Dubai, UAE–The announcement of the resumption of relations between Saudi Arabia and Iran and the settlement of many outstanding issues between the two countries carries many signs. Still, the matter remains dependent on making decisions regarding the renewal of economic and trade relations between the two countries.

The resurrection of ties between the two Middle East powerhouses has sparked global debates from Washington D.C. to Paris and Tokyo. Speculation is rife China is flexing its muscles in the energy-rich Middle East while the United States is backing out from its traditional role as a regional power broker and peacekeeper.

US Secretary of State Antony Blinken was in Beijing a few days back for talks – the first senior-level talks in five years. In an interview published in TRENDS on Tuesday, Blinken spoke about China recent involvement in the Middle East – especially Beijing’s role in the Saudi-Iran deal.

“If China takes initiatives that actually help solve problems and advance peace, that’s a good thing, and we support it,” said Blinken.“They [China] hosted the final round of discussions between Iran and Saudi Arabia that had been going on for two years, and the result was an agreement that at least has the possibility of reducing tensions between them and solving one of the problems, one of the many problems, that Iran poses.”

“If China can play a constructive role in – when the time is right – finding a just and durable peace in Ukraine and ending the Russian aggression, that would be a good thing,” he added.

They [China] hosted the final round of discussions between Iran and Saudi Arabia that had been going on for two years, and the result was an agreement that at least has the possibility of reducing tensions between them and solving one of the problems, one of the many problems, that Iran poses.

US Secretary of State Antony Blinken

Several countries across the world, including the region, welcomed the Saudi-Iran deal and many governments said the deal, if it lasts, will certainly ease tensions and would be good for economic growth.

According to Abdulkhaleq Abdulla, Professor of Political Science at New York University – Abu Dhabi, the Saudi-Iranian reconciliation and Iranian-GCC openness will undoubtedly reduce tensions in the Arabian Gulf. Any reduction in tension and rivalry will benefit regional stability and promote growth and economic prosperity.

“I believe that all countries in the region now want to move away from the political rivalries that have existed for the past ten years and focus on a single issue. Perhaps the only one is growth and the economy, which concerns the Gulf states as well as Iran, especially after the economic sanctions imposed on it and the difficult living and financial situation it is in,” he said to TRENDS, adding that these reconciliations and this shift from hostility to friendship are real indicators that the economic ties will strengthen between Saudi Arabia and Iran, as well as between Iran and the Gulf states.

Data from the Saudi General Authority for Statistics shows that the trade data between Riyadh and Tehran ceased in 2015 and were not updated. The value of trade exchange between Saudi Arabia and Iran back then was US$330 million.

All countries in the region now want to move away from the political rivalries that have existed for the past ten years and focus on a single issue. Perhaps the only one is growth and the economy, which concerns the Gulf states as well as Iran, especially after the economic sanctions imposed on it and the difficult living and financial situation it is in.

Abdulkhaleq Abdulla, Professor of Political Science at New York University – Abu Dhabi

Trade and economic relations between the two countries may allow the return of those dealings that were suspended, in addition to new forms of cooperation, considering the diversification of the Iranian economy and the possibility of Tehran exporting agricultural commodities, and raw materials, such as iron, to meet the needs of Saudi construction projects.

“The most important direct economic outcome of the new normalization is the reduction in geopolitical risk, which has long weighed on everything from shipping insurance to sovereign credit ratings,” says Justin Alexander, an economist specialized on GCC issues.

“This assumes that the normalization proceeds as planned and results in a stable relationship with good bilateral communication, even though significant differences remain on key policy issues,” he told TRENDS.

From mid-2021 to the end of 2022, Saudi Arabia benefited greatly from the global oil boom, which increased the balance of its sovereign fund and its ability to carry out foreign investments in many countries.

The most important direct economic outcome of the new normalization is the reduction in geopolitical risk, which has long weighed on everything from shipping insurance to sovereign credit ratings.

Justin Alexander, an economist

On the other hand, because of the economic sanctions, Iran’s oil revenues have declined compared to before 2018, necessitating the need for foreign investment.

Tehran was relying heavily on the success of the nuclear talks with the West to bring back foreign direct investment into the oil and gas sector and modernize its infrastructure, which is critical to the Iranian economy and the manufacturing sector.

According to World Bank database figures, Iran’s share of foreign direct investments during the period 2019-2021 was $1.51 billion, $1.34 billion, and $1.43 billion, respectively, which are insignificant amounts by the standards of Iran’s needs for those investments and the scarcity of foreign exchange due to sanctions.

So, if the new agreement between Riyadh and Tehran succeeds in increasing bilateral investment, the injection of Saudi funds in direct investments would improve the performance of the Iranian currency exchange rate, mainly if those investments are large and long-term.

“Not only Saudi Arabia, but also the Gulf states are ready to invest in Iran,” according to Abdulla.

“Saudi and Emirati officials, as well as officials from the other Gulf states, have expressed a desire to invest heavily if expectations of a different Iranian experience are realized.” “The countries of the region want to move on from the struggles, disputes, and rivalries of the last ten years, and the Saudi Iranian reconciliation is the culmination of this,” he said.

