DUBAI — The rapid development of the information industry and solar photovoltaic power generation has underscored the importance of polysilicon material, highlighting a trend towards localizing its production in the Gulf region.

Polysilicon, a critical component found abundantly on Earth’s surface, especially in beach sand, is now extensively used across various sectors. Its primary application involves converting light photons into electricity, making it an essential element in manufacturing solar panels.

Currently, the market for establishing solar-powered electricity generation plants is flourishing globally, driven by efforts to shift towards clean energy. Forecasts suggest that global solar energy projects will surge by over 80 percent by 2025, with China leading the global supply chains for solar project components, particularly polysilicon.

The Gulf countries, having successfully shifted to alternative energy through numerous projects, have also sought to localize one of the most crucial industries in this field by launching polysilicon initiatives.

At A Glance * The Gulf region is making significant strides in the solar energy sector by focusing on local polysilicon production. * Qatar has taken the lead by opening the first Middle Eastern polysilicon production facility in December 2019, with an impressive capacity of 8,000 tons annually. * Saudi Arabia is set to further the region's solar ambitions by planning a large-scale polysilicon factory in collaboration with China's GCL Technology Holdings. * The move towards renewable energy, spearheaded by advancements in polysilicon production, is part of a broader strategy to reduce oil dependency. * The Gulf's rich resources and existing industrial infrastructure provide a solid foundation for becoming global leaders in renewable energy production.

In December 2019, Qatar became the first Middle Eastern country to operate a polysilicon production facility, boasting an annual production capacity of 8,000 tons. This project receives support from the Qatar Solar Energy Company, a joint venture involving the Qatar Solar Energy Company (associated with the Qatar Foundation), the German firm Solar World, and the Qatar Development Bank.

Designed with sustainability in mind, the plant features 1.1 megawatts of solar power and waste treatment facilities to recycle excess gases and water.

Qatar aims to sustain its renewable energy generation momentum as it pursues its long-term strategy outlined in the “Qatar National Vision 2030.” This strategy focuses on meeting the anticipated rise in energy demand while enhancing the sustainability of the energy mix.

Turning to Saudi Arabia, the country is witnessing a significant uptick in industries and their localization, including polysilicon projects. Reports from Bloomberg indicate that “GCL Technology Holdings,” a Chinese company, is in advanced discussions with Saudi Arabia to establish its first international factory there.

As both nations strive to diversify their energy relationships beyond oil, GCL Technology Holdings, the world’s second-largest polysilicon manufacturer, plans to set up a factory in Saudi Arabia with an annual production capacity of 120,000 tons.

Tianshi is optimistic that GCL Tech will start its production in Saudi Arabia by as early as 2025. He cites Saudi Arabia’s advanced infrastructure, manufacturing expertise, and abundant sunlight as key factors that could help the nation transition from an oil powerhouse to a leading solar energy producer, as reported by Al Arabiya.net.

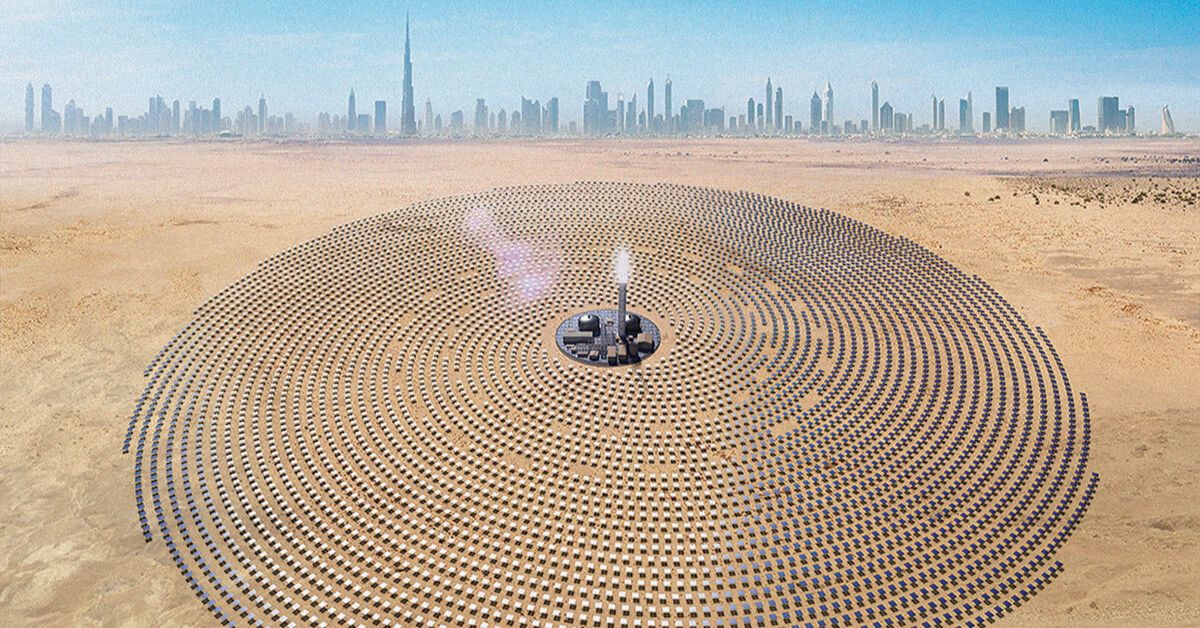

The UAE’s Mohammed bin Rashid Al Maktoum Solar Park is the largest single-site solar park in the world based on the Independent Power Producer (IPP) model. It has a planned production capacity of 5,000 MW by 2030, with investments totalling AED 50 billion. When completed, it will save over 6.5 million tons of carbon emissions annually.

The Gulf countries are on the right path with their recent focus on metal production, including polysilicon. This shift is deemed crucial, particularly against the backdrop of fluctuating oil prices and market instability.

By expanding into metal production, the Gulf nations are not only diversifying their economies but also significantly stabilizing their development, moving away from their traditional reliance on oil.

This is important as oil, a finite resource, is becoming less reliable as a sole means of supporting their economies. The availability of numerous minerals within the Gulf region reduces the need for these countries to import these materials, thus shielding them from market volatility associated with the production of some goods and meeting high demand.

The Gulf countries’ capacity to produce polysilicon and other metals is further enhanced by their abundant fuel resources, which are essential for mineral extraction and production, thereby increasing the profitability of these materials.

Moreover, the Gulf countries boast an existing industrial infrastructure and a level of cooperation among them. This regional integration is marked by each country having its unique advantages in terms of the types and quantities of metals available, fostering a collaborative industrial sector.

Specifically, in the context of polysilicon and many other metals, the Gulf’s production is distinguished by the fact that these processes do not require complex technology. Thus, the region can capitalize on technology-agnostic factories to boost its industrial capabilities.