Dubai, UAE — In the first five months of 2022 alone, and for the first time since the global financial crisis of 2009, various IPOs in the GCC raised $4.8 billion, a figure much higher than what IPOs in Europe could manage to mobilize.

Initial public offerings in the Gulf prove resilient to the volatility hurting deals in other markets, such as high oil prices, stable economies, and abundant liquidity fuel activity, according to May Nasrallah, Founder & Executive Chairman of deNovo Corporate Advisors.

Significant privatizations and private growth companies are now entering the IPO markets due to the recent surge of PO activity and frameworks introduced to enable SPAC formation and listing in the area.

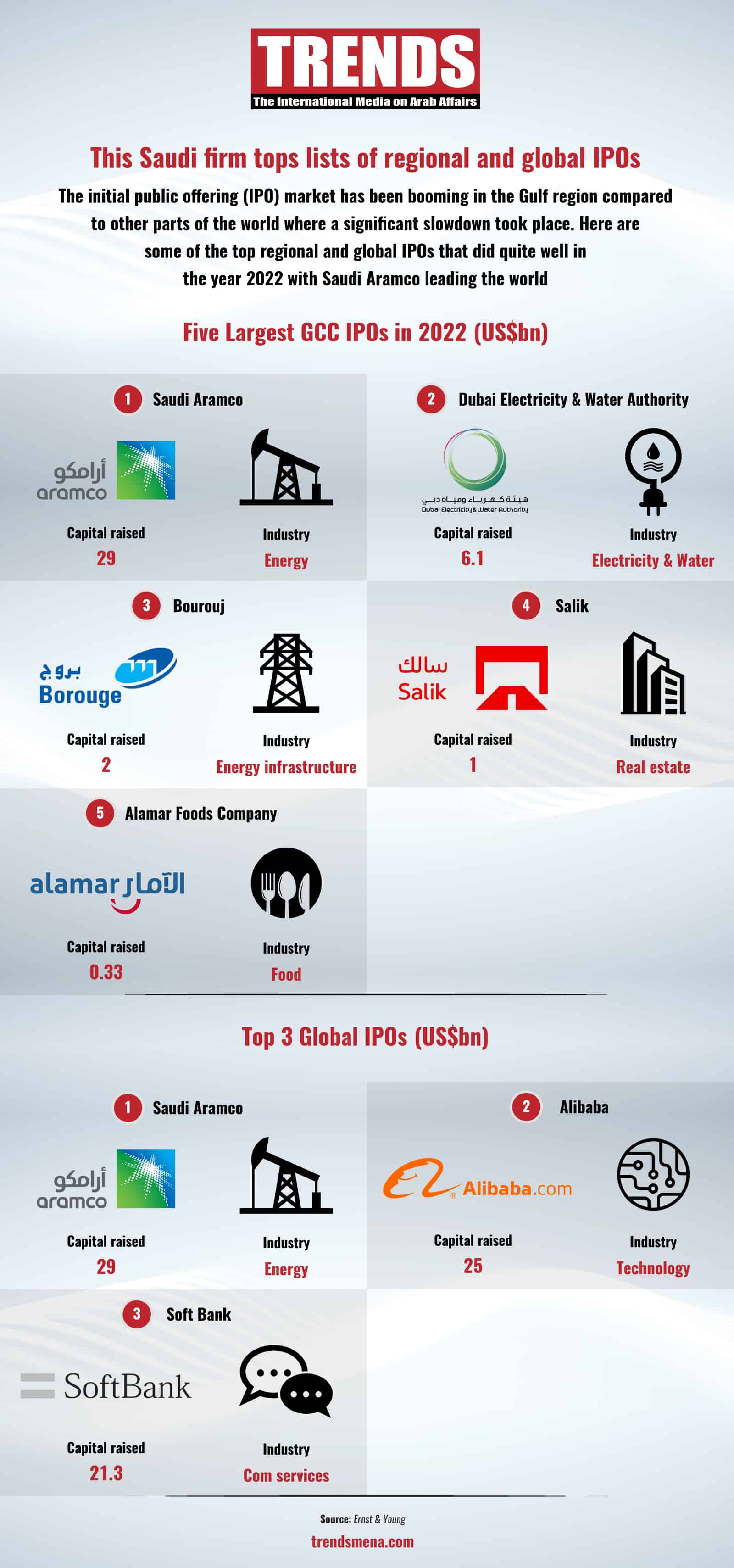

Here are some of the top IPOs in the GCC region: