-

Strict restrictions and intensive vaccination drive help the region deal with the pandemic

-

Massive drop in global oil demand and continuous closures in various sectors affect the GCC economies

By imposing strict restrictions on its citizens and reaching advanced stages in vaccination campaigns, the GCC proved to be one of the most influential regions fighting the COVID-19 pandemic. However, the massive drop in global demand for oil and the continuous closures in various sectors, 2020 had substantial social and economic repercussions.

COVID-19 statistics in the GCC

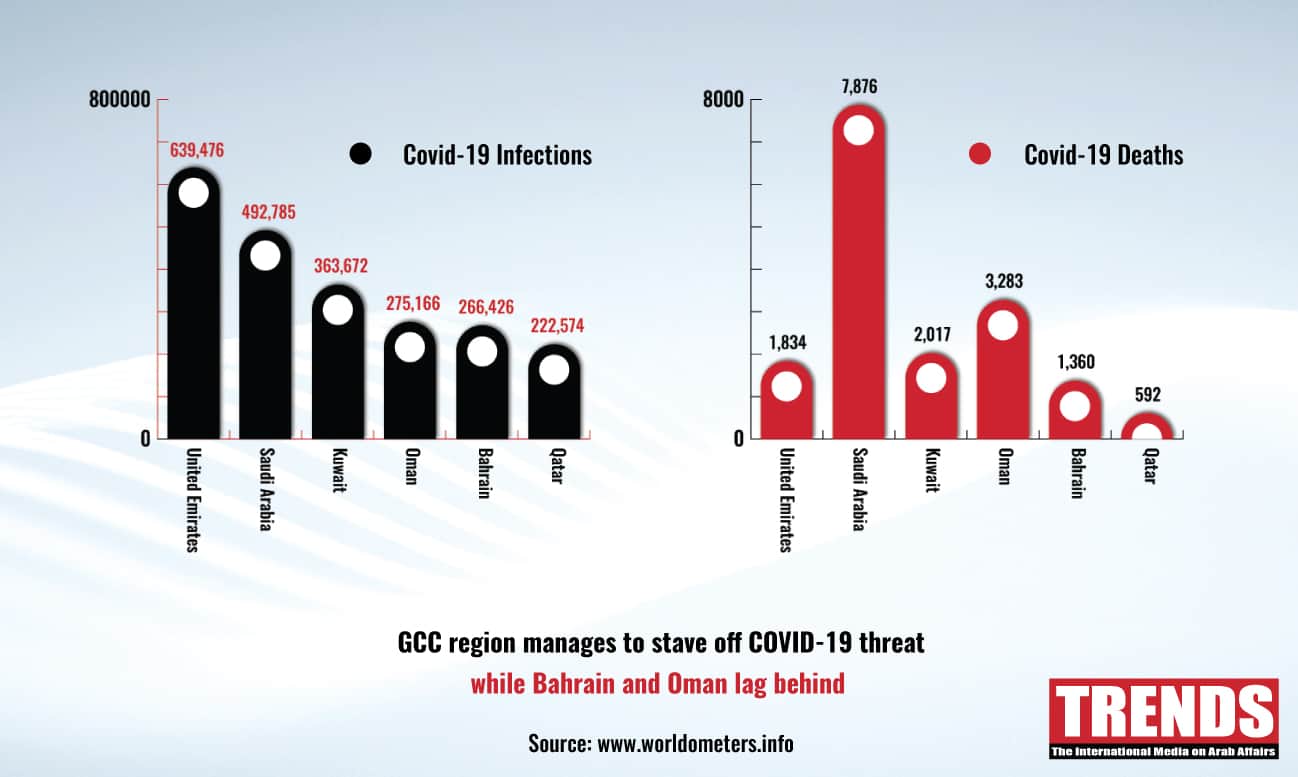

More than 184 million people were infected with Covid-19, while 3.9 million people died as a result. The UAE ranked first with 639,000 cases in the GCC, followed by Saudi Arabia (492,000), Kuwait (363,000), Oman (275,000) and Bahrain (266,000). Qatar reported least number of cases and with 222,000 infections, according to the Worldometers website.

