The global economy has been hit by a massive inflation wave, beginning with the United States, the European Union, and China, and spreading to the Gulf countries, forcing citizens to seek alternatives away from the government actions that may take longer to implement.

These unprecedented inflationary hikes result from Russia’s four-month-long conflict with Ukraine, which has disrupted global supply chains and increased shipping expenses, in addition to the surge in oil prices and numerous countries restricting food exports.

In a webinar conducted by Oxford Economics on Middle East regional growth trends in an inflationary world, Scott Livermore, Chief Economist, Oxford Economics Middle East, and Managing Director, demonstrated challenges that the current period of higher inflation may pose to the Middle East and GCC region.

Global overview

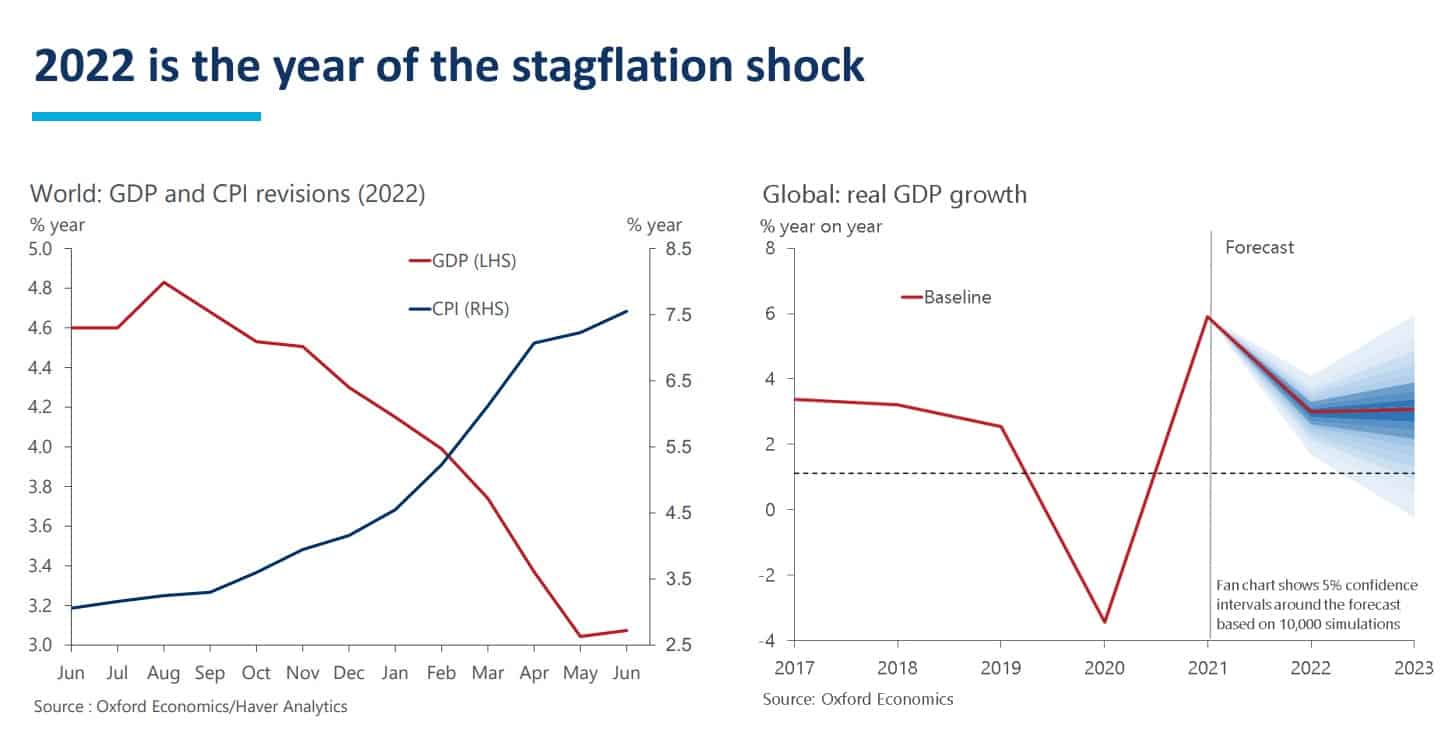

According to Oxford economic research, the global GDP growth has been revised down and inflation up over the past nine months. This is primarily due to supply chain concerns affecting the global economy.

