- ADCB to sell 80 percent stake in ADCP to Nine Yards Plus.

The transaction values ADCP at US$161 million and ADCB will gain of nearly US$133 million subject to closing conditions before end of December 2023.

ADCB will retain a 20 percent stake in ADCP post transaction and will continue its partnership via a long-term relationship agreement.

- Shenzhen, China - Saudi Ministry of Environment, Water and Agriculture discussed ways to enhance investments between the Kingdom and China...

The National Fisheries Development Program, a delegation of Saudi ministry, participated in the Global Investment Promotion Conference.

The conference was held in the Chinese city of Shenzhen, and the two sides discussed investment opportunities and improving investment relations between the two countries.

- Proceeds of the facility will be used for general corporate purposes.

The dual tranche borrowing comprises a conventional tranche and a commodity Murabaha financing facility has been concluded at competitive pricing.

The facility also includes a green-shoe option to increase the size up to AED 1.3 billion. Proceeds of the facility will be used for general corporate purposes.

- RIYADH, SAUDI ARABIA – The Saudi Ports Authority (Mawani) attained its highest improvement in the UNCTAD's Liner Shipping Connectivity Index...

This development aligns with the objectives of the National Transport and Logistics Strategy (NTLS).

This achievement adds to the recent major records, including a score of 77.66 during Q3.

- Slowing demand growth and rising US crude production will make it more difficult for OPEC+ to continue to prop up...

The Paris-based IEA, which advises oil-consuming nations, noted that prices had fallen by around $25 per barrel since September highs.

Efficiency improvements and a booming electric vehicle fleet have also been lowering oil demand, it added.

- Sharjah, UAE--The board of directors of the Arab Union for International Exhibitions Conferences (AUIEC), operating under the Council of Arab...

AUIEC plan for next year focuses on attracting new memberships in order to expand its network and active participation in union members' activities and events

The union is set to organise prominent events like the Arab Industries Exhibition in the UAE and Iraq and the Conference of the Exhibition Industry in the Arab World

- Tesla's Autopilot program has spurred numerous government investigations as well as media exposes focusing on misuse or vulnerabilities. The system...

The recall affects models across Tesla's portfolio and will be addressed by an "over-the-air software remedy" typically performed remotely

The recall covers 2.03 million Tesla vehicles and includes Models S, X, Y and 3. Authorities in Canada said they were recalling 193,000 vehicles there

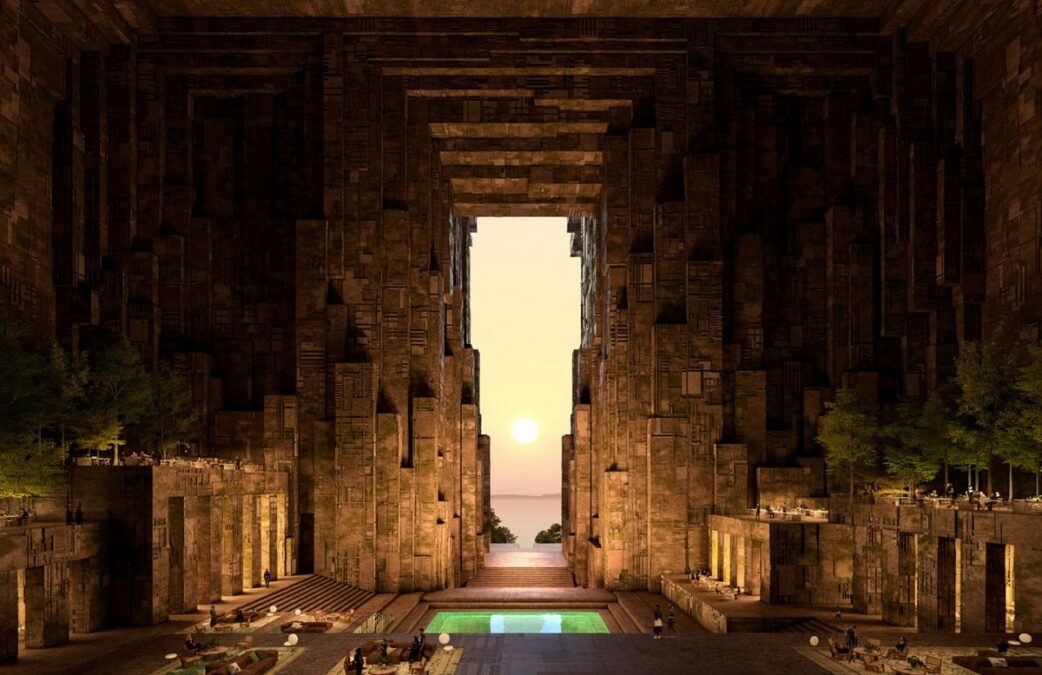

- NEOM, Saudi Arabia - Saudi Arabia's $500 billion mega project, has introduced Utamo, a new art and entertainment destination set...

Described by NEOM as "an innovative and multipurpose event and performance space," Utamo features VIP lounges and signature restaurants

NEOM envisions Utamo as a venue where "reality and the digital realm converge," aiming to redefine entertainment benchmarks

- The IMF said the debt relief will facilitate access to additional financial resources that will help it strengthen economy, reduce...

Its external debt has fallen from 64% of GDP in 2018 to less than six percent of GDP by the end of 2023

The IMF said that Somalia has implemented a poverty reduction strategy for at least a year

BYD logs record EV sales in 2025

It sold 2.26m EVs vs Tesla's 1.22 by Sept end.

Google to invest $6.4bn

The investment is its biggest-ever in Germany.

Pfizer poised to buy Metsera

The pharma giant improved its offer to $10bn.

Ozempic maker lowers outlook

The company posted tepid Q3 results.

Kimberly-Clark to buy Kenvue

The deal is valued at $48.7 billion.