Gold prices reached record levels in 2020 following an increase in investor appetite because of COVID-19. The price of yellow metal decreased slightly at the beginning of 2021, but in recent months it returned to its previous level with expectations of growth in the latter half of the year.

In recent past, gold prices reached their highest levels, with new Coronavirus strain infections raising concern over global economic recovery resulting in investors to look at gold. Gold grew by 0.2 percent to U$1,791.55 for onsite trading and US$1,793 for onsite trading.

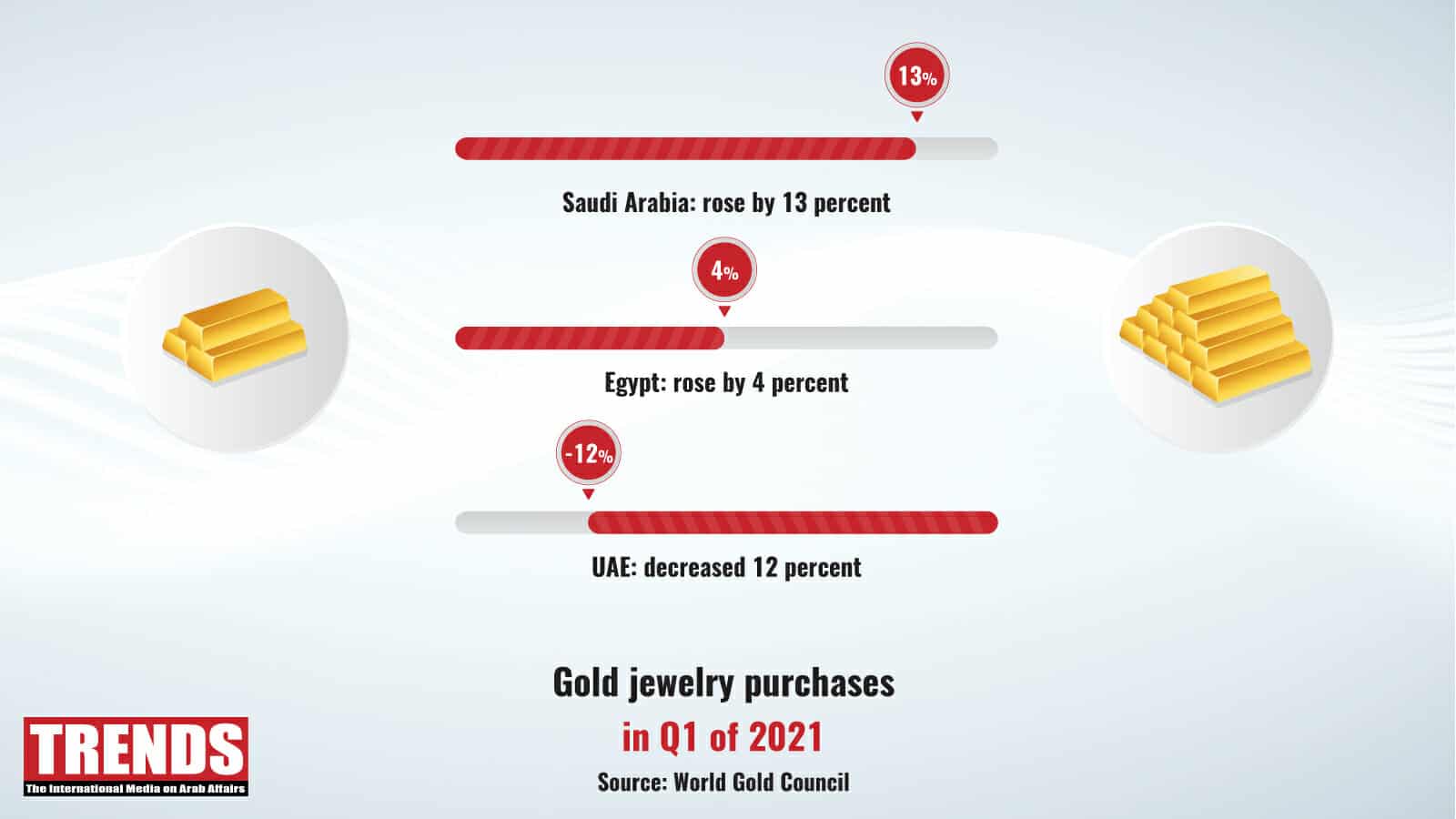

Saudis shop more gold

China purchased 191.1 metric tons of gold in 2021, followed by India, which bought 102.5 metric tons. The US purchased 23.3 tons of gold during the same period.

On the other hand, UAE overtook the list of Arab countries, as its citizens purchased 8.3 tons of gold in the first three months of 2021. Saudi Arabia ranked second with 7.8 tons and Egypt was in third place with 7.1 tons for the same period.

