Riyadh, Saudi Arabia — Saudi Arabia announced on Tuesday a substantial tax relief program for multinational corporations establishing regional headquarters within the kingdom.

This bold initiative, part of a broader strategy to transform the world’s largest crude oil exporter into a dynamic business hub, offers a 30-year tax holiday, including a zero-percent rate for corporate income and withholding taxes.

The Saudi Investment Ministry’s announcement arrives just weeks before the January 1 deadline, after which multinational companies must establish regional bases in Saudi Arabia to remain eligible for government contracts. This policy is seen as a strategic push to intensify economic diversification and reduce the kingdom’s reliance on oil exports.

The Regional Headquarters (RHQ) program in Saudi Arabia, meanwhile, has attracted more diverse companies, with a $242.5 million investment in 2023, notably in Software & IT services.

Finance Minister Mohammed al-Jadaan emphasized the program’s benefits, stating that it provides greater visibility and certainty for businesses planning to expand in the region.

At A Glance * Saudi Arabia offers 30 years of tax relief for multinationals establishing regional headquarters in the kingdom. * The initiative aims to diversify the Saudi economy beyond crude oil exports and establish the country as a business hub. * The announcement comes ahead of a January 1 deadline for multinationals to open regional offices in Saudi Arabia to qualify for government contracts. * The tax relief includes a zero-percent rate for corporate income tax and withholding tax. * Executives had been awaiting details of the tax scheme for months. * Finance Minister Mohammed al-Jadaan highlights the move as beneficial for businesses and integral to Saudi Arabia's transformation journey. * The initiative encourages participation in various projects, including the 2029 Asian Winter Games and Expo 2030. * The regional headquarters programme, launched in February 2021, aims to rival Dubai as a base for global firms in the Middle East. * Over 200 licenses have already been granted under this program. * Analysts are uncertain if firms are genuinely committed to Saudi Arabia's vision or just seeking to retain access to Saudi funds. * Other benefits of the programme include unlimited work visas and a 10-year exemption from quotas for hiring Saudi nationals.

He expressed eagerness to welcome more multinational corporations to partake in various sectors, including major upcoming events like the 2029 Asian Winter Games and Expo 2030.

Launched in February 2021, the Regional Headquarters (RHQ) Program aims to position Saudi Arabia as a competitor to Dubai, a popular location for global firms operating in the Middle East. To date, over 200 licenses have been issued under this initiative.

In February 2021, Saudi Arabia implemented legislation mandating international companies to establish a regional headquarters in the Kingdom to qualify for government contracts starting 1 Jan 2024.

With certain exemptions, failure to do so would likely exclude participation in lucrative commercial deals in Saudi Arabia. The regulations apply to all government agencies and not only those that are subject to the KSA Government Tenders and Procurement Law.

The RHQ Program is an initiative jointly developed by the Ministry of Investment (MISA) and the Royal Commission for Riyadh City and approved by the Kingdom’s cabinet through a resolution dated 27 Dec 2022.

This mandate stems from Vision 2030 and aims to generate private-sector employment — nearly two-thirds of the country’s approximately 35 million people are under the age of 35– and reduce the economy’s reliance on oil. In 2022, Saudi’s non-oil sector grew by more than 6 percent.

