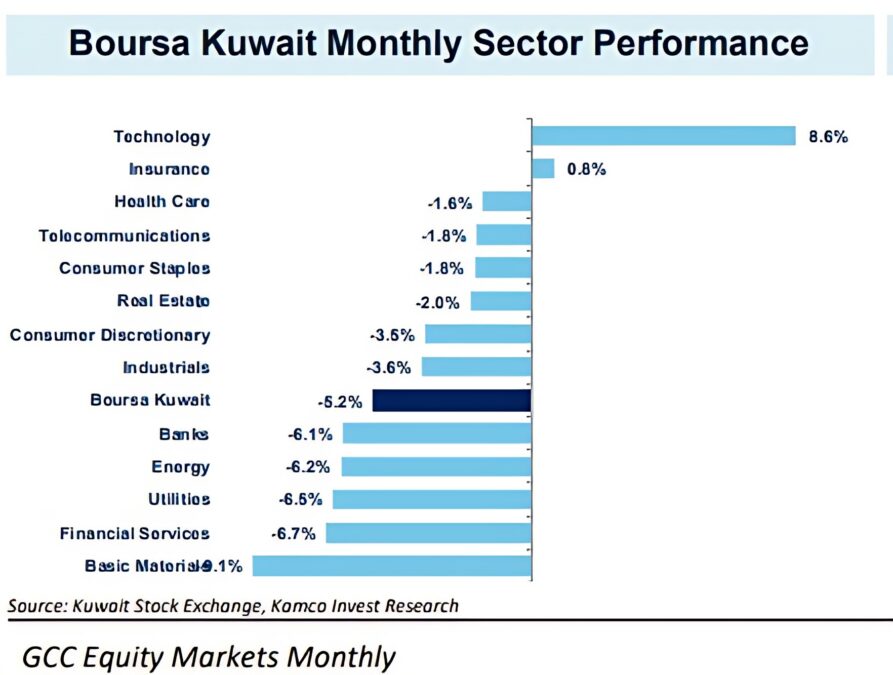

Kuwaiti benchmarks saw their largest monthly decline in 13 months since October 2022, amid a broad-based downturn that impacted most sectors in the region and globally.

In market segments, the Main 50 Index experienced the steepest monthly drop of 7.6 percent, as the performance of stocks within the index trended downward.

The Premier Market Index and the All-Share Market Index both reported monthly declines of 5.0 percent and 5.2 percent, respectively, while the Main Market Index fell by 5.6 percent during the month. Regarding YTD 2023 performance, all Kuwaiti benchmarks were in the red, with the Premier Market Index down by 12.0 percent, followed by a 10.4 percent decline for the All-Share Market Index. The Main 50 Index and Main Market Index decreased by 7.7 percent and 3.6 percent, respectively.

