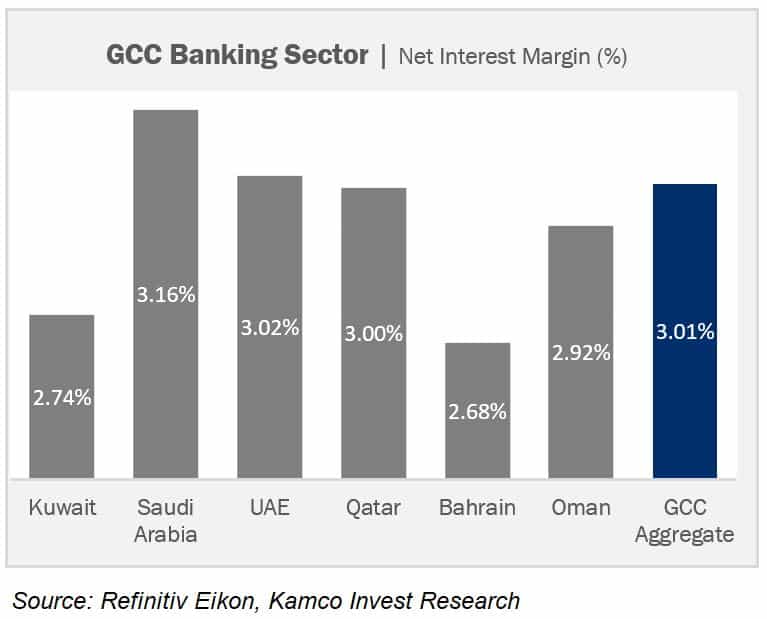

KUWAIT CITY — Rising interest rates in the US and the nearly full replication by most GCC central banks during 2022 resulted in higher aggregate net interest margins (NIM) for the GCC banking sector. According to a new report by Kamco Invest, the NIM for GCC banks averaged at a multi-year high of over 3 percent during Q4-2022, despite only partially reflecting the higher interest rates, as the bulk of the rate hikes were made during the second half of the year.

The report revealed that Saudi Arabian banks reported the highest average margin of 3.2 percent during the quarter, followed by UAE and Qatari banks, with margins also above the 3 percent mark after several quarters. Higher margins were also reflected in yield on credit (net interest income vs. aggregate gross loans) for the GCC banking sector, which reached a multi-quarter high of 4 percent during Q4-2022, compared to 3.7 percent during Q3-2022.

Bottom-line performance for the GCC banking sector remained relatively flat quarter-over-quarter, with net income reported at US$11.4 billion, in line with the previous quarter. This came despite higher net interest income and non-interest income during the quarter, with total bank revenue reaching another record of US$28.0 billion. However, higher operating expenses and elevated provisions booked during the quarter offset most of the earnings growth recorded during Q4-2022.

On the other hand, aggregate lending in the GCC remained strong during the quarter. Central bank data showed Qatari banks experiencing the strongest lending growth during Q4-2022, while Bahraini and UAE banks showed a slight decline. Data on listed banks also showed growth, with aggregate GCC gross loans reaching a new record of US$1.87 trillion, increasing by a strong 3.2 percent or US$57.5 billion during the quarter.

Outstanding net loans witnessed slightly smaller growth of 2.8 percent during the quarter as a result of elevated provisions booked during Q4-2022. The growth in customer deposits bounced back to stronger growth during Q4-2022 after showing a six-quarter low growth during the previous quarter. Aggregate quarter-over-quarter growth in customer deposits stood at 2.5 percent, reaching US$2.2 trillion at the end of Q4-2022. The quarter-over-quarter change in customer deposits was broad-based, with only Bahraini banks recording a marginal decline during the quarter, while most of the other country aggregates showed growth.

