DUBAI, UAE — Islamic banking, a major component of the Islamic finance market, accounts for 70 percent of the industry’s assets and is undergoing a historic transformation driven by groundbreaking fintech advancements.

In the last four years, assets in Islamic banking have surged from $1.8 trillion to $2.8 trillion, with projections reaching an impressive $4 trillion by 2026, predominantly led by the GCC nations.

A new report by red_mad_robot titled ‘State of Fintech: The Islamic Banking Industry’ indicates that this sector has maintained growth momentum despite economic recovery challenges, disruptions in the supply chain, and rising inflation.

This growth represents less than 1 percent of the total global asset volume (about $1500 trillion). However, Islamic assets have been growing annually by 17-18 percent since the 2010s, significantly outpacing the growth of conventional banks.

AT A Glance * Islamic banking constitutes 70% of Islamic finance market assets, undergoing transformation due to fintech advancements. * Assets in Islamic banking increased from $1.8 trillion to $2.8 trillion in four years, projected to reach $4 trillion by 2026, mainly in GCC nations. * Despite global economic challenges, Islamic banking has grown, representing less than 1% of global asset volume but growing annually by 17-18% since the 2010s. * Islamic banking assets are heavily regulated, with 43% in GCC countries and 40% in other MENA countries; Iran and Saudi Arabia control 59% of these assets. * Significant growth in Islamic banking observed in non-core Islamic finance jurisdictions like Russia, Canada, the U.S., Maldives, Nigeria, and Tajikistan. * Largest Islamic banks are in Malaysia, Indonesia, Bangladesh, and Bahrain, with Malaysia holding the largest share of Islamic banking assets. * Al Rajhi Bank of Saudi Arabia is the world's largest Islamic bank, with significant growth in assets and net profit. * Islamic banking development varies globally, with some countries entirely based on Sharia principles and others offering Islamic services in conventional banks. * Saudi Arabia's Islamic fintech sector is expanding, with SAMA's regulatory sandbox hosting 16 companies, and the fintech sector projected to reach $48 billion by 2025. * The UAE is a hub for Islamic fintech startups, with significant players in various fintech services and a diverse banking sector offering both conventional and Islamic banking. * UAE's Islamic banking sector includes full-fledged Islamic banks and banks with Islamic windows, showing higher growth than conventional banks. * High oil prices and strong economic conditions expected to support UAE Islamic banks' credit fundamentals in 2023. * The global Islamic fintech market is growing rapidly, expected to reach $179 billion by 2026, with Indonesia, the UK, and the UAE leading in the number of Islamic fintech companies.

Islamic banking assets are heavily regulated and certified by governments in Muslim-majority countries. The GCC countries play a leading role, holding 43 percent of global Islamic banking assets, followed by other MENA region countries with 40 percent. Notably, 59 percent of total assets are controlled by just two jurisdictions: Iran (37 percent) and Saudi Arabia (22 percent).

Interestingly, the sector’s expansion in non-core Islamic finance jurisdictions suggests growth in new markets and possible stagnation in more mature ones. Remarkable growth in Islamic banking has been observed in Russia (183 percent), Canada (146 percent), the U.S. (138 percent), Maldives (121 percent), Nigeria (101 percent), and Tajikistan (84 percent).

Despite the concentration of Islamic finance assets in the GCC and MENA regions, the world’s largest Islamic banks are located in Malaysia, Indonesia, Bangladesh, and Bahrain.

Malaysia holds the largest share of total Islamic banking assets at 21.8 percent, followed by Saudi Arabia (19.5 percent), the UAE (14.1 percent), Kuwait (11.4 percent), and Qatar (11 percent) respectively. Among the top 100 Islamic banks, 42 are based in Asia, holding 29 percent of these banks’ total assets but generating only 16 percent of their combined net profits.

