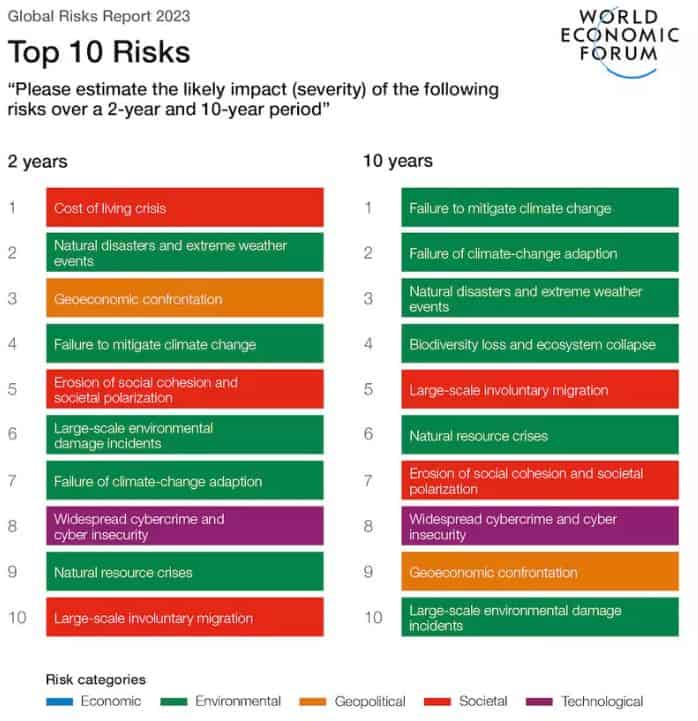

Against a backdrop of the persistent health and economic overhang of a global pandemic and a war in Europe, as 2023 begins, the world is facing a set of risks that feel both wholly new and eerily familiar. According to the World Economic Forum’s Global Risks Report 2023, the world’s top current risks are energy, food, inflation and the overall cost of living crisis. Over the next two years, the cost-of-living crisis remains the number one threat, followed by natural disasters and trade and technology wars.

Over the next 10 years however, lack of climate mitigation and climate adaptation lead, with biodiversity loss and ecosystem collapse viewed as one of the most rapidly deteriorating global risks over the next decade. Geoeconomic confrontation, erosion of social cohesion and societal polarization, widespread cybercrime and cyber insecurity and large-scale involuntary migration all feature in the top 10 over the next 10 years.

The last time income disparity featured among the top concerns was in 2013, in the aftermath of the global financial crisis. Energy price volatility was among the top ten in 2012, alongside food crises. But the combination of societal, technological, economic, environmental and geopolitical risks we face today is unique.

On the one hand, there is a return of “older” risks – similar to the low-growth, high inflation, energy volatile, low investment era of the 1970s against the backdrop of the Cold War – that are understood historically but experienced by few in the current generations of business leaders and public policy-makers. But in parallel, there are relatively new developments in the global risk landscape: historically high levels of public and private debt, the ever more rapid pace of technological development and the growing pressure of current climate change impact as well as the dire future outlook. Together, these are converging to create a unique, uncertain and turbulent 2020s.

Over 80 percent of experts surveyed expect consistent volatility over the next years, with multiple shocks accentuating divergent trajectories. Such pessimism is understandable. Risks that are more severe in the short term are embedding structural changes to the economic and geopolitical landscape that will accelerate other global threats faced over the next 10 years.

The most obvious knock-on effect is to environmental challenges which dominate the long-term risk outlook. Distraction with today’s shocks and more immediately upcoming concerns risks creating slow, uncoordinated action to both mitigate and adapt to climate change, leading to more extreme weather events and biodiversity loss with unstable, spiralling outcomes. The confluence of direct loss and damage from the physical impacts of climate change – rising sea levels, extreme weather events, heatwaves and wildfires, with the indirect consequences – such crop failures and a struggle to access basic resources, the beginning of climate migration and increasing civil unrest, then threatens the livelihoods of many, particularly in the developing world.

And yet, ignoring today’s crises and short-term risks in favour of longer-term threats such as climate is also impossible. There is no way forward on the investments for climate action if millions face the risk of hunger, thirst, displacement and violence, if families have to make unbearable choices between heating vs eating, or if governments face trade-offs between avoiding default and financial calamity today vs investing in the education, health, and infrastructure necessary for the next generation.

Yet these are the choices many individual households, organizations or entire governments face today. Existing inequalities within and between nations are being exacerbated, as large economies face recession and debt distress. Geopolitical and economic risks have put net-zero commitments and pledges to the test and exposed a divergence between what is scientifically necessary and what is politically feasible. As both inequality and climate pressure grow, the risk of political instability increases, incapacitating further the structures and institutions that can navigate the complex outlook. Technological advancements, unchecked, create new risks for jobs and livelihoods, wars and conflicts, as well as societal cohesion and mental health. And with global risks inherently interconnected, the frequency and severity of “polycrises” – where cascading impacts compound risks, often in unpredictable ways – is likely to increase over the next decade.

Act now – and together

Yet, it is still within our control to manage these complex, concurrent risks and limit their consequences – provided we can move past short-termism, crises-driven mindsets and solo approaches. Four key principles are critical to prevent further deterioration in the risks outlook – and leap forward to a brighter era.

First and foremost, leaders must rethink the time horizon of risks. While risks may play out as having short- and long-term impact, action to address those risks must occur in the shortest timeframe: today. In today’s risk landscape this means addressing both socioeconomic and climate concerns now and together.

Second, governments and business together must invest in multi-domain, cross-sector risk preparedness by building societal resilience through financial inclusion, education, health, care and climate-resilient infrastructure. Without a return to growth, jobs, and human development at a national level, countries face the risk of ever-growing polarization and political stalemates.

Third, it is necessary to strengthen and re-build international cooperation and multilateral governance. The recent overload of crises has turned the focus of nations inwards. While national preparedness is necessary, many global risks are better or only addressed through international coordination, data sharing and knowledge exchange, from climate change to technology governance.

Finally, foresight itself must be enhanced at global, national and institutional levels. Using scenarios, finding data on weak signals, appointing a risks officer function and scanning multistakeholder perceptions, can all help strengthen the ability of leaders to understand the risks landscape. This month global leaders gather at the World Economic Forum’s Annual Meeting. As they gather and consider action on global risks, solidarity, holistic approaches, and global cooperation are the only way forward.

Saadia Zahidi is Managing Director of World Economic Forum.

The opinions expressed are those of the author and may not reflect the editorial policy or an official position held by TRENDS.