ABU DHABI, UAE — GCC equity markets saw their first decline in three months, influenced by the worst monthly performance in global equity markets this year.

Despite a recovery in the second half, the MSCI World Index was down 3.6 percent in August 2023, following a hawkish Fed that stoked fears of prolonged higher rates. Some economists are even pricing in another rate hike this year and the first cut deep into next year.

The MSCI GCC Index experienced a slightly steeper decline of 3.8 percent during the month, led by drops in four out of seven exchanges, including Saudi Arabia.

This decline occurred despite oil gaining for the third consecutive month due to supply cuts and steady demand data. Qatar was the worst-performing market in the GCC in August 2023, with a slide of 7.0 percent, led by declines in almost all indices on the exchange.

Kuwait and Bahrain followed with declines of 3.4 percent and 2.0 percent, while Saudi Arabia’s TASI was down by 1.7 percent.

The declines in Qatar erased all gains since the start of the year, reporting the biggest decline in the GCC at 4.6 percent, followed by Abu Dhabi and Kuwait, both at 3.9 percent declines. On the other hand, Dubai was the best-performing market with a YTD 2023 gain of 22.4 percent, followed by Saudi Arabia at 9.7 percent.

The GCC sector chart showed declines in most sectors, with healthcare leading at -11.6 percent, followed by Food & Beverage and Telecom. Banks and Materials were down by 3.9 percent and 2.9 percent, respectively, while Insurance and Energy showed gains of 5.9 percent and 4.4 percent, respectively.

According to Kamco Invest’s report titled “GCC Markets Monthly Report – August 2023,” Boursa Kuwait closed August 2023 with the second-biggest monthly decline of 3.4 percent, closing at 7,005.84 points, led by consistent declines during the month.

The decline was mainly led by large-cap stocks, including banks, with the corresponding index reporting the third-biggest decline this month. In terms of market segments, the Premier Market Index witnessed the biggest monthly decline of 4.5 percent in August 2023, as the performance of most of the constituent stocks in the index declined.

The Main 50 Index and the Main Market Index reported a relatively small monthly gain of 1.1 percent. The declines affected the YTD 2023 performance for the market, with the All-Share Index showing the second-biggest decline in the GCC at -3.9 percent.

The Premier Market Index declined by 5.2 percent since the start of the year, whereas the Main 50 Index receded 1.5 percent versus a 1.7 percent gain for the Main Market Index.

Saudi Arabia’s headline equity index, TASI, reported a monthly decline in August 2023, reflecting recent earnings announcements that affected investor sentiment despite elevated energy prices.

The benchmark TASI peaked at a closing high of 11,636 points at the beginning of the month but mostly trended downward during the rest of the month to close with a decline of 1.7 percent at 11,491.2 points. However, Saudi Arabia ranked second in the GCC in terms of YTD 2023 performance with a gain of 9.7 percent.

On the other hand, the FTSE ADX index edged up by 0.2 percent during August 2023, closing the month at 9,810.2 points and recording its third consecutive monthly gain. In terms of sectoral indices, the picture was even, as five out of the ten sectors recorded growth during the month, while the remaining five recorded declines.

On the gainers’ side, the Healthcare index witnessed the biggest monthly gain, registering a 19.3 percent growth to close the month at 3,607.9 points. The Consumer Discretionary index followed with an 11.7 percent index gain to close the month at 9,131.1 points.

Three out of the five constituent companies of the Consumer Discretionary sector witnessed gains in share prices during the month.

On the decliners’ side, the Telecommunications index led the way with a 10.8 percent slide during the month to close at 4,946.2 points, followed by the Consumer Staples index, which witnessed a 3.4 percent fall in August 2023.

