Dubai, UAE–The Dubai Financial Market (DFM) and the Dubai World Trade Centre (DWTC) will be holding the MENA IPO Summit in Dubai, which they said in the region’s only IPO-focused summit, from 23-25 Jan, 2023.

A statement issued by the emirate’s media office said the inaugural summit will shed light on the “strong impetus and promising prospects of the IPO sector in Dubai”. It added the summit comes on the back of a record IPO activity in 2022 and the expected momentum in 2023.

The DFM saw the listing of five government-related and private sector companies–DEWA, Tecom, Salik, Empower and Taaleem–in 2022.

A total of AED 31 billion ($8.4 billion) were raised by these companies in the IPOs, which were subscribed multiple times over, drawing AED 672 billion.

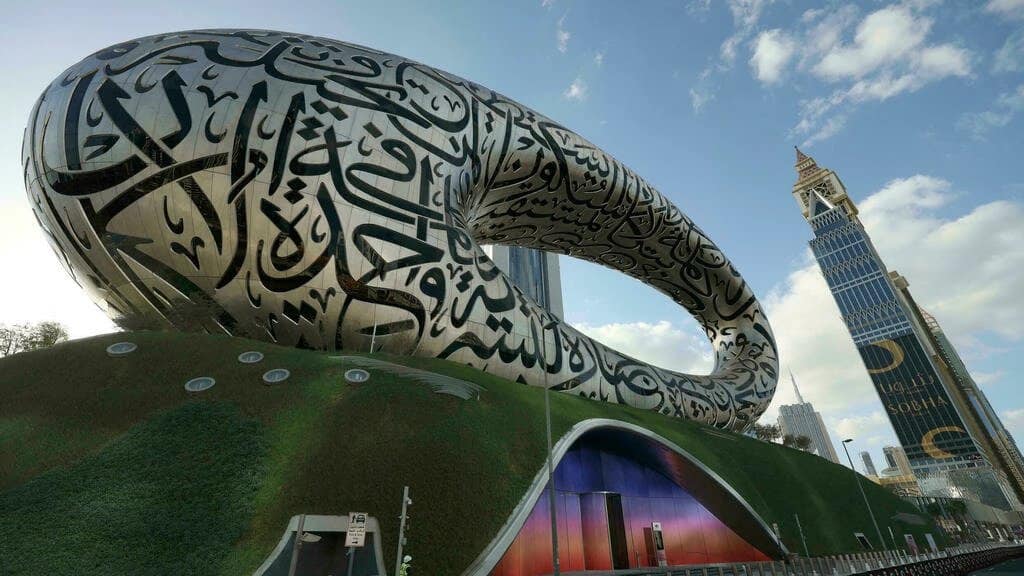

Taking place at The Museum of the Future, the summit will gather industry experts besides “showcasing a roadmap for startups and SMEs in Dubai, including expertise around its regulatory environment, business culture and capital opportunities for scaling ventures through to an IPO”.

Helal Al Marri, Director General of Department of Economy and Tourism in Dubai, said, “The new markets’ ecosystem and its regulatory enhancements have created an attractive environment for various types of businesses such as government-related conglomerates, private corporations and family businesses to going public and listing through an array of listing options that cater to their requirements in terms of size, growth stage and jurisdiction.”

Experts set to share their insight include Dr. Maryam Buti Al Suwaidi, CEO Securities and Commodities Authority (SCA); Hamed Ali, CEO, DFM and Nasdaq Dubai; Mohammad Al Bastaki, CEO, Emirates NBD Capital; Fadi Ghandour, Managing Partner, Wamda Capital; Thomas Varghese, CFO, Dubai Electricity and Water Authority (DEWA); Abdulla Belhoul, CEO, TECOM Group; Miguel Azevedo, Head of Investment Banking, Middle East & Africa & Managing Director, Citi.

The Summit is supported by a group of leading international financial institutions including HSBC and Emirates NBD as Platinum Sponsors, Goldman Sachs, Rothschild & Co. and Edelman Smithfield as Diamond Sponsors, and Moelis & Company as a Supporting Partner.

IPO Boom

In the first five months of 2022 alone, and for the first time since the global financial crisis of 2009, various IPOs in the GCC raised $4.8 billion, a figure much higher than what IPOs in Europe could manage to mobilize.

Read full story here: GCC IPOs resilient to volatility hurting other markets

Resilient

Initial public offerings in the Gulf proved resilient to the volatility hurting deals in other markets, such as high oil prices, stable economies, and abundant liquidity fuel activity.