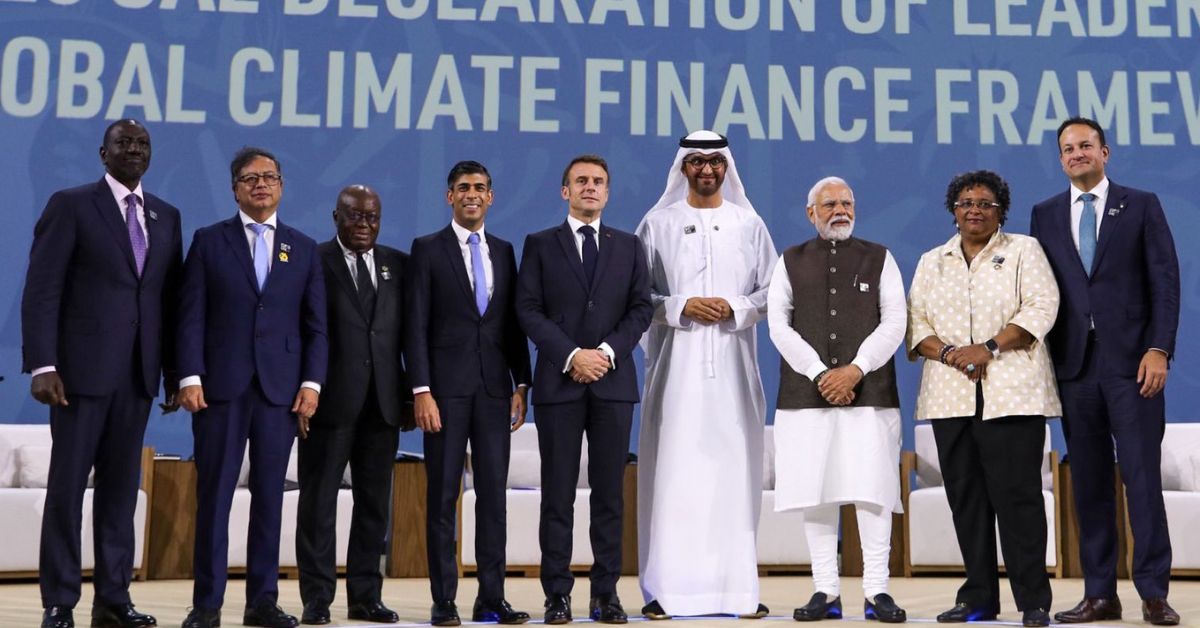

DUBAI, UAE — Climate finance was a focal point at COP28, the 28th Conference of the Parties to the United Nations Framework Convention on Climate Change, hosted in Dubai from November 30 to December 12, 2023. Amid the pressing climate crisis, securing sufficient funds for developing countries’ mitigation and adaptation efforts was crucial.

Antoine Samaha, Managing Director & Partner at Boston Consulting Group (BCG), discussed with TRENDS how COP28 tackled the issue of inadequate adaptation funding in developing countries. A notable initiative is the Loss and Damage Fund, established on COP28’s first day to aid developing countries in dealing with climate change impacts. However, the challenge remains significant. The fund’s pledges, totaling around US$ 520 million, fall short of the actual needs.

“The main challenge ahead is to secure more funding and ensure its efficient and equitable distribution. This requires collaboration with all nations, especially those capable of contributing more,” he said.

Over the next 30 years, an estimated US$ 100-150 trillion is necessary for key areas like decarbonizing industries, developing renewable energy and green infrastructure, and supporting global adaptation and resilience projects. Despite progress, financial investment in these areas is insufficient, with a substantial gap between the needed and current capital allocations.

Samaha added that the financing gap is even wider for adaptation and resilience, requiring about $500 billion annually, but only about 10% of this need is met. This shortfall is most severe in climate-vulnerable countries. COP28 aimed to shift the perception of adaptation and resilience projects from being unfinanceable to ensuring they receive the needed capital.

COP28 marked a significant milestone with the historic agreement to establish a loss and damage fund, aimed at helping developing countries cope with the effects of climate change. This agreement, reached on the conference’s first day, garnered pledges from various countries.

The allocation of these resources is expected to focus on countries particularly vulnerable to climate change impacts, such as devastating floods, droughts, and rising sea levels. These nations, having contributed the least to the climate crisis, are bearing the brunt of its effects. The mechanisms for resource allocation are still being developed to ensure effective and equitable distribution.

In addition to the loss and damage fund, COP28 has seen progress in discussions around establishing a dedicated Loss and Damage (L&D) Finance Facility with several potential sources and allocation principles:

Public Sources: Developed countries are expected to increase their contributions, acknowledging their historical responsibility and the needs of vulnerable nations. This may include scaled-up pledges to funds like the Green Climate Fund (GCF) or direct contributions to the L&D facility.

Innovative Mechanisms: Options such as levies on fossil fuel companies, carbon pricing revenues, or debt-for-climate swaps are being explored to generate substantial, dedicated funding streams.

Private Sector Involvement: Mobilizing private capital through blended finance, risk-sharing instruments, and targeted incentives can unlock significant resources.

Allocation Principles: The fund prioritizes countries most vulnerable to climate impacts, ensuring direct access to minimize bureaucracy and implementing robust mechanisms for transparency and accountability. The aim is to align L&D finance with existing adaptation and mitigation efforts to avoid duplication and maximize synergies.

“Overall, COP28 is undertaking significant steps to ensure that the most vulnerable countries receive the support they need to address the impacts of climate change. However, the path ahead requires continued effort and strategic coordination to fully realize these goals,” Samaha explained.

The role of climate finance in achieving climate change goals is pivotal. Finance can be the most effective tool for reaching net-zero emissions, serving a dual purpose: supporting renewable energy and other mitigation strategies to limit global warming to 2°C or below, in line with the Paris Agreement, and financing adaptation measures for resilience against climate impacts.

However, current financial flows are inadequate. Analysis from BCG and The Rockefeller Foundation indicates that the capital currently deployed accounts for only about 16% of the total climate finance required to mitigate negative climate effects and adapt processes and infrastructure worldwide.

Encouragingly, initiatives like the US Inflation Reduction Act and the EU Green Deal are prompting rapid responses in the financial sector, creating new opportunities in renewable power, transportation, nature-based solutions, and adaptation. These emerging financial models and the growing market for adaptation and resilience solutions signify a positive shift. Yet, challenges persist in effectively directing investments.

According to Samaha, blended and catalytic finance is key in creating a new financial architecture for net-zero agreements. Financing a just transition is also critical, with investors encouraged to incorporate just transition principles into their criteria and to scale up global funding, especially for developing economies.

“This strategy involves leveraging metrics to assess companies and address funding gaps. The transition requires a massive investment of around $37 trillion in energy and industrial infrastructure by 2030. Despite planned energy-sector investments of $19 trillion, an $18 trillion gap remains, highlighting the need for collective action across public and private sectors,” he noted.