On the other hand, mortality rate was highest in Saudi Arabia (7000) followed by Oman (3000), Kuwait (2000), the UAE (1800), Bahrain (1300) and Qatar (592).

Economic fall-out

The World Bank predicted that the GCC countries’ Gross Domestic Product would decline by 9.3% in 2021 from pre-Covid-19 levels, while the percentage of decrease in 2020 ranged between 4.4% and 7.7% for the oil-exporting countries.

According to a report by the International Monetary Fund (IMF), the GCC governments have announced several stimulus packages to shore up their respective economies in Q1 2020 and later released additional funds in early 2021.

Saudi Arabia

The IMF report said that Saudi Arabia announced a US$18.7 billion package for the private sector or 2.7% of its GDP in March 2020. The government-imposed taxes and fees were deferred and the Ministry of Health was provided with adequate funds to fight the pandemic.

Saudi Arabia intends to diversify its production sources as part of its Vision 2030. In addition, Crown Prince Mohammed bin Salman revealed the National Strategy for Transport and Logistics at the end of June 2021 to strengthen the Kingdom’s status as a leading logistics hub connecting the three continents.

United Arab Emirates

The UAE government spent about US$8.7 billion, or 2.8% of the country’s GDP, on various financial measures to support sectors affected by the COVID-19.

According to the IMF report, the plan included US$4.4 billion in private-sector support and US$400 million in government fee reductions.

The UAE’s GDP shrank by 6% in 2020 and is epected to register a growth of 2.5 % this year. As a result, the UAE Central Bank extended several stimulus measures totaling US$13.6 billion until mid-2022.

Kuwait

The Kuwaiti government set over US$1.6 billion, or 1.5% of the country’s GDP, to fund the efforts to control the spread of COVID-19. It also granted companies and citizens low-interest loans and eliminated several government taxes.

In addition, Kuwait’s government approved a law in March 2021 that would provide a US$2 billion reward to frontline workers fighting the pandemic in recognition of their efforts, and the Parliament confirmed it on May 27.

According to the IMF, Kuwait’s GDP is expected to drop by 8.1% in 2020 before recovering slightly to 0.6% growth in 2021 and 3.2% growth in 2022.

Qatar

Qatar announced a financial package of US$20.5 billion (about 14% of its GDP) in March 2020 to reduce the ill effects of the Covid-19 pandemic. Support programmes for small businesses and the most affected sectors, such as tourism and services, were included.

After its economy dropped by around 3.9% in the last quarter of 2020, Qatar has spent billions of dollars preparing to host the 2022FIFA World Cup. In December, the IMF estimated that Qatar’s GDP would decline by 2.5% in 2020 before rising to 2.7% growth in 2021.

Oman

Oman’s GDP declined by 6.4% in 2020 due to the outbreak and the drop in global oil prices. As a result, the government debt has risen to 81% of GDP, up from 60% in 2019. In addition, the Sultanate is expected to approve an income tax on high-wage employees starting next year.

Oman’s Sultan Haitham wants to reduce the country’s fiscal deficit from 1.7% of GDP to 0.7% of GDP by 2024.

Bahrain

Bahrain issued a financial package in March 2020, with measures totaling about 6% of GDP and significant contributions to the health sector to fight Covid-19. The initial package was approved for three months, but it was later extended and targeted the pandemic’s most threat actors and individuals.

According to the IMF, Bahrain’s economy shrank 5.4% in 2020 due to the Covid-19 pandemic and the drop in oil prices.

As a result, the IMF advised Bahrain to implement several financial reformsincluding reducing public debt, which grow exponentially in 2020, reaching 133% of GDP, up from 102% in 2019.