The Gulf Cooperation Council countries have embarked on transformative missions to diversify their economies away from oil, having realized that revenues from oil are expected to decline in the face of reductions in global demand starting around 2040, if not sooner.

This will be driven by higher demand for renewable energy and improvements in energy efficiency and storage.

Since the price of oil has been volatile, these countries have been exposed to economic disruption. And with the world transitioning away from fossil fuels, these countries decided to broaden the income possibilities to other necessary avenues.

The region’s biggest economy, Saudi Arabia, unveiled its ambitious long-term strategy for the Kingdom, known as ‘Vision 2030’.

To push tourism, Saudi Arabia targets 100 million visitors for 2030—30 million are meant to come from abroad while the rest would be people travelling within Saudi Arabia. Other countries in the region also have spelled out their plans to reduce dependence on oil.

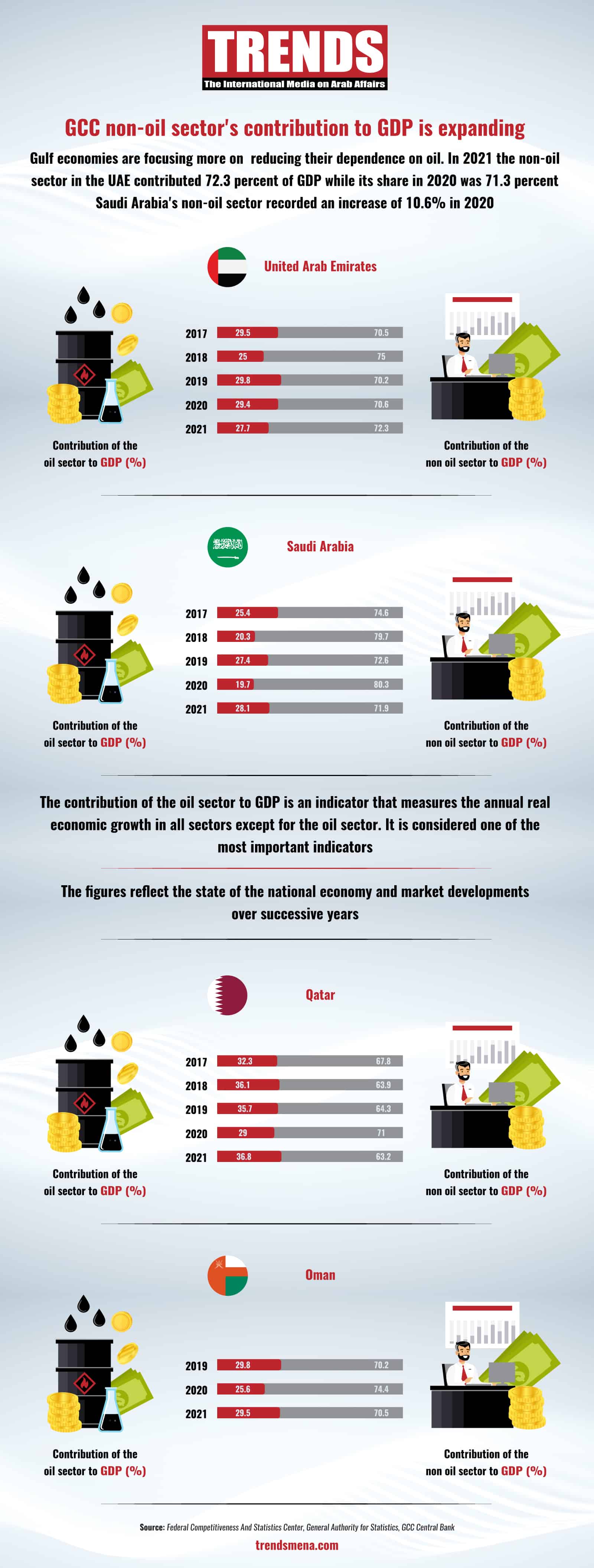

TRENDS looks at the contribution of oil and non-oil sectors towards the GDP of four GCC states: