- With Benjamin Netanyahu building up a huge force ahead of an expected land incursion into Gaza, Iran has warned of...

The prospect of an all-out war pushed oil prices up Wednesday, though Washington's decision to suspend some sanctions on Venezuelan output tempered the gains

Risk aversion among traders was increased by concerns the Federal Reserve would hike interest rates again, or at least keep them elevated for an extended period

- Manama, Bahrain--Bahrain Economic Development Board (Bahrain EDB) has attracted $295 million in direct investments within the Information and Communications Technology...

The direct investments from 14 local and international projects for the ICT sector are expected to generate over 1,600 jobs within three years

A top EDB executive said the growth of the ICT sector is a priority for Bahrain and remains a contributor to the diversification of the national economy

- Baghdad, Iraq - Saudi banks have offered to fund Iraq's largest housing project, which was previously stalled by South Korea's...

Some Saudi banks have expressed their interest in contributing funds, along with several Iraqi banks and foreign investment companies

The Bismaya project had already seen the construction of approximately 30,000 out of the planned 100,000 houses near the capital Baghdad

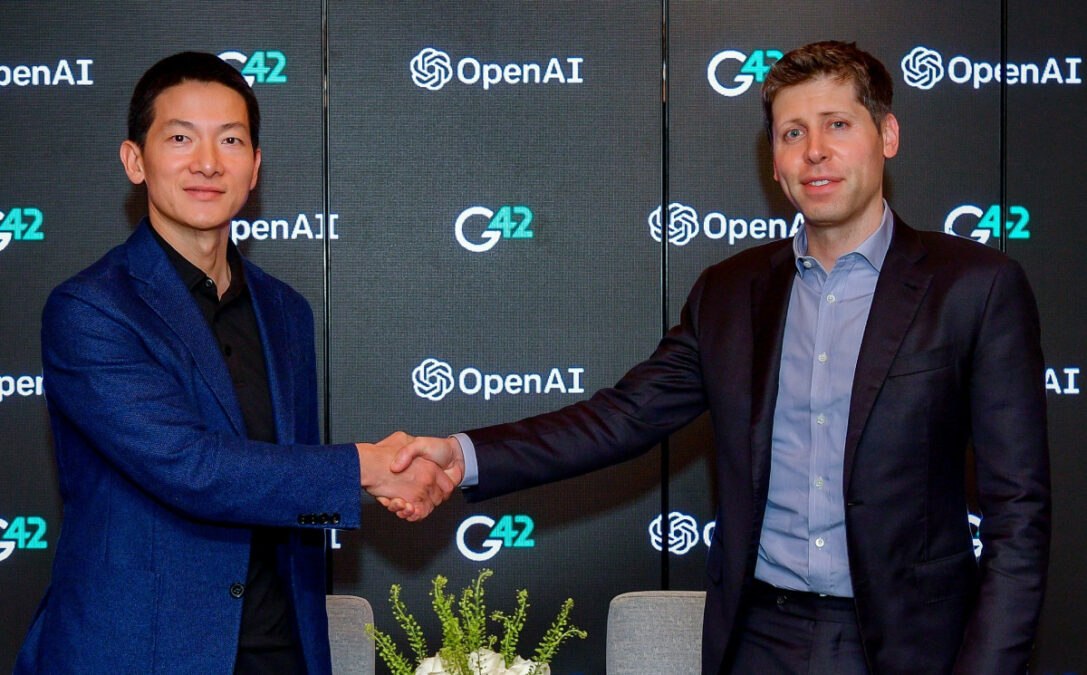

- Dubai, UAE-- G42 has announced a partnership with OpenAI to deliver cutting-edge AI solutions to the UAE and regional markets....

The collaboration will leverage OpenAI’s generative AI models in domains where G42 already has deep expertise, like financial services, energy, healthcare and public services

Owing to the solutions created by G42, organisations in the UAE will be able to simplify the process of integrating AI capabilities into their existing enterprise landscapes

- Riyadh, Saudi Arabia - The Saudi Central Bank (SAMA) signed an agreement with the Monetary Authority of Singapore (MAS) on...

The agreement seeks to facilitate activities of both organizations in international markets

It will also provide a framework for cooperation between their innovation departments

- Despite global economic challenges, the region showcased resilience in the first half of 2023, backed by a robust performance in...