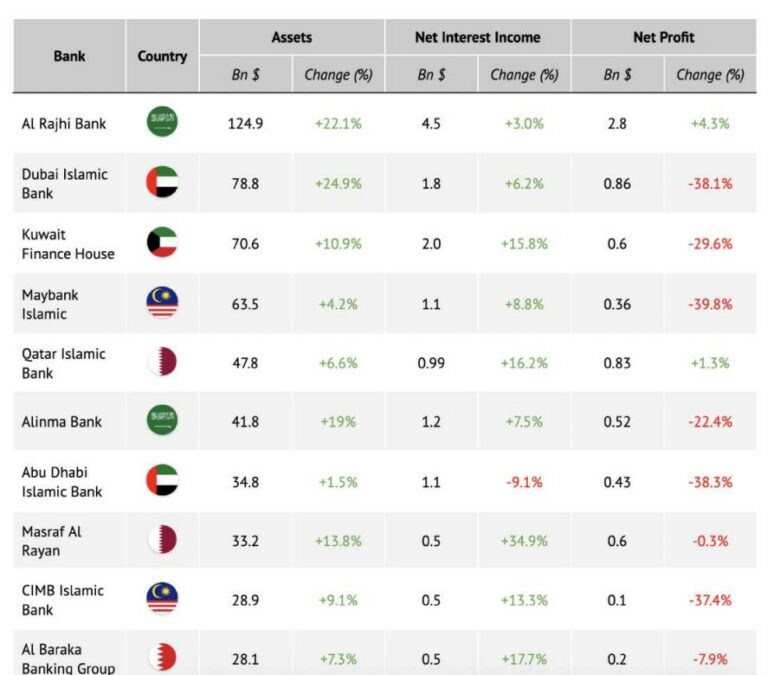

Saudi Arabia’s Al Rajhi Bank leads as the world’s largest Islamic bank, with total assets increasing by 22 percent to $125 billion in 2020. It generated $2.8 billion in net profit in 2020, accounting for 26 percent of the total net profit of the top 100 Islamic banks. Dubai Islamic Bank and Kuwait Finance House rank second and third, respectively.

The development of Islamic banks

In terms of development, Islamic banking varies across countries. Some nations’ banking systems are entirely based on Sharia principles, while others have conventional banks offering separate Islamic financial services.

In Saudi Arabia, Islamic financial institutions are regulated by the Saudi Arabian Monetary Agency (SAMA). The country’s Vision 2030 program, aimed at diversifying the economy away from oil, bodes well for the global Islamic finance market, potentially benefiting Islamic banks and sukuk issuance.

The Saudi Islamic fintech sector includes 40 companies, with 16 operating within SAMA’s regulatory sandbox, all offering Sharia-compliant products and services. SAMA estimates the fintech sector could reach $48 billion by 2025 based on transaction volume.

The banking sector in Saudi Arabia, being the largest Islamic finance market globally, accounts for 33 percent of global Islamic bank assets. The country has the highest proportion of Islamic financing (86 percent) compared to other nations where conventional and Islamic banks coexist.

Key Players in Islamic Finance The Islamic finance market is categorized into several geographical zones: • GCC: Saudi Arabia, Kuwait, the UAE, Qatar, Bahrain, and Oman • MENA: Iran, Egypt, Algeria, among others • South Asia and Asia Pacific, Southeast Asia: Malaysia, Indonesia, Brunei, Pakistan, among others • Europe: Turkey, United Kingdom, Ireland, Italy, Russia, among others • Central Asia: Kazakhstan, Uzbekistan, Tajikistan, among others • The United States Top countries by assets GCC and MENA countries contribute over 70 percent of global Islamic finance assets. The largest countries in terms of Islamic finance assets are Iran, Saudi Arabia, Malaysia, South Africa, and Qatar.

In the UAE

Regulatory: The Central Bank of the UAE issues licenses to ensure that the Islamic banking sector provides services fully compliant with Islamic Sharia.

Fintech: The UAE is one of the most developed Islamic fintech markets, acting as a Middle East hub for Islamic fintech startups. Major players include Tabby, a leader in Buy Now, Pay Later (BNPL) services; Beehive, a Dubai-based peer-to-peer lending platform offering Sharia-compliant financing to SMEs; and PayTabs, a provider of payment solutions.

Banking Sector: Mobile banks in the UAE have download figures ranging from 100,000 to 1 million. The diversity in services, including both conventional and Islamic banking, caters to a varied audience. For instance, Abu Dhabi Commercial Bank offers a digital product for all ADCB customers and an international digital account in the UK – ADCB Nomo UAE. Al Hilal Bank, a subsidiary of ADCB, provides Al Hilal Digital, an Islamic banking service with financial literacy training and a marketplace, as well as Al Hilal | Nomo UAE – a digital account for UAE residents in the UK, plus Islamic banking.

The UAE banking sector includes eight full-fledged Islamic banks, fifteen banks with an Islamic window licensed by the Central Bank, and nine Islamic finance companies with an Islamic Window. Islamic banks in the UAE grew by 8 percent in 2022, surpassing the 3 percent growth of conventional banks, driven by increasing demand for Islamic products and extensive distribution networks.

High oil prices and strong economic conditions are expected to continue bolstering the credit fundamentals of UAE Islamic banks in 2023, helping to mitigate the effects of rising profit rates on borrowers. Additionally, Islamic banks in the UAE have a higher deposit-funded ratio (86 percent) compared to conventional banks (79 percent).

Promising Digital Services in Islamic Banking

The future of Islamic finance is closely tied to digitalization, with fintech companies at the forefront of adopting new technologies and setting new standards for financial interactions. This trend is poised to drive the development of the Islamic financial system.

The global Islamic fintech market was estimated to be around $79 billion in transactions in 2021. It is expected to grow at an average of 18 percent annually, reaching $179 billion by 2026. Saudi Arabia, Iran, Turkey, the UAE, Malaysia, and Indonesia are the largest fintech markets. Indonesia leads in the number of Islamic Fintech companies (61 companies or 20 percent), followed by the UK (45) and the UAE (42).