London, United Kingdom – The UK government is considering temporary renationalization of indebted Thames Water, Britain’s biggest supplier of the commodity, media reports said Wednesday, one day after its chief executive resigned.

Sarah Bentley stepped down with immediate effect amid mounting worries over the company’s debt which totals nearly £14 billion ($18 billion) — as the creaking sector faces a huge bill to clean up sewage.

Thames Water supplies 15 million homes and businesses in London and elsewhere in southern England.

Canadian pension fund Ontario Municipal is its biggest shareholder with almost one-third of the group.

Britain privatized its water industry in 1989 when Margaret Thatcher was prime minister.

The country’s water companies have accumulated combined debt of £54 billion since privatization, to fund investments and shareholder dividends, according to an investigation last year by The Guardian newspaper.

Responding to reports of a possible renationalization, a government statement said Thames Water’s present situation was “a matter for the company and its shareholders”.

“The sector as a whole is financially resilient. (Water regulator) Ofwat continues to monitor the financial position of all the key water and wastewater companies,” it added.

UK media said ministers were in talks about the possibility of temporarily bringing the utility company back into public hands under a so-called special administration regime (SAR).

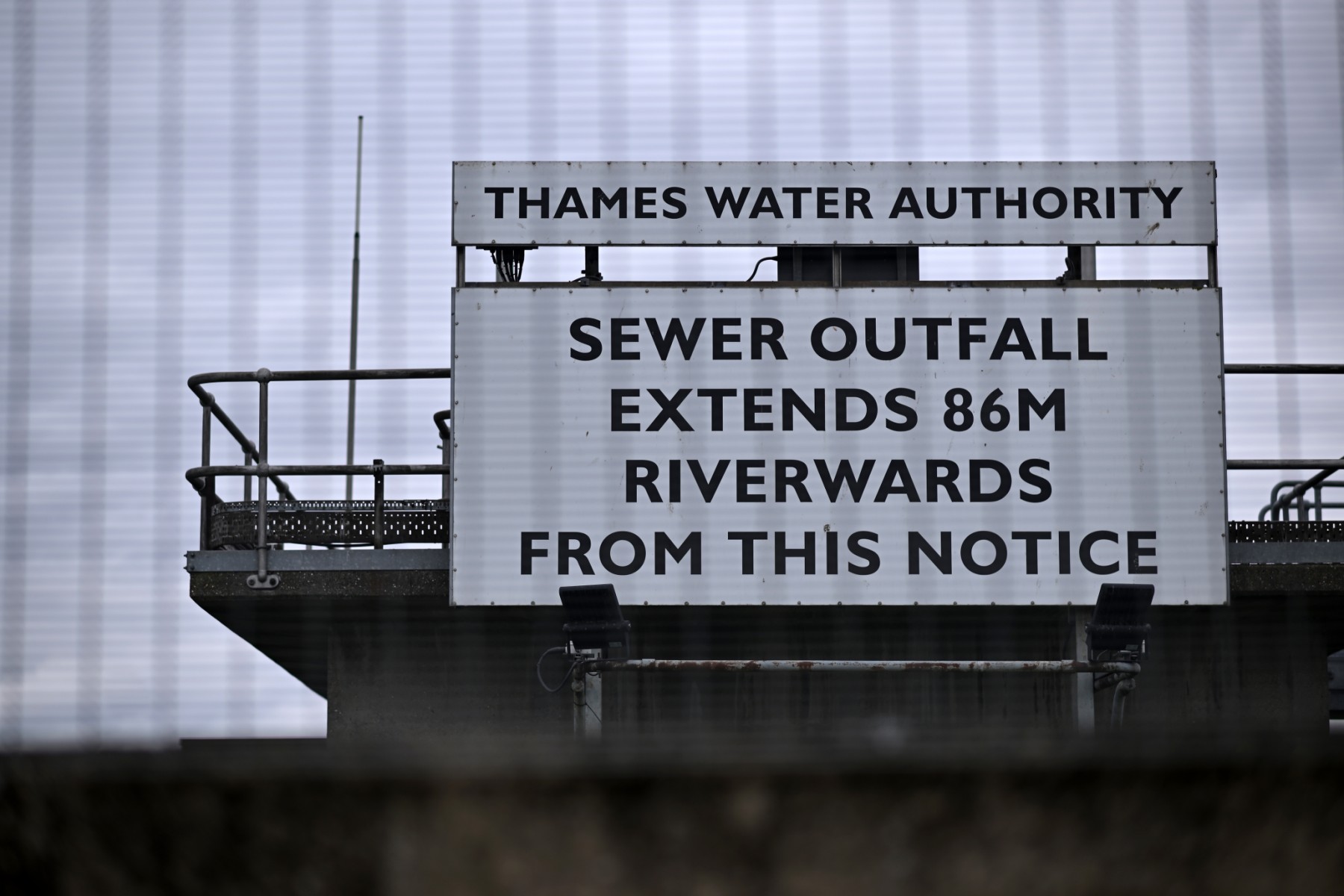

England’s privatized water companies last month pledged to make massive investments to stop raw sewage being pumped into waterways as concerns mount about water quality and laxer environmental protections post-Brexit.

Water firms have been under fire for years over releasing untreated wastewater into rivers and seas, blighting fragile ecosystems and leading to illnesses in people and the closure of beaches.

Campaigners have expressed outrage that the billions of pounds recently promised to upgrade infrastructure would be passed on to consumers already struggling with higher bills under a cost-of-living crisis fueled by elevated inflation.

The Times newspaper on Wednesday said water bills could surge 40 percent by 2030 to fund the works.