ANKARA — Türkiye is woven into the fabric of the region and the world by road, rail, sea, and air with connections to more than 342 destinations in 121 countries and same-day coverage of 16 time zones exclusively through domestic airlines.

Türkiye’s tourism and entertainment sector, along with its geographic location between Europe and Asia, traditionally makes it an attractive country for real estate investment. Political stability and economic growth prospects help it attract foreign interest and local demand for residential and commercial property assets.

Middle Eastern investors, in particular, find the relatively affordable property prices, a favorable climate, and the historical and cultural appeal of Türkiye very appealing.

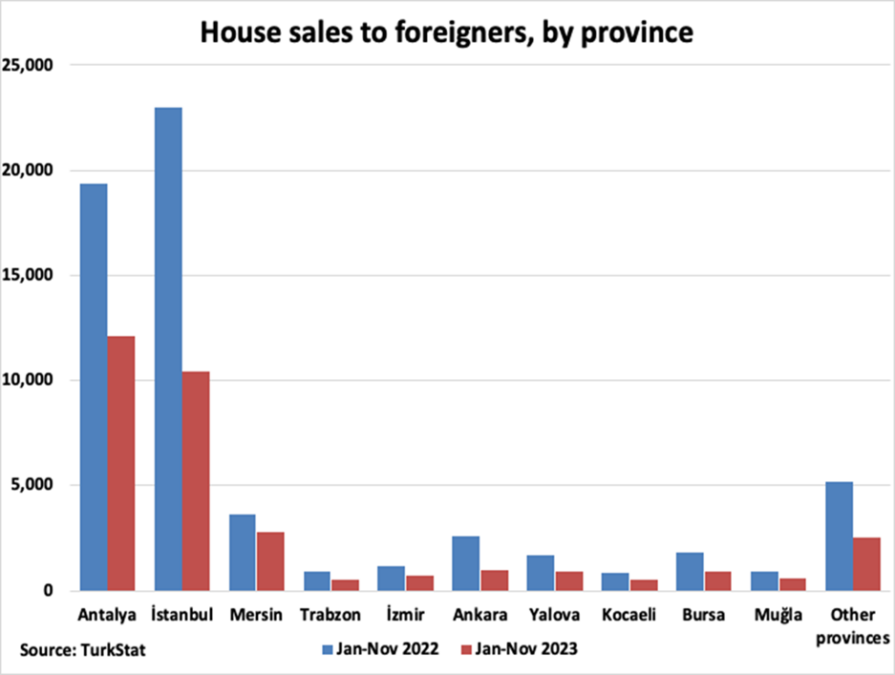

Istanbul, Antalya, Izmir, Bursa, and Bodrum traditionally lead in property purchases, with Istanbul being a hotspot for premium properties, according to Endeksa, a Turkish platform that offers real estate values and analysis.

The not-so-good news is that fragile economic conditions and currency depreciations have impacted market dynamics, with the property sector experiencing periods of rapid development followed by severe slowdowns.

A recent policy reversal by the Central Bank of the Republic of Türkiye (CBRT) to raise interest rates to 45 percent aims at stabilizing the Lira, with little success so far. The Turkish government is also pushing mandates to ease foreign investment regulations and encourage the flow of funds into the sector, doing its best to keep the sector front and center in the eyes of investors.

These include simplifying bureaucratic property-buying processes for foreigners to make these more efficient and transparent, including a 1-week max purchasing process as well as offering citizenship in return for sizable investments in real estate.

“The economic situation shifted the act of purchasing properties between 2023 and 2024 from a long-term investment purpose to a more short-term role of an investment for foreign individuals, who seek to acquire real estate for vacationing, establishing a retirement abode, or simply seeking a place to settle down,” Ali Sassilaoğlu, Founder and business development manager at A. ESTATE, told TRENDS.

“Consequently, Türkiye transforms into an insecure breeding ground for foreign investors who are disinclined to procure real estate solely for investment purposes. The ramifications of these conditions are reflected in the escalating property prices, owing to the elevated interest rates.”