Despite global economic challenges, the region showcased resilience in the first half of 2023, backed by a robust performance in the construction sector

Future projections indicate growth, with Egypt's construction market expected to expand and Saudi's diversification efforts fueling further development

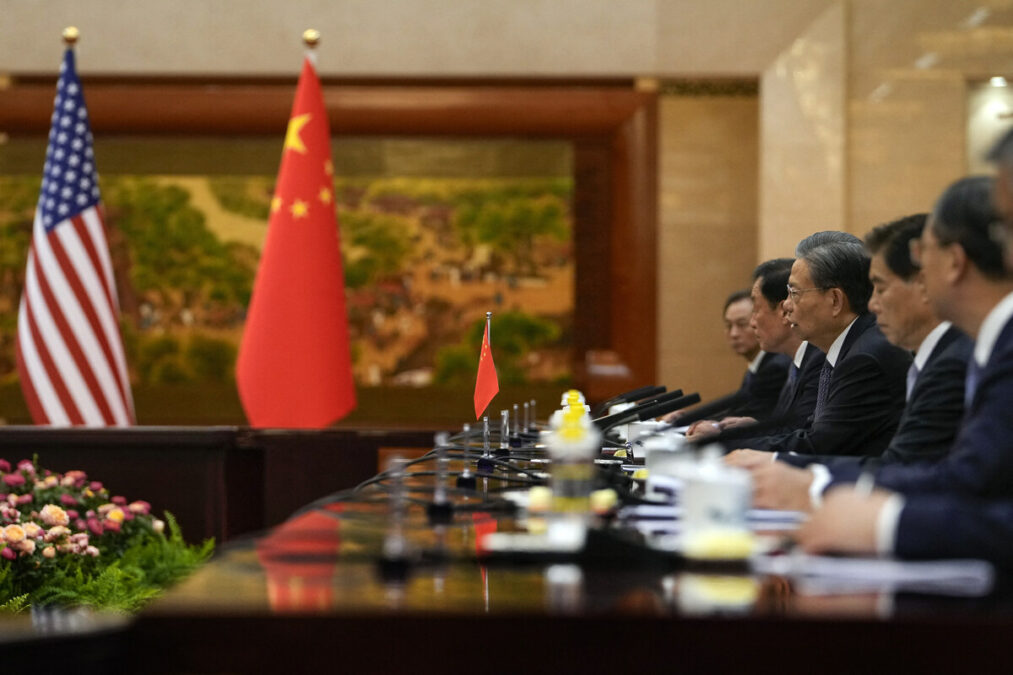

- Washington, United States - The United States on Tuesday said it was tightening curbs on exports of state-of-the-art AI chips to...

The measures are the latest chapter in the policy started under the Trump administration to limit Beijing's ability to gain ground and become a leading tech economy.

The new rules tighten measures taken a year ago that banned the sale to China of microchips that are crucial to the manufacturing of powerful AI systems.

- Markets had enjoyed a healthy run Tuesday on optimism that while Israeli Prime Minister Benjamin Netanyahu was preparing for a...

Asian markets mostly fell, with Hong Kong, Shanghai, Singapore, Mumbai, Jakarta, Taipei and Manila all down, along with London, Paris and Frankfurt.

Crude jumped more than two percent at one point on worries about supplies from the oil-rich region in the event of a wider war.

- Riyadh, Saudi Arabia -- Saudi-listed ACWA Power has signed seven cooperation agreements with Chinese firms for solar, green hydrogen and...

The agreements were signed with entities including State Power Investment Corporation, one of the largest state-owned power generators in China.

The agreements, which include green hydrogen and water desalination projects, the third Belt and Road Forum held in Beijing on October 17-18.

- Dubai, UAE - Global tech giants such as Google, Microsoft, Zoom and Huawei are among more than 6,000 businesses displaying...

Global tech giants such as Google, Microsoft, Zoom and Huawei are among more than 6,000 businesses displaying their latest advancements at the event.

The 2023 edition has attracted 180,000 technology specialists from 180 countries, a 40 percent increase from previous years.

BYD logs record EV sales in 2025

It sold 2.26m EVs vs Tesla's 1.22 by Sept end.

Google to invest $6.4bn

The investment is its biggest-ever in Germany.

Pfizer poised to buy Metsera

The pharma giant improved its offer to $10bn.

Ozempic maker lowers outlook

The company posted tepid Q3 results.

Kimberly-Clark to buy Kenvue

The deal is valued at $48.7 billion.