DUBAI, UAE – The total investable wealth currently held in the BRICS bloc amounts to US$45 trillion and its millionaire population is expected to rise by 85 percent over the next 10 years, a report said.

There are currently 1.6 million individuals with investable assets of over US$1 million in the grouping of the world’s leading emerging economies, including 4,716 centi-millionaires or ‘centis’ (with more than US$100 million in investable assets) and 549 billionaires, said the inaugural BRICS Wealth Report, published by international investment migration advisory firm Henley & Partners in partnership with global wealth intelligence firm New World Wealth.

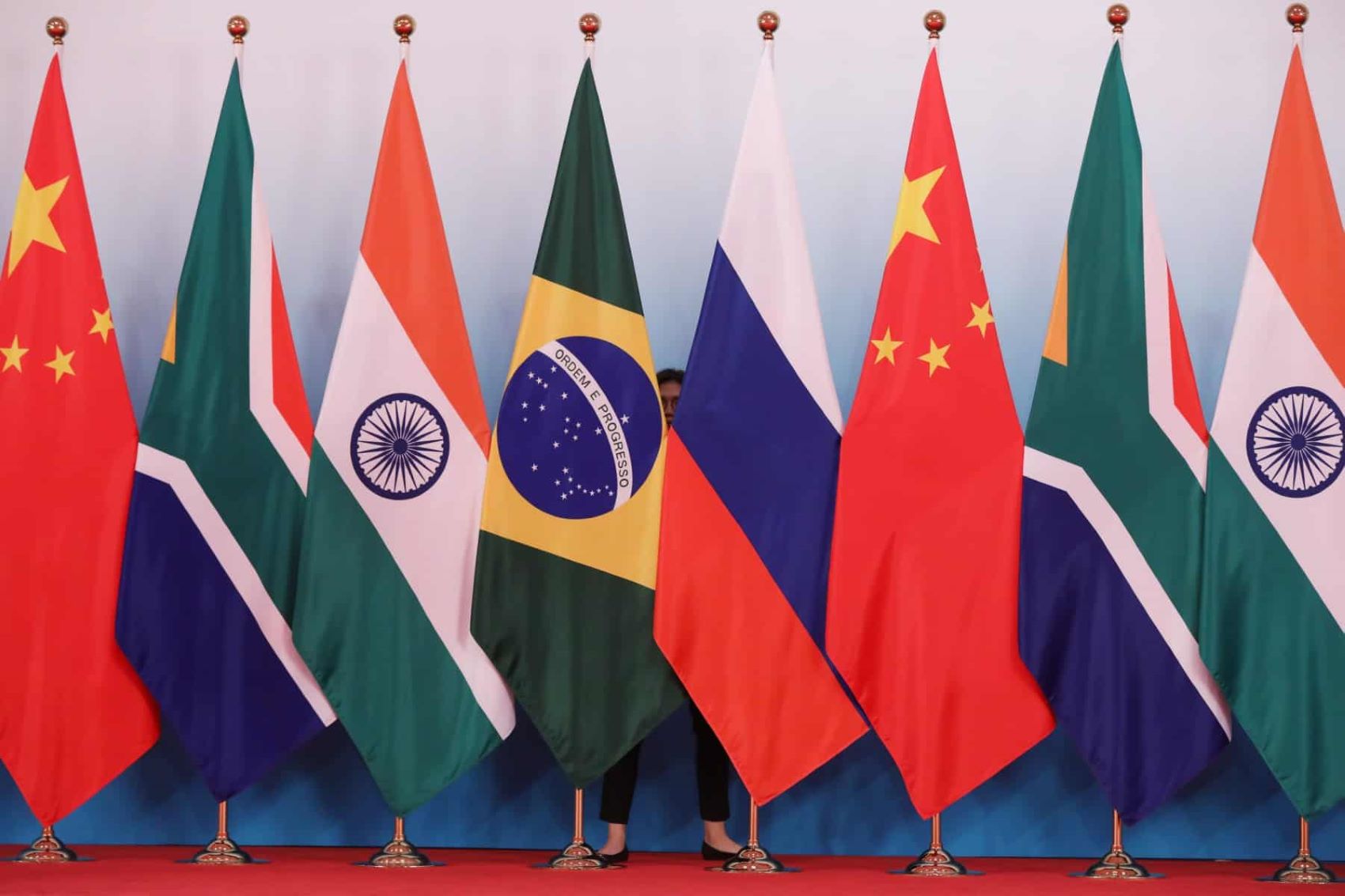

The original BRICS comprising Brazil, Russia, India, China, and South Africa added substantial new financial firepower and geopolitical clout with the inclusion this month of new Middle East and North Africa (MENA) members Egypt, Ethiopia, Iran and the UAE, a press release said.

The BRICS bloc now represents over 45 percent of the world’s population and accounts for a larger share (nearly 36 percent) of global GDP than G7 countries (30 percent) when adjusted for purchasing power parity (PPP).

CEO of Henley & Partners, Dr Juerg Steffen says BRICS is now a highly influential player in the global economy, presenting attractive new opportunities for investors, entrepreneurs and talented high-net-worth individuals.

He said, “The inclusion of MENA countries is not just a political realignment but a recognition of their growing economic stature. The region, historically pivotal due to its energy resources, is now asserting a more diversified economic role.”

He added, “For investors worldwide, MENA’s growing participation in BRICS opens a realm of possibilities beyond the region, offering access to fast-growing consumer markets, strategic geographic positioning, and unique cultural and business environments.”

BRICS private wealth unpacked

The new report reveals that in the last decade, private wealth grew by 92 percent in China, which is now home to 862,400 millionaires, including 2,352 centi-millionaires and 305 billionaires.

