The wave of inflation continues to put pressure on consumers not just in the United States, Europe, and the Arab world, but also in the Gulf region.

Energy and consumables costs drive the rise in consumable prices in different countries at varying rates, with a clear exposure to the increase in imports from overseas to satisfy basic supplies.

With global inflation continuing to affect the Gulf countries, consumer prices in the GCC countries increased by 1.5 percent in October 2021, compared to the same period in 2020, according to the most recent data released by the GCC Statistical Center.

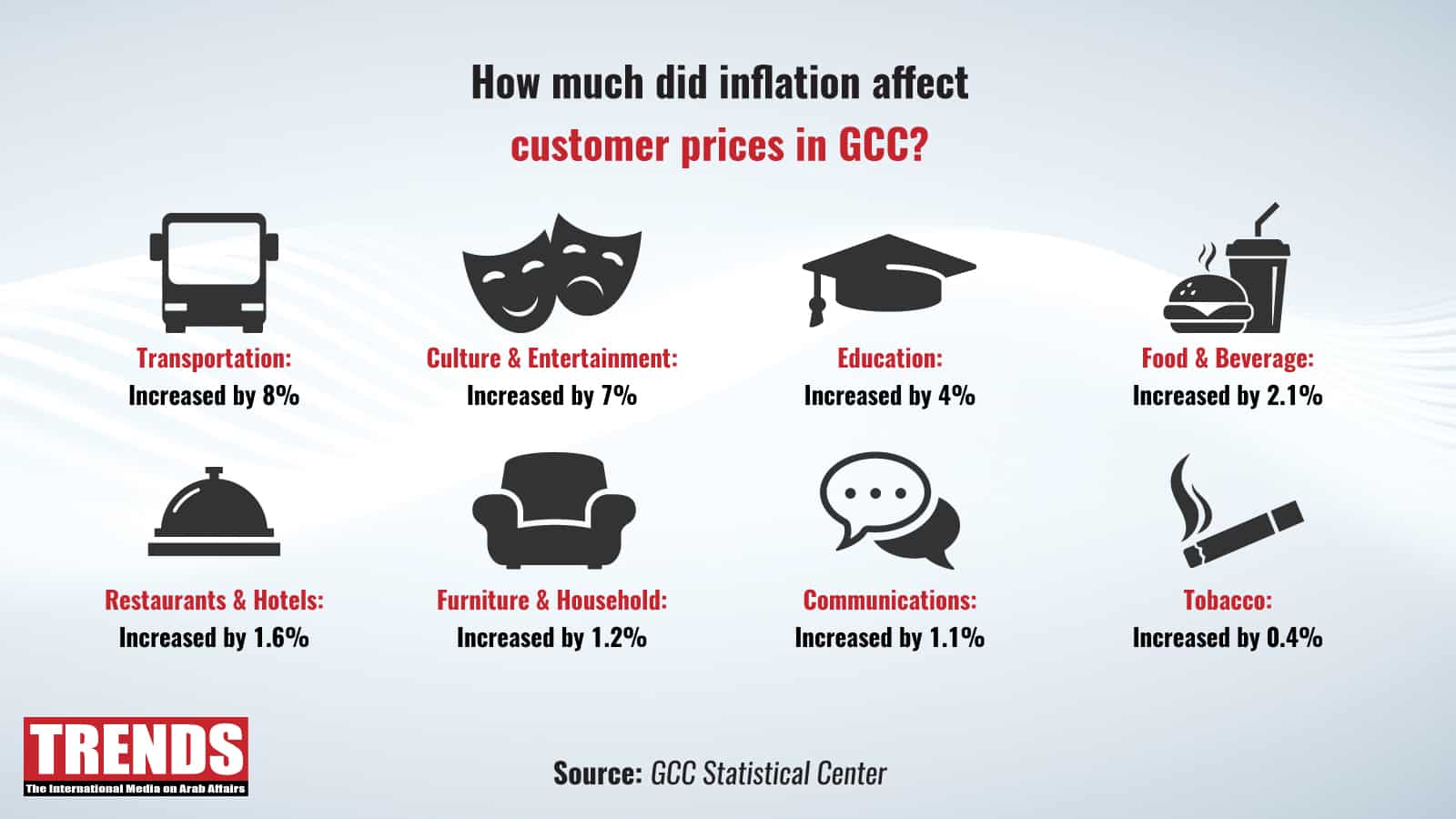

According to the center, prices in the transportation sector increased by 8 percent, culture and entertainment by 7 percent, education by 4 percent, food and beverage by 2.1 percent, restaurants and hotels by 1.6 percent, furniture and household fixtures by 1.2 percent, communications by 1.1 percent, and tobacco by 0.4 percent.

On the contrary, the group of miscellaneous products and services saw a 0.1 percent decline in costs, while the housing group had a 1.9 percent fall in prices, the clothing and footwear group saw a 0.2 percent decrease in prices, and the health group saw their prices stabilize at their prior levels.

The report also showed that the transportation group contributed 1.0 percentage points to the total Gulf inflation rate of 1.5 percent in October 2021, the food and beverage group contributed 0.4 percentage points, the culture and entertainment group contributed 0.2 percentage points. In addition, all furniture groups, communications groups, education groups, restaurants, and hotels groups contributed 0.1 percentage points each.