“In my opinion, the UAE will be among the biggest beneficiaries, owing to the depth of intra-trade between Iran and the UAE, as well as the UAE and Saudi Arabia, the region’s two largest partners, so that the benefit will be shared by Iran, Saudi Arabia, the UAE, and the rest of the Gulf countries. Trading is possible, but investments are also promised if this conciliatory trend continues. I believe that the influx of Gulf investment, particularly from Saudi Arabia and the UAE, will benefit Iran greatly, easing the economic burden on Raisi’s government, which has not achieved much on the economic front and is experiencing difficulties”, he continued.

On the other hand, the Saudi-Tehran economic interests necessitate that Iran makes similar investments in Saudi Arabia, resulting in stronger relations and promoting common interests.

“The agreement happened on a government-to-government level, however,this doesn’t necessarily guarantee that the sentiment will trickle down to the business communities in each country, “says Dr. Robert Mogielnicki, Senior Resident Scholar at the Arab State Institute in Washington.

“Business people are always looking for new and untapped opportunities, but the political risks are extremely high in either direction.” “Gulf governments can marshal certain business interests, government firms, or government-related entities; however, there is bound to be some trepidation,” he told TRENDS.

For his part, Abdulla considers that the Saudi Iranian reconciliation and Iranian-Gulf openness are still in their early stages and that we have a long way to go before we know the outcome of this reconciliation.

“The beginning is promising, and everyone should keep a positive and optimistic attitude, which will benefit the Gulf’s current environment.” But we’re dealing with Iran, which is still in a state of revolution unlike any other, and we have no idea who we’re dealing with or who is ruling because of differences and conflicts between the revolution’s institutions and the moderate party. Despite this, positive signals are emanating from Iran, and it wishes to communicate with neighboring countries because of economic sanctions and pressures, and the Gulf countries always extend their hand in the hope that the Iranian side will transform into a less dangerous side to the security of the Arab Gulf”, he said.

According to Alexander, travel and tourism are likely to be the sector that benefits most immediately, particularly given a backlog in demand for pilgrimage in both directions (principally by Iranians to Mecca and Medina as well as by Saudi Shia to sites such as Mashhad in Iran.

The agreement happened on a government-to-government level, however,this doesn’t necessarily guarantee that the sentiment will trickle down to the business communities in each country.

Dr. Robert Mogielnicki, Senior Resident Scholar at the Arab State Institute in Washington

Mogielnicki, on the other hand, is more cautious, believing that the two sides are still a long way from establishing deep and sustainable links in trade, investment, and tourism.

“I don’t see any direct economic impact for Saudi Arabia or Iran.” Economically, the only likely gains in the near term will be indirect benefits for Saudi Arabia due to the perception that this agreement has reduced regional tensions and the likelihood of conflict. These indirect economic benefits, however, are hard to quantify,” he said.

“Despite the attention and promotion this agreement has received, my impression is that expectations are very low.” I doubt many Saudis, Iranians, or other informed observers believe this agreement will go smoothly. Nonetheless, the Abraham Accords serve as a recent example of a regional realignment that has led to economic cooperation, especially between the UAE and Israel. It’s not a perfect comparison, but it shows how quickly dynamics can shift with support from the upper echelons in regional governments,” he added.

Developing trade and economic relations between Iran and Saudi Arabia may be one of the most essential factors in the two countries’ other ties.

However, while the recently concluded agreement reflects the two countries’ determination to develop positive relations and close many files of disagreements, the future of these relations is also linked to other factors.

According to Abdullah, one of these challenges is that Iran still does not make the Gulf states feel safe and secure. Yesterday, Iran detained a ship in the Strait of Hormuz, and before that, it attacked an oil tanker. During May, Iran sent unsettling messages indicating that, despite the dialogue, internal parties may want this openness, dialogue, and reconciliation to end.

Moreover, while sanctions remain, trading directly in dollars with Iran is not possible, as Iraq has experienced.

While US sanctions remain in place, investments from any country will be extremely logistically difficult. Iran needs capital and there are many areas where Saudi companies could contribute significantly, such as building solar and wind capacity.

“The hope is that the potential for substantial investment from Saudi Arabia and other Gulf states could be a motivating factor for Iran to reach a nuclear deal with the US,” Alexander said.

He pointed out that trading in the Chinese Yuan is unappealing. “Iraq has recently been reported to be considering repaying some of its gas import debts to Iran by financing Iranian pilgrims visiting Saudi Arabia.” Effectively, trade is limited to barter. Although China is keen to make the yuan a trading currency, and both Saudi Arabia and Iran have significant bilateral trade with China, China’s capital controls make it unappealing for third parties to use yuan among themselves,” he said.

Iran–Saudi relations in historical context:

While current debates on the Iran-Saudi relationship are, by necessity, focused on current manifestations of competition between the two sides, the sense of rivalry between them has a longer history.