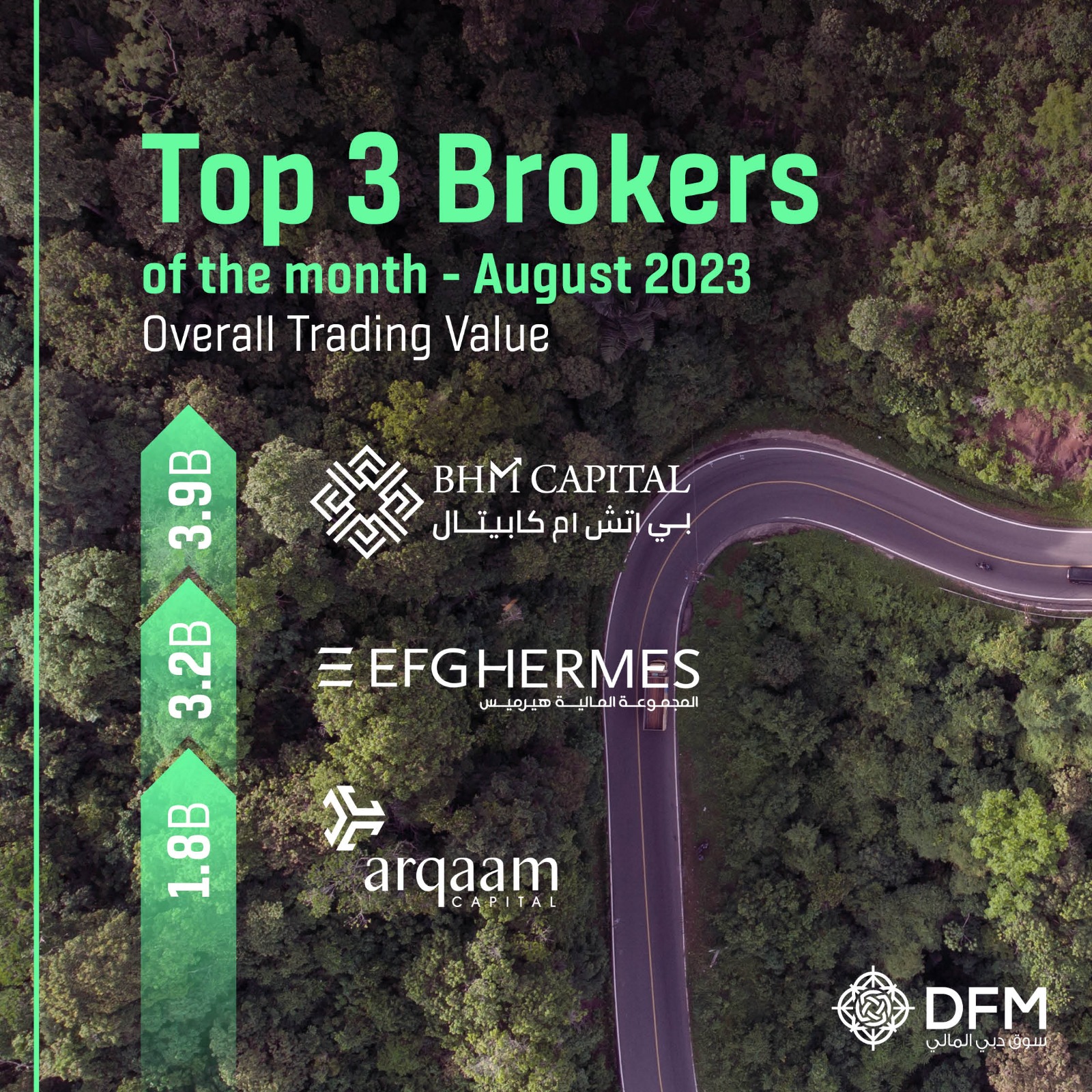

For its part, the DFM General Index witnessed a monthly gain of 0.6 percent in August 2023 to close at 4,082.87 points, registering its fifth consecutive monthly gain.

Monthly index performance was mixed during the month after five out of the eight indices witnessed declines, while the remaining three saw gains to offset the overall decline.

After posting gains in the previous month, the Qatar Stock Exchange reported the biggest month-over-month decline in August 2023.

The QE 20 index closed the month at 10,194.7 points, witnessing a decline of 7.0 percent, almost in line with the performance of the Qatar All Share Index, which reported a monthly decline of 6.7 percent to close at 3,436.68 points.

With the decline in August 2023, the YTD 2023 returns for the QE 20 index were slashed to a decline of 4.6 percent, the biggest in the GCC, and the QE All Share index reported a YTD 2023 decline of 0.4 percent.