India follows in the second place in the BRICS HNWI ranking, with 326,400 millionaires, including over 1,000 centis and 120 billionaires, and wealth growth soaring by 85 percent over the past 10 years.

The UAE’s millionaire population has also shot up since 2013, by 77 percent, and the Middle East’s leading wealth hub is now home to 116,500 millionaires, including over 300 centis.

Investment expert Jeff D. Opdyke said, “Nations once considered ‘developing’ or ‘emerging’ or the pejorative ‘third world’ are now dynamic economies that are changing the global order.”

Top 10 wealthiest BRICS cities

China lays claim to five of the Top 10 wealthiest cities in the grouping, with its capital Beijing securing top honors as the wealthiest BRICS city, home to 125,600 millionaires, including 347 centi-millionaires and 42 billionaires.

The UAE and India each have two cities in the Top 10.

Dubai is in third place, living up to its reputation as the ‘City of Gold’ with 72,500 millionaires making it their home, of whom 212 are centi-millionaires and 15 are billionaires, and Abu Dhabi sits in 10th place with 22,700 resident millionaires (including 68 centis and 5 billionaires).

Even though BRICS now controls more of the world’s GDP PPP than the G7, its citizens have significantly less economic mobility than those residing in the most advanced economies.

Wealth growth forecasts for BRICS countries

Looking to the decade ahead, when it comes to private wealth growth projections, India leads the BRICS pack with a forecast 110 percent increase in wealth per capita by 2033.

UAE follows with its its wealth per capita expected to expand by over 95 percent.

China (85 percent), Ethiopia (75 percent), South Africa (60 percent), and Egypt (55 percent) are all forecast to enjoy wealth growth of over 50 percent in the next decade, the press release added.

The Russian Federation’s capital is the only Top 10 city with a declining millionaire population over the past decade, says the report.

Moscow saw a 24 percent drop in HNWIs while the rest of the wealthiest cities in BRICS have all enjoyed significant private wealth growth of between 75 percent (Abu Dhabi) and — in the case of Shenzhen — a 140 percent more millionaires than in 2013.