Iran’s 1979 revolution, so often heralded as a game changer in the region and Islamic world, undoubtedly played a significant role in shaping the relationship as we know it today. However, the broader Cold War context, as well as both states’ regional ambitions and roles as major oil producers prior to the revolution, are important.

During the Cold War, Shah Mohammad Reza Pahlavi was entrusted with securing Western interests in the region, echoing the West’s current placing of trust in an authoritarian, ambitious leader.

The shah, like Mohammad bin Salman, was armed with the most advanced weapons and turned a blind eye to domestic repression that went hand in hand with modernization efforts and vanity projects. Following the UK’s withdrawal from the region, both Iran and Saudi Arabia were seen as ‘twin pillars’ of Persian Gulf security, with Iran in particular playing a key role as a bulwark against the perceived Soviet threat to the region.

The two monarchies were united by a desire to preserve the regional status quo and to counter the tide of Arab nationalism, which both saw as a major threat.

As Saudi Arabia began to assert its position as a key oil producer, it was also able to undermine Iran’s regional clout – as seen through its role in the Arab oil embargo following the Yom Kippur War, and in its rapidly swelling coffers.

Thus, in the lead up to the events of 1979, both states ramped up their military spending to reinforce their regional standing and domestic control.

Relations between the two countries deteriorated after the Iranian Revolution of 1979. Soon after, Saudi Arabia provided financial support to Baghdad during the Iran-Iraq War.

In 1987, diplomatic relations broke down when, following the death of 200 Iranian pilgrims during the Hajj pilgrimage, Ayatollah Khomeini called for the overthrow of the Saudi monarchy.

In the 1990s, relations thawed due to Iran’s need to rebuild its battered economy after eight years of war.However, the invasion of Iraq in 2003 and the leadership of Mahmoud Ahmadinejad reignited the rivalry, leading to what has become known as the “Middle East Cold War”.

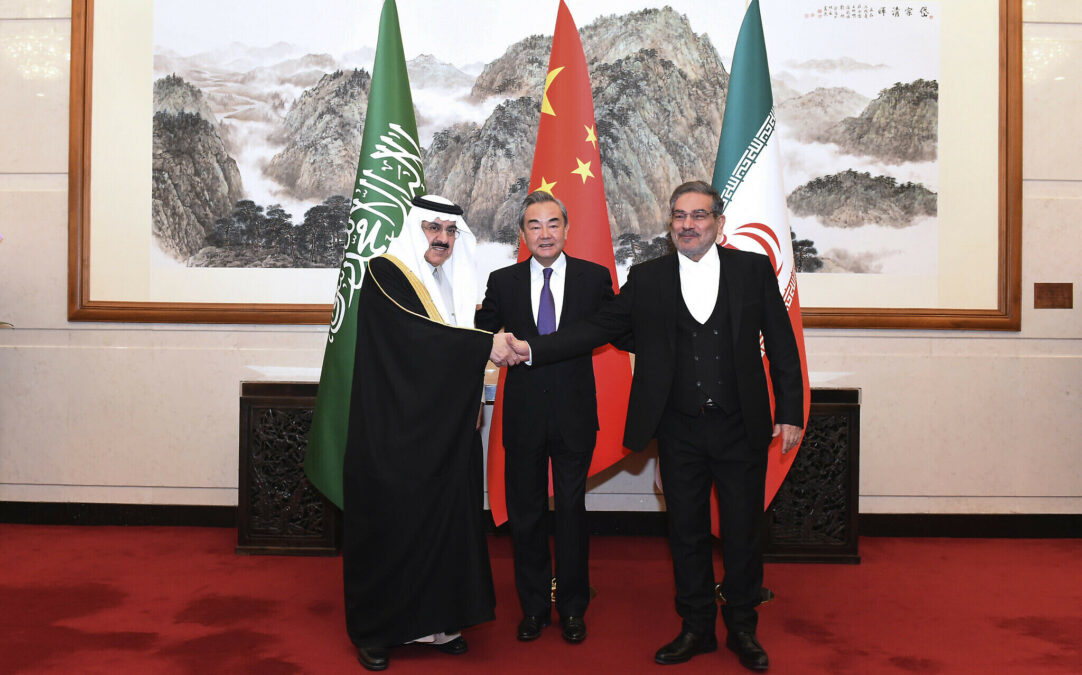

On 10 March 2023, representatives of Iran and Saudi Arabia met secretly in Beijing to announce a Chinese-sponsored agreement to restore diplomatic relations between the two countries.

Officials in the UAE, Kuwait, and Oman all praised the agreement as a step toward stability and prosperity that will benefit all parties. Even Bahrain, which is notorious for being wary of engaging Iran, issued a statement welcoming the agreement and expressing hope for conflict resolution through dialogue and diplomacy.

After the announcement of the Saudi Iranian deal, Iran’s Supreme National Security Council secretary, Ali Shamkhani, met with top security and economic officials in the UAE, suggesting an acceleration and widening of UAE-Iran relations.