However, according to Livermore, there is reason to stay cautiously optimistic, given a 3 percent growth forecast is only marginally below pre-crisis levels.

Limited impact of the Russian-Ukrainian war on the GCC

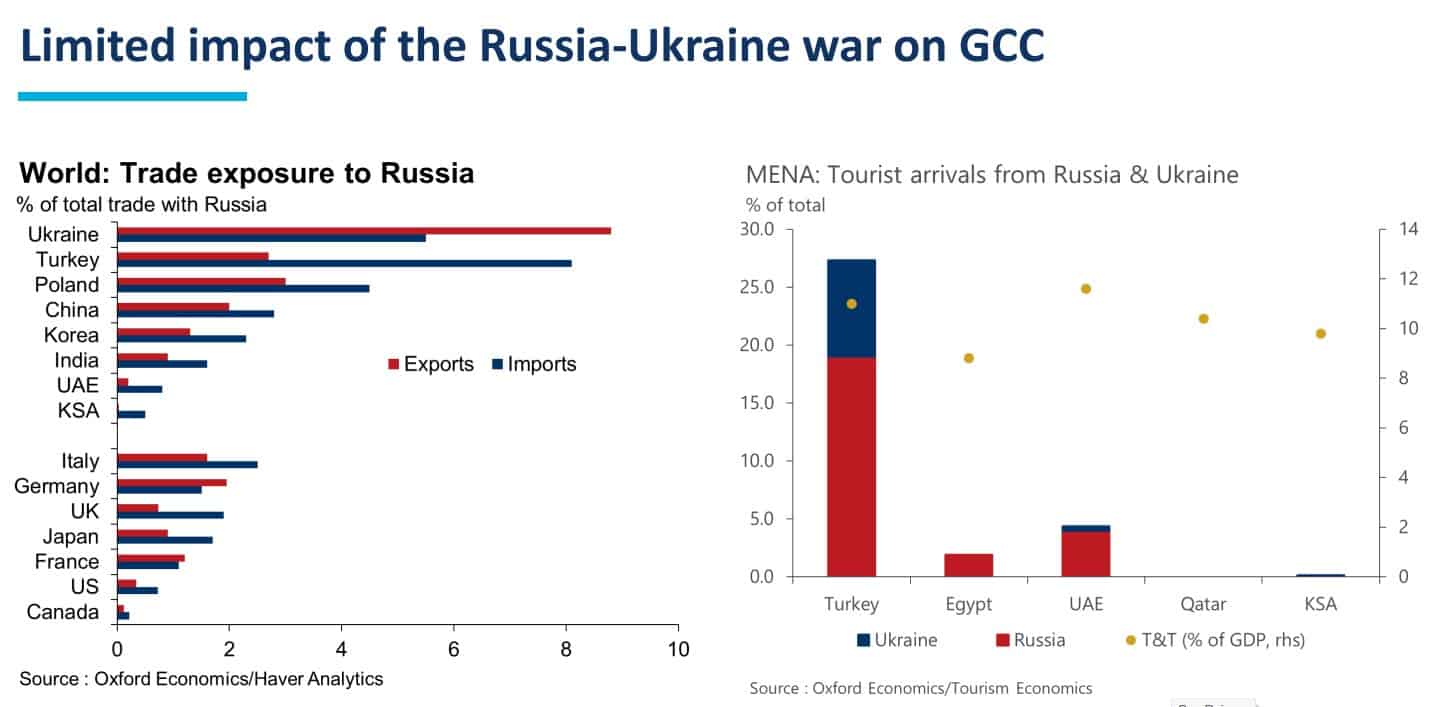

The webinar also discussed the impact of the Russian-Ukrainian war on the GCC, demonstrating that the immediate impacts of this conflict are largely concentrated on Eastern Europe, with the Middle East being significantly less directly complexly impacted.

Livermore added that even though the crisis creates an initial headwind, Russia is a very tiny market for exports from the UAE and Saudi Arabia.