Abu Dhabi Securities Exchange

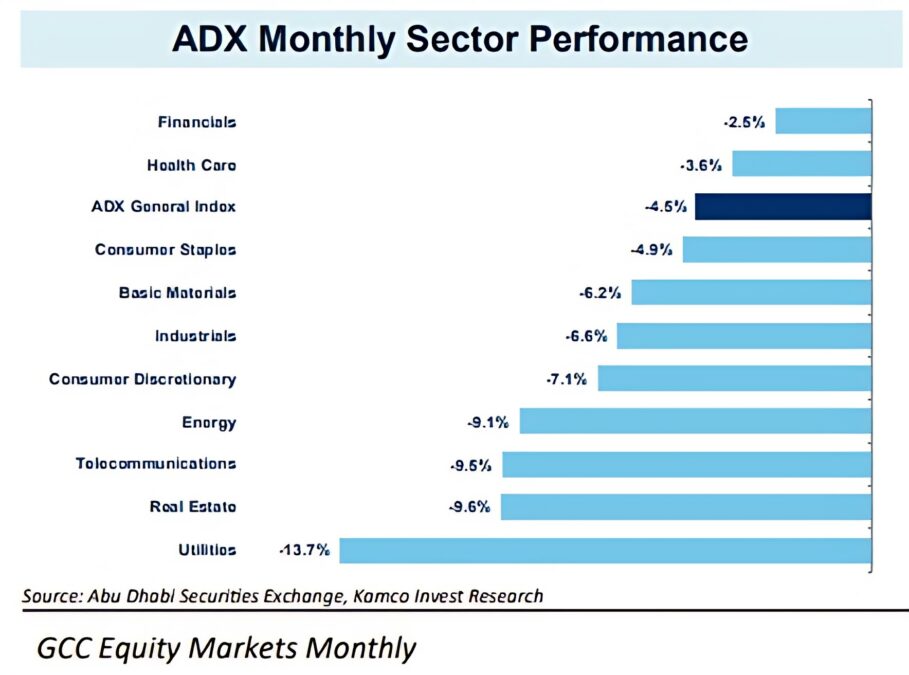

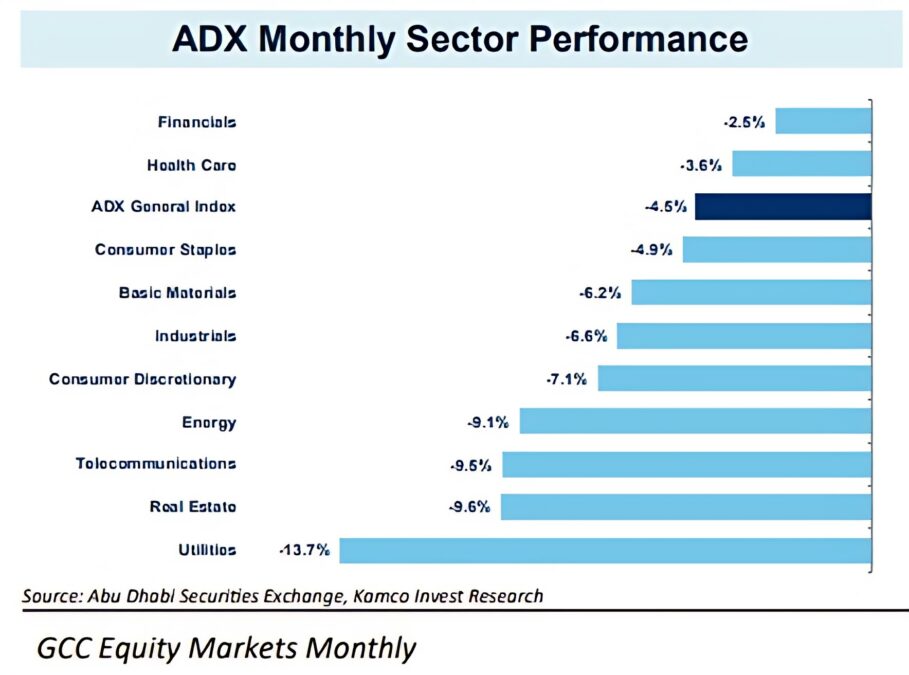

The FTSE ADX index declined by 4.5 percent during October 2023, ending the month at 9,343.88 points, which exacerbated the year-to-date performance of the index, now reflecting a decrease of 8.5 percent.

Across the board, all ten sectors on the exchange saw declines in October 2023. The utilities index experienced the most significant drop among the sectors, largely due to Abu Dhabi National Energy Co—the sole constituent in the sector—whose shares fell by 13.7 percent during the month.

The real estate index was next, with a 9.6 percent monthly decrease, ending the month at 7,929.1 points. Within this sector, three out of five companies reported declines, with Al Dar Properties Co leading the downturn with a 9.7 percent drop in its share price. The telecommunications index also saw a notable decline of 9.6 percent after all four telecom companies in the sector experienced drops, including Etisalat with a 9.7 percent slide in share price.

Dubai Financial Market

The DFM General Index suffered the second-largest decline in the GCC for October 2023, falling by 6.9 percent to close at 3,877.08 points. This marked the index’s first downturn after six consecutive months of gains since April 2023.

The monthly index performance was predominantly negative, with six out of eight indices declining. The consumer staples index faced the steepest monthly drop, plunging by 18.6 percent to 112.5 points, primarily due to a 10.3 percent fall in shares of Emirates Refreshments Co.

The real estate index was the second-largest loser, with a 14.2 percent decrease after significant share price drops among the sector’s heavily weighted companies, including Deyaar Development (-12.6 percent) and Union Properties (-14.7 percent). Conversely, the materials index bucked the trend with a 5.2 percent increase for the month, closing at 99.6 points, buoyed by the National Cement Company, which saw its share price grow by an equivalent amount.

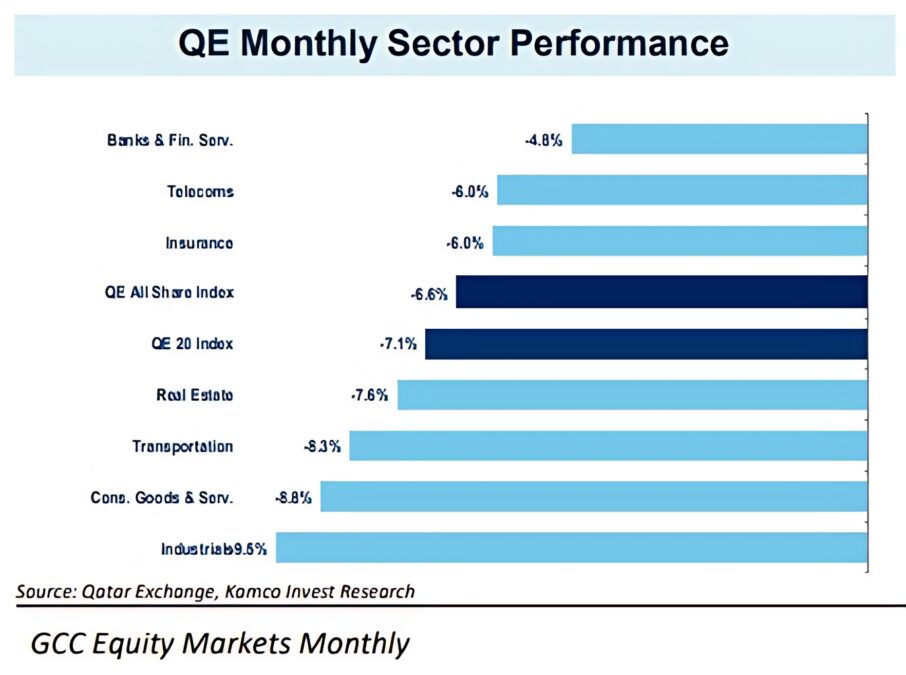

The Qatar Stock Exchange experienced the most significant month-over-month downturn in the GCC for October 2023. The main index concluded the month at 9,523.5 points, reflecting a 7.1 percent decrease.

Similarly, the Qatar All Share Index also saw a 6.6 percent drop, revealing widespread weakness across the market. This downturn in October pushed the year-to-date (YTD) 2023 decline for the QE 20 index to 10.8 percent. In comparison, the QE All Share index recorded a YTD decline of 6.4 percent.

On the regulatory side, the exchange announced a change to expedite the settlement cycle from T+3 to T+2, starting January 2, 2024, aiming to reduce the risks tied to the longer settlement duration.