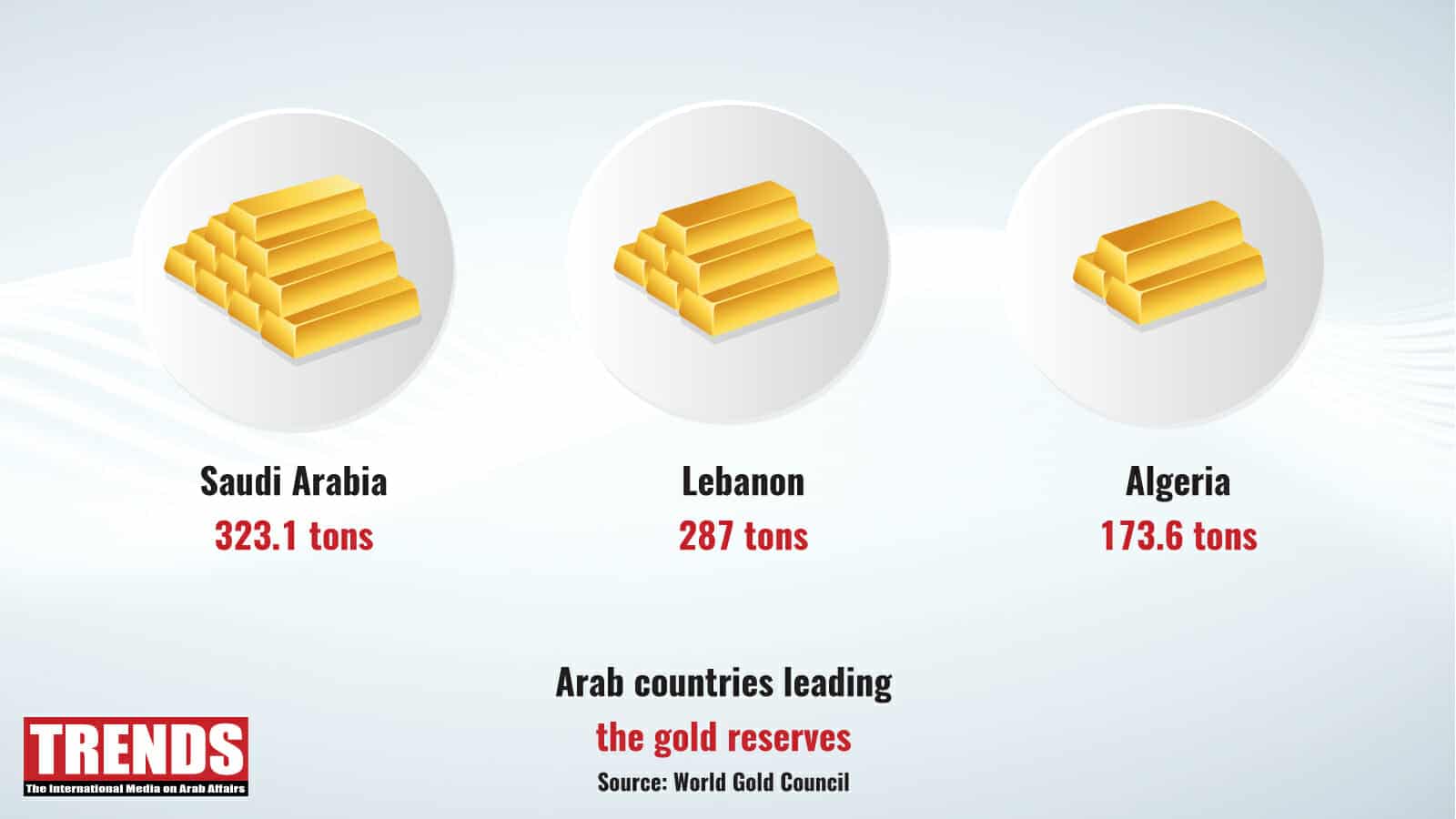

Gold reserves

In August 2021, the World Gold Council published a report on the gold reserves in countries throughout the world. The report showed that the Central Banks’ precious metal reserves were 35,544.3 tons and of this, 1385.2 tons was in the central banks of 16 Arab countries.

The proportion of the reserves in the Arab countries listed is 3.89 percent. The report noted Saudi Arabia had 323.1 tons of gold among the Arab countries followed by Lebanon, with estimated reserves of 287 tons and Algeria with 173.6 tons.

As for the global rating, the report showed that the US topped the ranking with having 8133.5 tons of gold reserves followed by Germany 3,359.1 tons and France 2436.3 tons.

Future demand

In 2021, central banks are likely to keep purchasing gold at or above the same rate as in 2020, and the gold supply is expected to increase modestly over the previous year by 2021.

“As global economic growth continues, we are encouraged to see a re-establishment of consumer demand with strong growth in joy year-over-year”—Louise Street Senior Market Analyst at the World Gold Council said. Investment, however, is more complex.

Street added:” In H1 of 2021, tactical investors have had a more mixed impact on strategic purchases from individuals and institutions. Partly with gold ETFs, this was observed, where inputs during the second quarter compared sales effects in the previous quarter.

While ETFs will probably not repeat the record performance of 2020, the need for effective risk hedges and a constantly low-rate environment supports our view that investors’ strategic allocation throughout the rest of the year is expected to improve consumer demand the entire year, Street said.

The Nirmal Bang Commodities analyst Kunal Shah estimated that the price of gold would rise once again amid the spurt in number of Coronavirus infections in the US and China, and the prospects of slowing global growth in the second half of this year.

He also expected that gold would touch US$1,850 this year, according to a global news agency report. However, the dollar had undermined the allure of gold in the early months of 2021, and the global gold prices were also affected by a wave of US debt sales and higher rates.