DUBAI — 2023 marked a year of recovery for the cryptocurrency industry, bouncing back from the scandals, blowups, and price declines of 2022. With crypto assets rebounding and market activity increasing, many anticipate the end of the crypto winter and the onset of a new growth phase.

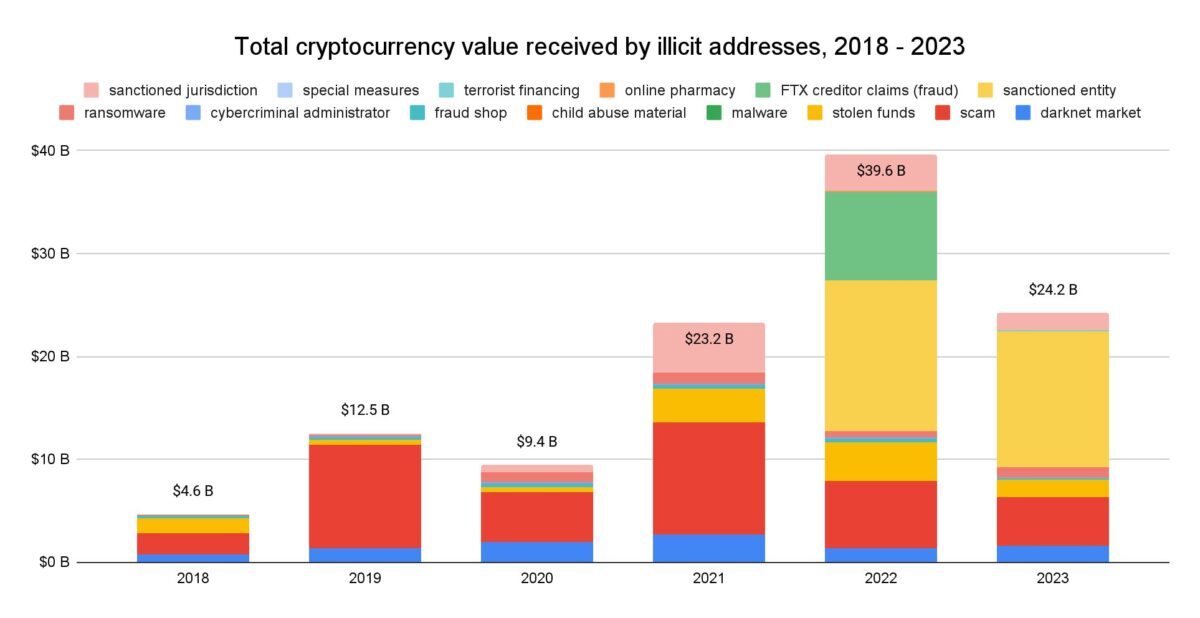

A recent Chainalysis report highlighted a significant drop in the value received by illicit cryptocurrency addresses in 2023, totaling US $24.2 billion. These figures are considered lower-bound estimates, reflecting inflows to currently identified illicit addresses. The report predicts these totals will likely increase as more illicit addresses are discovered and their historical activity is included in future estimates.

Nicola Buonanno, VP of Southern EMEA at Chainalysis, shared with TRENDS some notable shifts in crypto crime. In 2023, revenues from crypto scams and stolen funds fell sharply, with total illicit revenue down by 29.2 percent and 54.3 percent, respectively. The decline in stolen funds was primarily due to a significant reduction in DeFi hacking.

DeFi, a rapidly growing and compelling sector of the cryptocurrency ecosystem, is known for its transparency. Buonanno suggests that the decline in DeFi hacking may indicate an improvement in security practices within DeFi protocols, a positive development for the crypto community.

Particularly in the UAE, where a higher proportion of crypto activity occurs on decentralized exchanges (48 percent) compared to centralized exchanges (46 percent), this improvement is significant.

However, ransomware and darknet market revenues rose in 2023, diverging from the overall downward trend. Buonanno notes the increase in ransomware revenue is concerning, suggesting attackers may be adapting to advancements in cybersecurity. Despite the Hydra shutdown, darknet market activities are resurging, with total revenues approaching their 2021 highs.

Revenues from crypto scams and stolen funds fell sharply, with total illicit revenue down by 29.2 percent and 54.3 percent, respectively.

Nicola Buonanno, VP of Southern EMEA at Chainalysis

It’s also notable that last year, sanctioned entities and jurisdictions accounted for $14.9 billion in transaction volume in 2023, representing 61.5 percent of all illicit transaction volumes measured.

Emerging trends

Digital criminals continually evolve their tactics, exploiting the crypto landscape’s inherent anonymity and rapid changes. One significant development, as noted by Buonanno, is the increase in romance scams. In these scams, criminals build relationships with individuals to pitch fraudulent investment opportunities. This approach is often more challenging to uncover because the scam centers on developing a personal connection, making the victim believe they are helping a potential romantic partner.

Buonanno emphasized the effectiveness of this emotional manipulation. For crypto criminals to monetize their attacks, they typically need to cash out their illicit funds, primarily through centralized exchanges. Buonanno highlighted the crucial role of cryptocurrency exchanges in combating crypto crime.

He suggests that exchange compliance teams should vigilantly monitor the blockchain for suspected wallets of crypto criminals. By identifying when these wallets transfer funds to their platforms, exchanges can take proactive measures such as freezing funds or reporting to law enforcement.