Nilay Sarıbey Türkçakal, a broker at Beytkum Real Estate Translation Construction Co., said the Turkish real estate market is known for its real estate appreciation potential, offering strong rental yields and attractive resale opportunities at higher prices. “Its different landscapes offer different housing types in every region and city of Türkiye, from urban and luxury apartments to seaside and farmland villas.”

Real estate impact of inflation and currency depreciation

Inflation averaged 15 percent annually for five straight years up to 2021, before surging to an average of 65 percent between 2022 and 2023, significantly draining the local currency, according to official figures from TurkStat. Today, $1 is approximately equal to 32 Turkish Liras (TL), up from 5.45TL in March 2019.

The Turkish Lira’s peg to the US Dollar has wreaked havoc for companies dealing with real estate financing costs and negatively impacted local affordability and demand for properties. A hike in commodity prices also directly inflated construction material and labor costs, to the detriment of the housing sector. In December 2023, the construction cost index (CCI) increased by 67.3 percent year-on-year (yoy), while the material index grew by 54.2 percent yoy, and the labor index swelled by 112 percent yoy.

Foreign buyers prefer more stable currency and monetary policies to better manage their investments, yet, high inflation tends to make real estate purchases more enticing due to increased buying power for holders of foreign currency.

“Real estate investments involve long-term commitments, and investors prefer markets with lower risks of economic instability. A stable economy reduces the likelihood of significant fluctuations in property values,” Sassilaoğlu said.

Türkiye’s Economy

Türkiye’s economy grew about 4 percent in 2023, slower than the annual GDP expansion of 5.5 percent in 2022, and 11.4 percent in 2021, according to recent IMF figures.

“The recent actions to raise the policy rate, increase taxes, and liberalize some financial sector measures have reduced risks and lifted investor confidence, compressing spreads and improving the reserve position of the CBRT,” said the IMF.

The IMF projects the Turkish economy to grow even slower at three percent in 2024, although the World Bank’s estimate is nearer to 4.3 percent GDP growth.

In November 2023, Türkiye recorded a current account deficit of $2.72 billion, and Bloomberg reported that the country’s budget deficit widened by nearly 900 percent in 2023, reaching $46.5 billion from only $4.74 billion in 2022, according to the Turkish Treasury and Finance Ministry.

One way to offset that is to attract more Foreign Direct Investment (FDI), and the property sector is well-suited for that role.