Alternatively, travel tourism is more vital to the region. Russia and Ukraine arrivals accounted for 2.3% of overall arrivals in the MENA area, making it the second-most reliant region on output travel from these two unstable nations.

However, there is significant variation with some destinations more clearly exposed than others such as Turkey, Egypt, and the UAE. For example, Russia was the second largest origin market for tourists to Dubai with Ukraine also ranking among the top 20.

According to Livermore, the present political attitude and the continuous airline connections between the region and Russia could result in several destinations in the Middle East, most notably the UAE, a considerably larger proportion of the Russian market, which might be beneficial for growth.

Energy prices and spike of food prices

Regarding energy costs, Oxford Economics forecasts that oil prices will average more than $120 per barrel over the next few quarters and will only gradually decline in 2023.

Food prices have also increased. In recent months, the food Commodity Price Index of the World Bank has reached nominal record highs. It has increased by 15% since the beginning of the year and by over 80% since two years ago, indicating quite severe inflationary pressures.

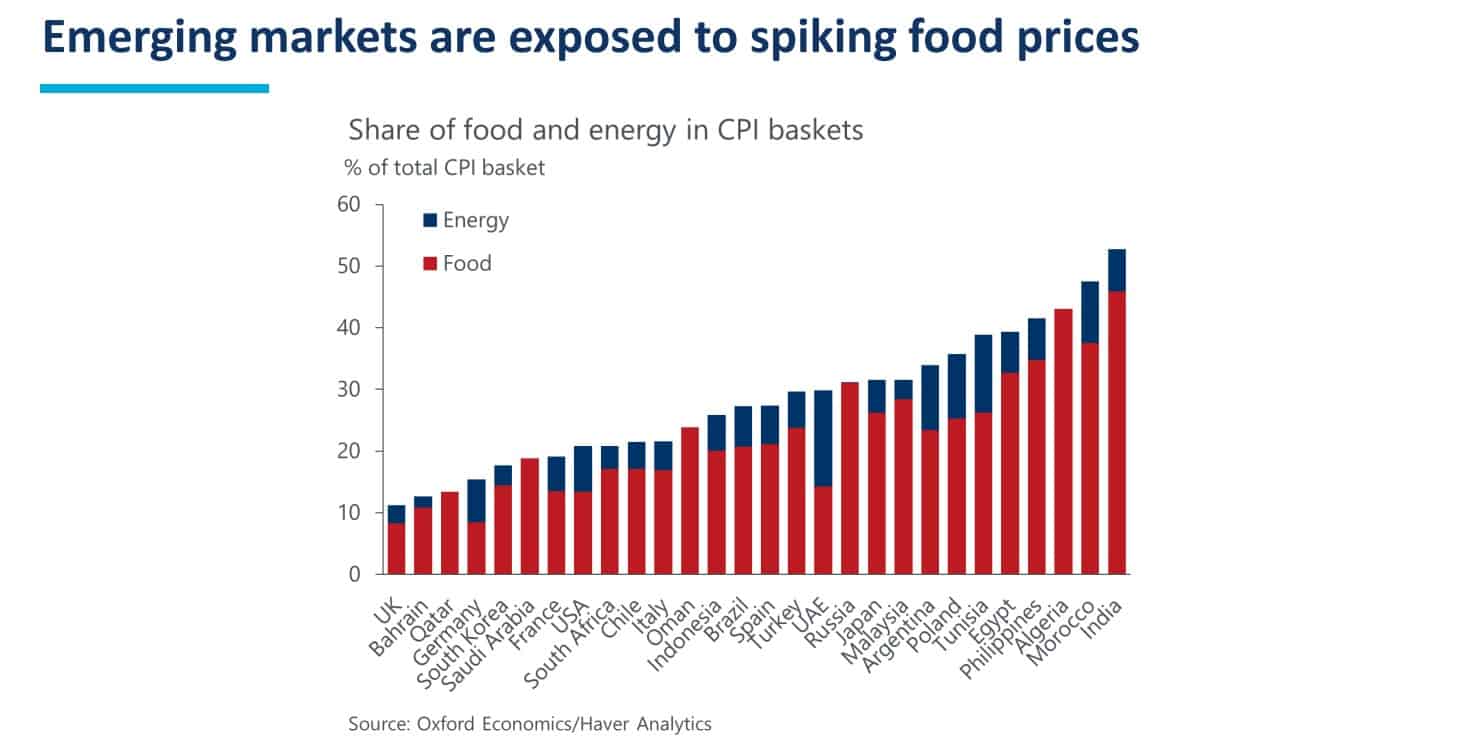

The emerging markets will be the most exposed and particularly vulnerable to a spike in the energy and food prices such as India, Morocco, and Algeria. Therefore, these nations are especially vulnerable to rising commodity prices, which might have a negative effect on their economies due to inflation.

