Riyadh, Saudi Arabia – Public Investment Fund (PIF) Governor Yasir Al-Rumayyan on Wednesday said that the Kingdom’s mineral wealth currently stands at $1.3 trillion, with a target to increase it to $1.5 trillion.

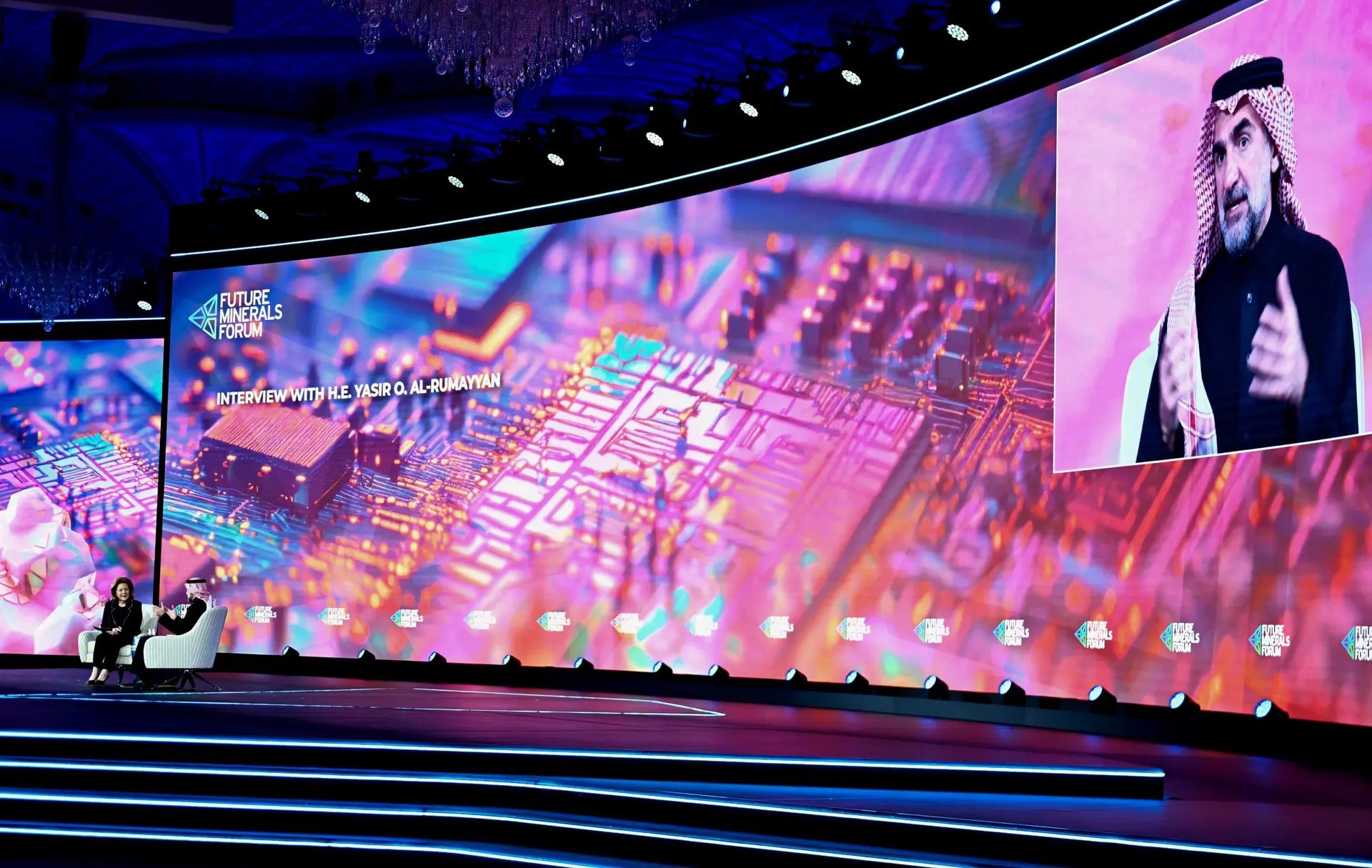

Speaking at the third annual Future Minerals Forum (FMF) held in Riyadh on January 10-11, Al-Rumayyan said the Ma’aden mining company owned by the PIF has expanded its exploration activities for gold, zinc, lithium, and other metals.

He said the global demand for metals would increase sixfold by 2040 and pointed out that the Kingdom possesses mineral reserves and additional resources that can be effectively utilized.

During the forum held at the King Abdulaziz International Conference Center, Al-Rumayyan undelined the Kingdom’s role in energy transitions, a low-carbon future, and its targeted investments in vital minerals. He highlighted how the Kingdom can provide strategic support and meet the growing demand for metals.

Al-Rumayyan also underlined the ongoing efforts of the PIF and their significance to the Kingdom’s economy.

“We are currently conducting the largest global exploration program,” he said adding that a joint investment project between the PIF and Ma’aden was aimed at accessing minerals that are not currently available in the Kingdom.

Al-Rumayyan highlighted the introduction of a new bachelor’s degree in mining sciences at the King Fahd University of Petroleum and Minerals, which will include a curriculum on artificial intelligence (AI) and its applications, including in the mining sector, where AI can assist in exploratory efforts for all types of minerals.