-

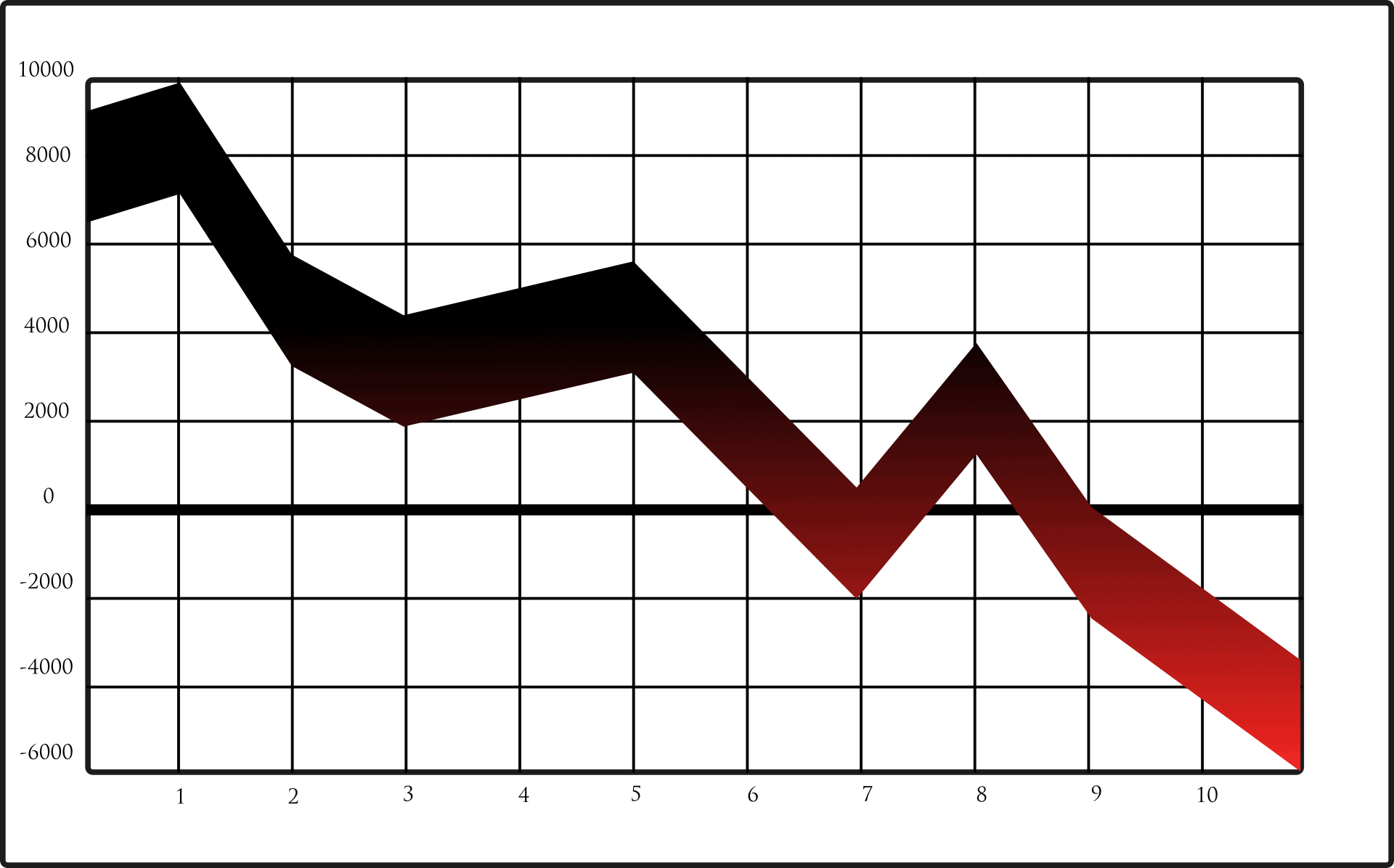

The Lebanese pound has lost around 90% of what it was worth in late 2019

-

Matters made worse by the August 4 Beirut Port explosion last year

Lebanon’s currency reached new lows on Sunday, June 12, trading at around 15,150 to the dollar, said local reports.

With this, the Lebanese pound has reportedly lost around 90% of what it was worth in late 2019, when a pyramid scheme involving its central bank came to light.

Back then, the central bank’s governor Riad Salameh was accused the so-called “financial engineering”: a scheme that involved borrowing from commercial banks at high rates to keep the government’s finances afloat.

After that fell apart, the Lebanese government tried in October 2029 to tax a number of things — including tobacco, petrol, and video-calling over platforms such as WhatsApp — to shore up revenue collection, but had to back off after widespread protests.

Since then, the country, has been facing crisis after crisis in sectors as diverse as food, fuel, and healthcare.

Transparency International in 2020 gave Lebanon just 25 out of 100 in its Corruption Perceptions Index, where lower points mean more corruption. Lebanon ranked 145 out of 180 countries on that index that year, down from 28 points and a rank of 137 in 2019.

Matters were made worse by the August 4 Beirut Port explosion last year, which infrastructurally devastated a part of the country’s capital and also paused all traffic in and out of the port itself.

Observers now point to a lack of political will and corruption for the stagnation in reform that could improve the situation there.

Depositors have been locked out of their dollar accounts since last year, but were promised some access starting July, with each customer getting $400 in cash and an equivalent in Lebanese pounds at a rate close to market value.

However, the International Monetary Fund has criticised Lebanon’s proposal for dollar deposit withdrawals and a capital control law yet to be approved by parliament, saying both measures would only be meaningful as part of broader reforms.