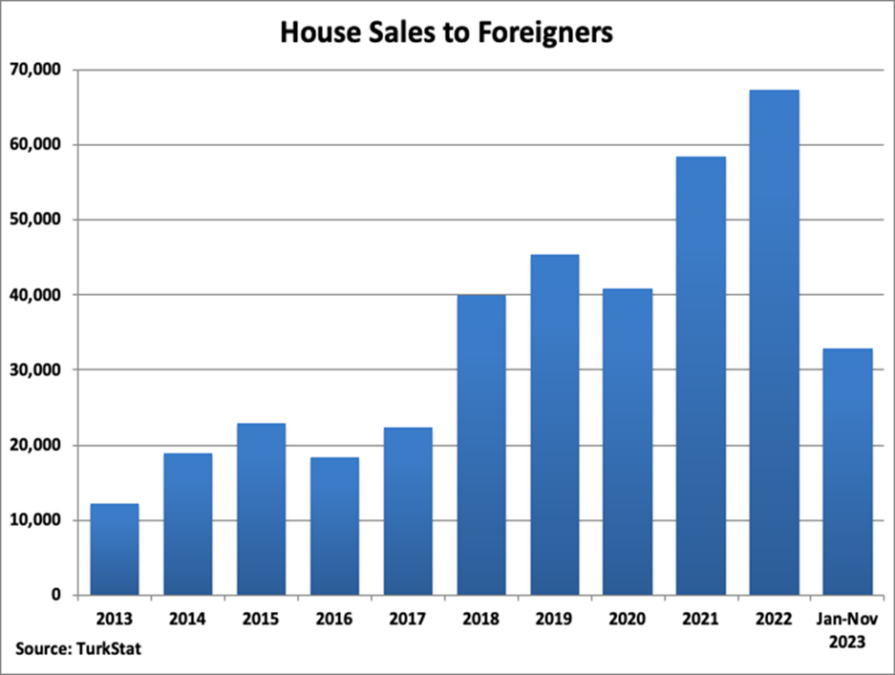

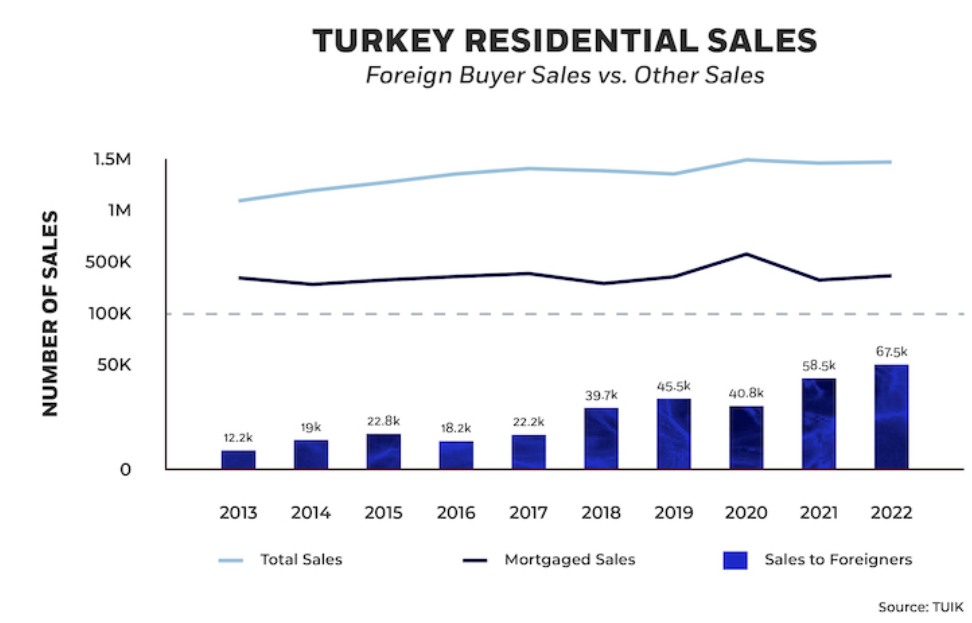

Over the past 20 years, Türkiye has secured nearly $240 billion in FDI, with real estate accounting for $62.5 billion of that or 26 percent of the total, according to Property Türkiye. In 2023, the country drew over $7 billion in capital. More FDI flows are expected in 2024, but the market is trending down, as evidenced by home sales in 2023.

Home sales in 2023

According to tuik.gov.tr, 1,225,926 homes were sold in 2023 in Türkiye, decreasing by 17.5 percent compared to 2022. Istanbul had the lion’s share of house sales with 16.2 percent totaling 198,739. Ankara was next with 114,432, or 9.3 percent, and Izmir registered 65,465 home sales or 5.3 percent.

The average home price was about $100,000 by August 2023.

According to Invest Gate, an Egyptian-based media, Arab purchases of properties in Türkiye experienced a decline of 61 percent year-on-year in November 2023, totaling around 2,400 units down from a peak of 6,500 units in December 2022.

The Türkiye-based property company Damas Group said Iraqis make up the largest group of Arab investors, having bought over 47,000 properties over the last eight years. Kuwaitis, Yemenis, and Palestinians are second, third, and fourth on the list of Arab buyers, according to the Turkish real estate company Hana.

In 2023, there were 35,005 property sales to foreigners, a 481 percent decrease year-on-year, with Russian citizens leading these purchases, followed by Iranians and Iraqis, according to Simply TR. Russians represented about a 30 percent share of foreign buyers followed by Iranians with a 12.3 percent market share and Iraqis at 5.5 percent.

The persistence of high prices in dollar terms was behind the decrease in property purchases by foreigners.

“Historically, investors from Iraq, Iran, Russia, Ukraine, Kuwait, Saudi Arabia, Jordan, the Netherlands, and Germany have shown great interest in the Turkish real estate market,” Türkçakal said.

“Property selection generally aligns with investors’ intentions, be it for personal use, rental income, or capital appreciation, but the most purchased real estate in Türkiye are flats, followed by detached buildings, villas, commercial real estate, student units, and land. Foreign investors own at least one real estate and the average ownership period is five years.”

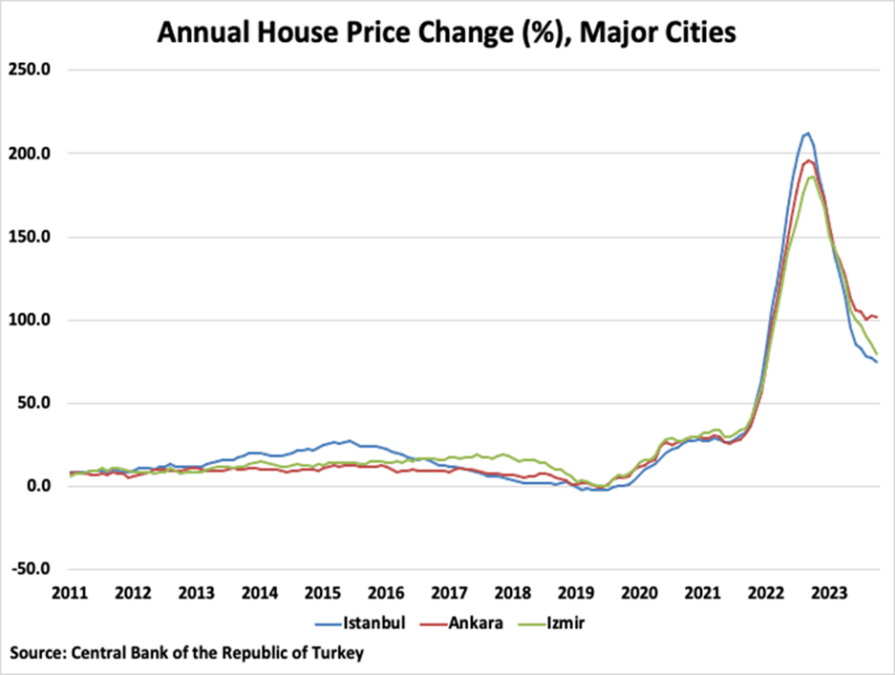

Nominal versus real property price growth

Türkiye’s nominal price growth was 86.5 percent in October 2023 compared to 2022, but factoring in inflation means this translates into a moderate 12.4 percent real price growth adjusted, according to the CBRT.

Istanbul’s nominal price growth was 66.7 percent but only 3.3 percent real, while Ankara’s was a 94.3 percent nominal growth versus 20.4 percent real and Izmir registered a 77.2 percent nominal price growth but was only 9.8 percent real, according to the Global Property Guide.

New dwelling prices rose nominally by 91 percent (18.4 percent real) year-on-year in October 2023 while existing dwelling prices increased by 86.8 percent nominally (15.8 percent real).

Rental yields across major Turkish cities

Gross rental yields are returns earned on the purchase price of a rental property, before taxation, vacancy costs, and other costs. Türkiye’s rental yields averaged a gross rental yield of 6.52 percent in Q3 2023, according to recent Global Property Guide research conducted in October 2023.

In Istanbul, rental yields on apartments varied significantly from 2.84 percent to 9 percent in Q3 2023.

In other cities, the rental yields are more or less similar to Istanbul. In Ankara, for example, gross rental yields were between 5.37 percent and 10.13 percent, with a city average of 7.15 percent.

Residential and commercial real estate markets

In 2023, the Türkiye residential real estate market was estimated at $89 billion and projected to reach $168 billion by 2029, growing at 11 percent annually between 2024-2029, according to Mordor Intelligence.

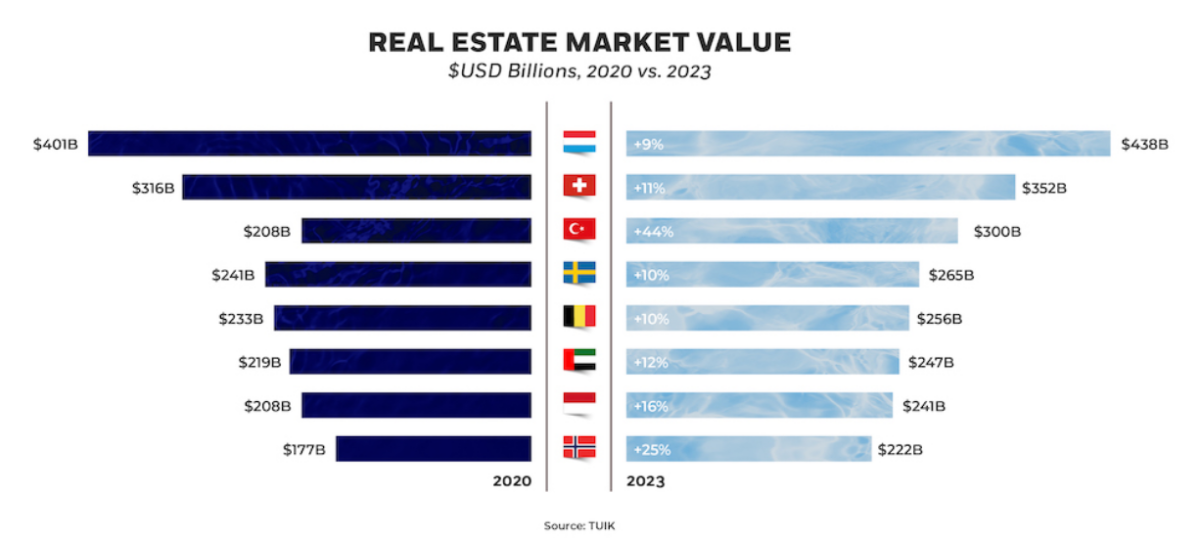

Meanwhile, the value of Türkiye’s commercial real estate sector was slated to surpass $300 billion by the end of 2023. Nominal real estate prices surged by over 50 percent between 2020 and 2023, resulting in large gains for investors, according to Property Türkiye.

Turkish regulatory incentives aimed at foreign buyers

“The regulation easing requirements for foreigners to acquire Turkish citizenship, the volatility in the Turkish lira against other currencies, and the VAT exemption for foreigners helped spur the sales,” said Melih Tavukçuoğlu, head of Istanbul’s Asian-side Contractors’ Association.

In more detail, Türkiye reduced the Land Registry’s title deed fees from 2 percent to 1.5 percent for both buyer and seller.

It granted VAT exemptions to buyers of Turkish property who do not live in Türkiye, but only if the purchase was made using foreign currency.

The stamp duty for “promise to sell agreements” was eliminated from a previous 0.95 percent.

A fixed capital investment of $500,000 or keeping a minimum of $500,000 in a Turkish bank account for at least three years, down from the earlier cap of three million dollars, earns these investors and depositors Turkish citizenship.

The minimum threshold to obtain citizenship through real estate investment stands at $400,000.

Residential properties valued under $174,484 are exempt from a luxury housing tax, and those valued between $174,484 and $261,726 are taxed only 0.3 percent of the amount over the base level.

Those who own only one residence will not be subject to any housing tax, while those who own more than one residence will not be subject to the luxury housing tax on the residence with the lowest value.

“The Foreign Direct Investments Law in Türkiye provides equal treatment to all investors and allows for international arbitration. It has bilateral investment promotion and protection agreements with more than 82 countries,” Nilay said.

“The attractiveness of the market is likely to be supported by ongoing infrastructure developments, urban renewal projects, and government investment incentives. Türkiye has ambitious targets in a wide range of infrastructure areas for 2023 and 2024, the centenary of the Republic of Türkiye. In 2024, housing sales in Türkiye are expected to continue their strong performance and exceed 500,000,” Nilay concluded.