Saudi Central Bank projects the rate of inflation to accelerate slightly in the first quarter of 2022.

In terms of the six GCC countries’ contributions to overall Gulf inflation in October 2021, Saudi Arabia contributed 0.5 percentage points, the UAE contributed 0.3 percentage points, and the remainder of the member states contributed 0.7 percentage points.

According to the center’s data, consumer prices in the GCC countries increased by 0.4 percent in October 2021 compared to September 2021.

The education sector increased by 1.9 percent, the cultural and leisure group increased by 1.6 percent, and the restaurants group increased by 1.6 percent, 1.0 percent for hotels, 0.5 percent for housing, 0.3 percent for furniture, 0.2 percent for transportation, and 0.1 percent for each of the food and beverage, tobacco, clothing and footwear, communications, and miscellaneous products and services groups. Prices in the health sector, on the other hand, fell by -0.2 percent.

Ralf Wiegert, Head of IHS Markit’s Middle East and Northern Africa Division, pointed out to TRENDS that wholesale costs have been rising at a significantly faster rate across the region, and that this will continue to affect consumer prices in 2022.

“Wholesale prices, on the other hand, are notoriously unpredictable, and not all the recent acceleration will be passed on to the consumer market. In other words, I’m not sure we should talk about inflation spiraling out of control; rather, it’s more of a rebound impact that could persist a little longer than expected after lowering prices during the epidemic and even before that, at least in the Gulf region,” he added.

Affected sectors: Food & Beverages lead

While food and beverages in Kuwait accounted for a very high increase in prices, education costs saw a decrease of 15.46 percent.

Prices in the F&B sector rose 10.1 percent year on year. Most sub-indices had price increases, but the highest rates were in the categories of fruits (+25 percent), vegetables (+9.7 percent), and meat (+15.3 percent).

However, prices in the residential services sector – primarily rents – grew only 0.2 percent year on year.

The sectors most affected by inflation in Qatar were entertainment and culture (25.3 percent), transportation (9.6 percent), and food and beverage (4.2 percent).

It should be noted that the housing, water, electricity, gas, and other types of fuel saw costs drop 3.58 percent, and the health sector saw prices fall 1.39 percent.

Even though the UAE’s overall inflation rate did not rise significantly, the costs of food and beverages in Dubai grew 3.5 percent, and those in the leisure and culture sector increased by 5.7 percent, while the prices in the transportation sector jumped 16.8 percent.

As reported by Saudi Arabia’s General Authority for Statistics, the annual inflation increase was due to a 6.4 percent growth in transportation — fueled by a 47.9 percent rise in gas prices — and a 1.4 percent rise in food and beverage prices.

The VAT connection

Global consulting firm PwC in its recent report on Middle East economy said the flip side of a strong recovery and the rebound in oil is the rising consumer prices.

Economists and policymakers remain divided as to whether the current global inflationary pulse will ease in 2022 — as the US Fed currently believes — or could become more long-lasting.

However, economies in the Middle East are exposed to these global price fluctuations because of heavy import dependence.

The report said there are also localized factors at play in each country, such as high population growth in Egypt and long-running rental deflation across the GCC, which pre-dates COVID-19 but has been exacerbated by expat departures. There have been some short-term labor constraints in the region, contributing to wage inflation.

Most countries have rebounded from the COVID-19 deflationary trend, but inflation has so far remained relatively constrained to historic levels in each country. Barring Lebanon, where a currency crisis is causing hyperinflation (138 percent in August 2021), Iraq has the highest inflation in the region at 7.4 percent, the most since 2012. However, other countries are only seeing their highest levels in two to five years, the report said.

Changes in fiscal policy have also been a factor in some countries, according to the PwC report released for November 2021.

“The tripling of the Saudi VAT rate to 15 percent in July 2020 sharply boosted inflation for a year, peaking at 6.2 percent in June 2021, the highest since 2009. However, it does not appear to have had a persistent impact, as inflation dropped sharply to just 0.4 percent in July 2021, roughly where it had been before the hike,” according to PwC.

The introduction of five percent VAT in Oman in April also had an inflationary impact, although slightly less pronounced in relative terms as inflation only increased by two percentage points that month (to 1.6 percent from -0.4 percent in March), partly because Oman implemented its VAT with a larger range of zero-rated items than Saudi Arabia did, to mitigate social hardship, the report said.

Other fiscal policy changes likely had an impact on inflation but are more difficult to attribute, added the report. Oman has been phasing in higher electricity and water prices in 2021and reducing subsidies in other areas.

Saudi Arabia increased a range of tariffs in July 2020, and then in July 2021, suddenly tightened its criteria for tariff-free imports from the GCC, which now excludes exports from free zones and requiring that exporting companies had a minimum of 25 percent GCC national employees.

Looking ahead, Bahrain recently announced plans to double its VAT rate to 10 percent, which could come in 2022 if parliament approves the plan and will add 2pp or so to its inflation.

Meanwhile, Qatar and Kuwait are still considering whether to introduce VAT, but neither is likely to do so during 2022, partly because of concerns about the inflationary impact.

The IMF forecasts only modest inflation in 2022, averaging 2.4 percent across the GCC, and then a steady 2.2 percent in 2023-26, close to the long-term average, according to the PwC report.