Mad dash for RHQ licenses

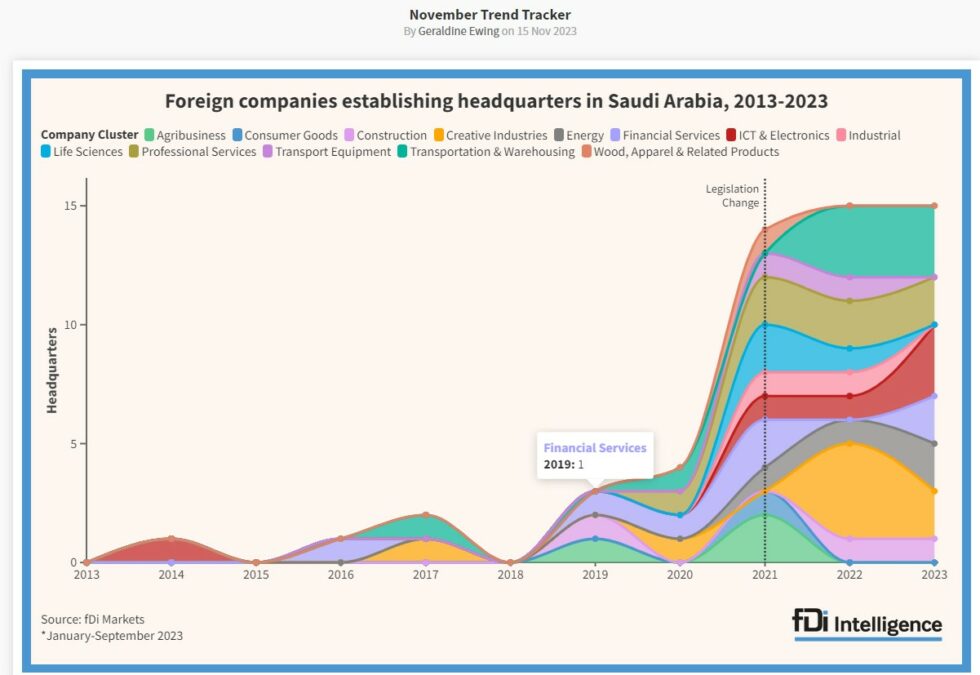

According to fDi Markets data, the RHQ program has resulted in a diversified and higher number of companies moving their headquarters besides investing in the country.

International companies have announced an investment of $242.5 million in headquarters in the first nine months of 2023 alone, compared to $214.2 million between 2013 and 2020, reflecting the eagerness of companies to stay in the race for lucrative contracts.

In 2023, 46.7 percent of newly established headquarters operate in the Software & IT services sector.

What incentives lie behind the HQs

Speaking from Riyadh at the Future Investment Initiative, Saudi Minister of Economy and Planning, Faisal Al Ibrahim, told CNBC that “when you move (the HQ), there are some benefits and incentives that will make that make sense. There’s a slew of incentives and benefits and support that’s always changing, always evolving. We prioritize the companies that are bringing value creation to where value is consumed, which create high-quality jobs for people in Saudi.”

The incentives the minister was talking about include a proposal to grant Premium Residency status to executives who currently have no employment-based special residency status. Today, applicants must pay for either a one-year or unlimited residency permit.

Saudi authorities have proposed that employees working at regional headquarters enjoy special treatment such as allowing a foreign spouse on a family residency visa to obtain work authorization and her dependent male children up to the age of 25 years to obtain a family residence permit, from the current age limit of 18.

From 80 firms that have been granted licenses to establish HQs, Saudi is planning to see 480 companies to open regional HQs by 2030, hoping to preserve additional corporate expenditures in the Kingdom. Already, top firms like PepsiCo, DiDi, Unilever, Siemens, KPMG, Novartis, Baker Hughes, Halliburton, Philips, SAP, PwC, Boston Scientific and Tim Hortons have moved their base operations to Saudi Arabia.

Exceptions to the mandate

Some companies will have the ability to operate in Saudi without needing a headquarters in the country, such as those whose foreign operations do not exceed $266,000.

Firms that bid for government contracts exclusively are also exempt from the mandate rules.

According to Clyde and CO., a global law firm, exemptions to having a RHQ also apply for the following:

1- Where there is only one technically acceptable offer

2- If the offer submitted by a company without its RHQ in the KSA, is the best offer from a technical perspective and has a value of less than 25 percent or more than the value of the second-best offer received by that government agency

3- An emergency, which can only be dealt with by inviting or directly contracting with companies that do not have an RHQ. The emergency could be a threat to public safety, public security or public health

4- The works or procurements in question can only be serviced by companies without an RHQ.

Yet, some areas of the mandate are still not clear.

Need for more clarity on the Saudi mandate

The Saudi government has released a thin set of regulations, including that company HQs should have at least 15 employees, with at least three at the executive director and vice-president levels. It is not clear what tax laws apply to these management arrangements.

Upon launching the program, MISA promoted zero corporate tax for 50 years, and a waiver on mandatory quotas to employ Saudis for a minimum period of 10 years. This was not followed by more recent updates, leaving companies unsure of how to proceed on these issues.

(With agency inputs)