Moreover, the net impact of stronger lending growth and slightly smaller customer deposit growth resulted in a marginal growth of 30 basis points in the aggregate GCC loan-to-deposit ratio at the end of Q4-2022. Despite the growth, the ratio remained below the 80 percent level and at one of the lowest quarterly levels, at 79.3 percent.

Highlights

Some of the key observations from the most recent financial quarter for the GCC Banking Sector include the following:

Limited impact from global banking crisis

The broader GCC banking sector is expected to see only a limited indirect impact from the ongoing banking sector crisis in the US and Europe. Shares of banks globally and in the region, especially, were affected due to fears of contagion, as the collapse of SVB was the biggest lender failure since the global financial crisis of 2008. However, the collapse had only a marginal impact, with minimal exposure of banks only in the UAE, while most of the other countries in the GCC remained unaffected.

A report from S&P showed that out of the 19 GCC banks the agency rates, the aggregate exposure to the entirety of the US was 4.6 percent of assets and 2.3 percent of liabilities at the end of 2022. The report said that GCC banks typically have limited lending activity in the US, and most of the assets these banks hold are invested in high-credit quality instruments or government instruments.

In terms of exposure to Credit Suisse (CS), shareholders of CS in the GCC, Saudi National Bank (SNB) had acquired a 9.9 percent stake in the bank late last year for US$1.5 billion. After the UBS acquisition, this stake is said to be worth US$280 million, according to a MarketWatch report. SNB also said in a recent statement that the CS dilemma will not affect the bank’s growth plans. The impact on SNB’s capital adequacy ratio was about 35 basis points after the UBS takeover, and there is no expected impact on SNB’s profitability, according to the statement.

Lending growth at 6-quarter high during Q4-2022

Lending growth continued to remain strong in the GCC during Q4-2022, resulting in record-high loan books at the end of the quarter. Aggregate gross loans reached US$1.87 trillion, up 3.2 percent quarter-over-quarter and 8.9 percent year-over-year, mainly led by strong growth across the GCC, except for a marginal decline for Bahraini banks.

Central bank data shows strong credit growth

Credit growth in the GCC remained strong during Q4-2022 despite higher interest rates, indicating robust economic activity and business confidence in the region. Manufacturing activity data from Bloomberg (Markit Whole Economy Surveys) showed PMI figures at one of the highest levels recorded recently for Saudi Arabia at 59.8 during February-2023, and elevated in the case of the UAE at 54.3 and at 51.9 for Qatar.

Central bank data on credit growth in the region showed higher quarter-over-quarter lending for all regional central banks, except for Bahrain, which reported a decline of 2.2 percent, and the UAE, which reported a marginal drop of 0.2 percent.

GCC central banks data showed that after months of marginal activity, Qatari banks reported the biggest lending growth during the quarter at 3.5 percent during Q4-2022, compared to a decline in lending during the previous quarter. Saudi Arabia continued to report strong growth during the quarter at 1.4 percent, although the pace of growth declined considerably and was the smallest since June-2019.

The growth in the case of Kuwaiti banks was also modest at 0.9 percent quarter-over-quarter and was the smallest growth since Q4-2020, while credit growth reported by Oman’s central bank came in at 1.2 percent during Q4-2022.

Loan-to-deposit ratio grows slightly

The aggregate loan-to-deposit ratio for the GCC banking sector remained below the 80 percent mark for the third consecutive quarter at the end of Q4-2022 but showed marginal growth, reaching 79.3 percent led by a fall in the ratio in Kuwait and Qatar that was more than offset by growth in the rest of the markets. At the country level, UAE-listed banks once again reported the lowest loan-to-deposit ratio of 70.7 percent, with only marginal improvement compared to the previous quarter.

Omani banks reported the strongest growth during the quarter at +170 basis points, with the ratio reaching 93.9 percent, the highest in the GCC, during Q4-2022. Saudi-listed banks followed, with a growth of +110 basis points, reaching a ratio of 85.5 percent, one of the highest levels for the Kingdom and the third-highest in the GCC after Oman and Qatar.