Dubai, UAE — Middle East customers are confident in the ability of their governments the most when it comes to the protection of data, says Saeed Ahmad, Managing Director of MENA at Callsign, a digital trust pioneer that deals in passive authentication, fraud prevention and intelligence.

Second only to the government are banks, with over 60 percent of the customers trusting them with their data confidentiality. Yet, Ahmad believes this number should be higher since we put our money in banks, which should guarantee a higher level of cyber protection.

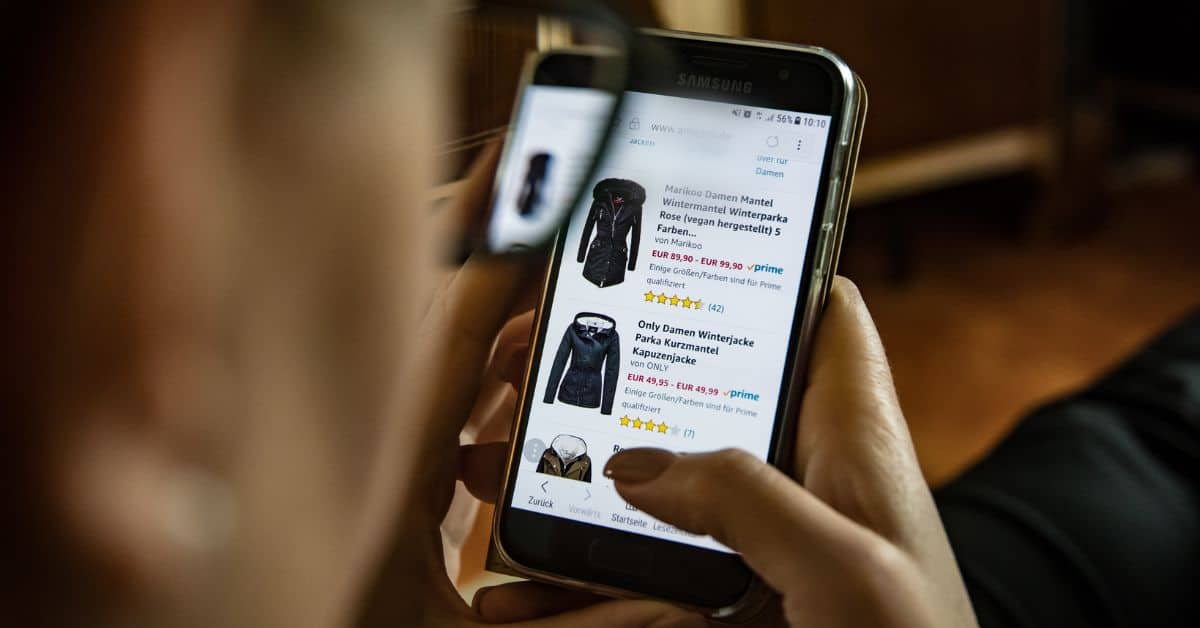

In third place come retailers, but only 50 percent of Middle East residents trust them with secure online transactions and data protection.

Digital trusts play a critical role in e-trade and online activity for consumers and the world’s economy.

Callsign estimates that the global digital economy will be worth $20.8 trillion in 2025, up from $14.5 trillion in 2021, while the cost of cybercrime is likely to increase from $6 trillion to $10.5 trillion during the same period.

That is why businesses and governments need to make safer choices about technological infrastructure.

They should not view technological damages as externalities that need no redress unless experienced and instead view citizens and users as stakeholders in technological progress. The bottom line is that they will need to prioritize digital trust in their decision-making.

Rising digital trust

To enhance GDP per capita, enterprises should consider installing digital identification systems supervised by banks and financial institutions. According to Callsign’s Digital Trust Index report, a one percentage point increase in digital trust is related to an average increase of $596.

Callsign’s Ahmad said that the digital trust index is based on the firm’s global research. It focuses on how worldwide consumers interact and feel about transacting online and how different markets and regions have reacted to various challenges with interacting online, especially fraud.

Non-Western markets trust digital and online services more than their Western counterparts, based on the index.

The poll probed customers’ confidence in digital and online services and offered a snapshot of regional differences. When comparing the regions with the highest and lowest levels of online and digital trust, there is a substantial discrepancy (30.7 percentage points) between the market with the highest degree of trust and the market with the lowest.

The Nordic countries have the highest trust rate in online and digital services, where 59 percent of consumers said they had complete faith in them.

MENA digital trust

Asia-Pacific (APAC) and the Middle East and Africa (ME&A) round out the top three, with 56 percent and 45 percent trust shares, respectively.

On the other hand, only around a quarter of Brazilian customers (28 percent) have confidence in digital and online services.

The most significant percentages of consumers, 37 percent and 36 percent, respectively, across all markets, credit positive moves in their digital trust to favorable experiences with online and digital firms in APAC and ME&A.

How to improve digital trust?

Ahmad told TRENDS, “Our research shows that 48 percent of the respondents find the identification of the digital identity is still the root of the problem, especially with the rising number of e-scams in the Middle East.”

For this reason, organizations must update their online constantly and continually create new OTPs for the safety of consumers, he said.

At the same time, the ongoing efforts of the region’s governments show how important it is to develop new laws and how essential it is to update the current regulations to match the new virtual world.

Another important aspect governments and organizations need to focus on while updating laws and practices is that most online transactions happen through mobile applications since buyers find it more convenient to search via phones.