Some of the iconic real estate holdings developed by Taiba Investments (Taiba) across Saudi Arabia suggest that the Kingdom is headed towards an unprecedented economic transformation under the leadership of Crown Prince Mohammed bin Salman.

Madinah- headquartered Taiba, a public joint-stock company listed on the Saudi Stock Exchange “Tadawul”, manages a portfolio of diversified investments spanning a number of sectors including real estate, tourism, maintenance, operation, industry, mining, agriculture, trade, investment services, mortgages, and technology sectors.

Established in 1988, the company’s commercial and hotel projects are located in prime positions in central Madinah.

The company is a key supporter of Saudi Arabia’s transformative Vision 2030, in particular in regard to economic diversification, where it is supporting the growth and development of public service sectors such as tourism.

Taiba, which has interests in hotels, tourism facilities and real estate, has a market capitalization of $1.5 billion, Refinitiv data shows.

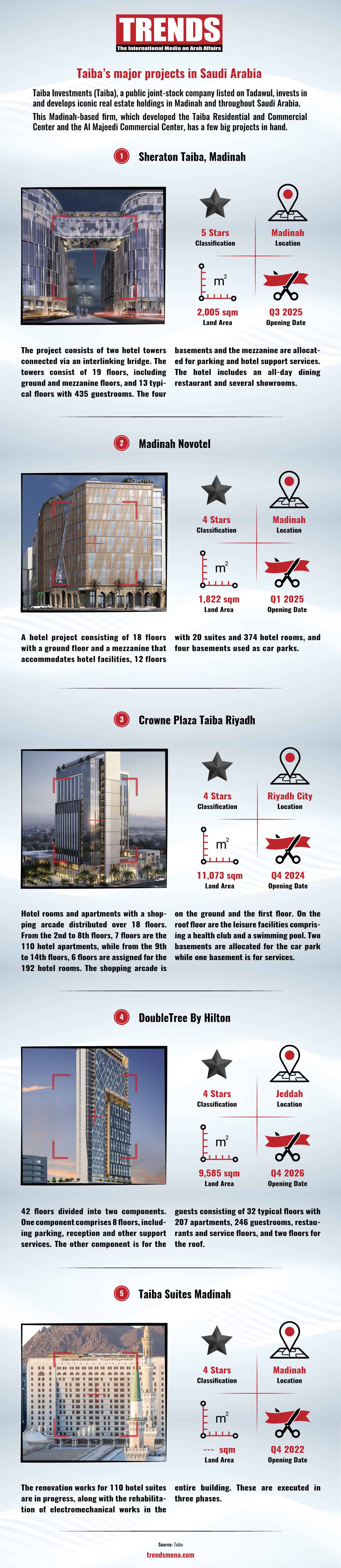

TRENDS takes a look at some of the major projects currently being executed by Taiba.