Inflation peak is lower in the GCC

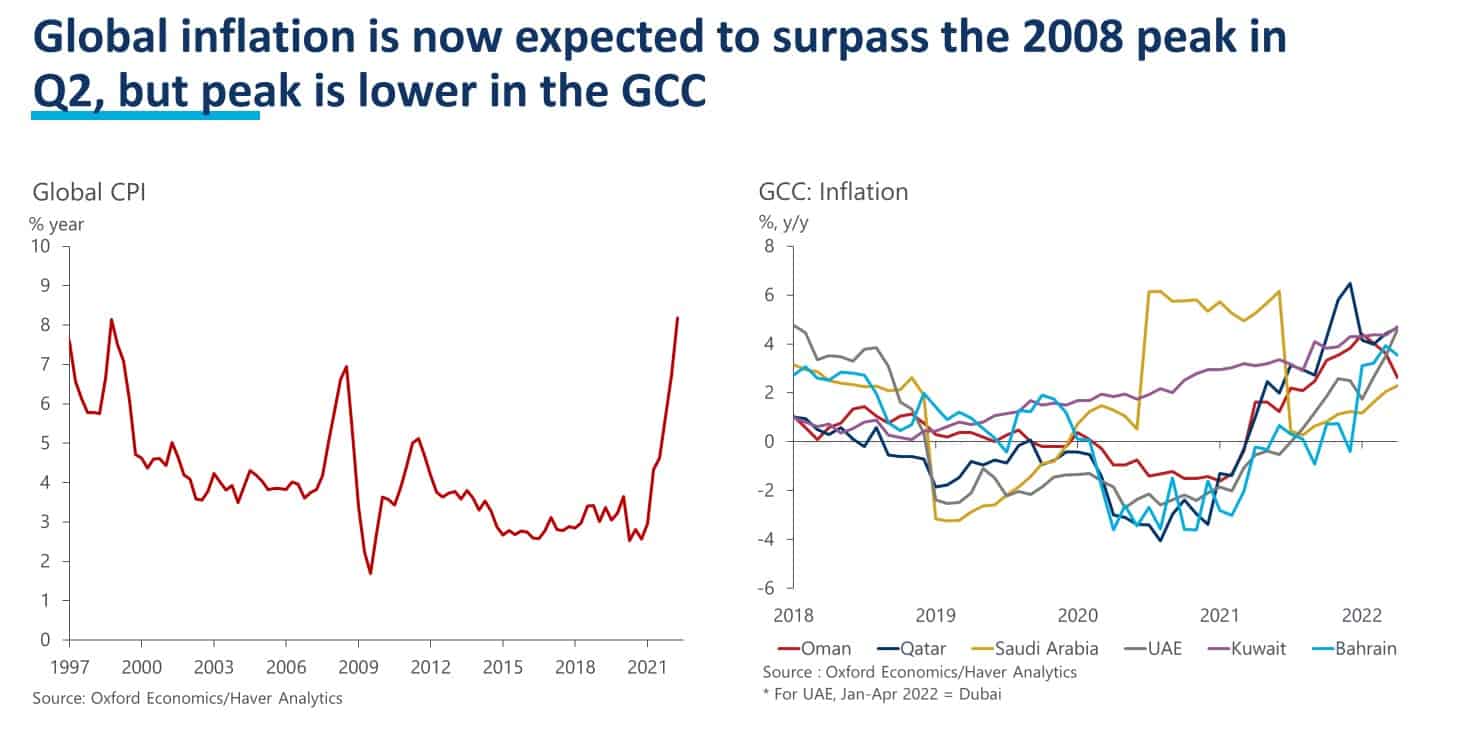

Livermore expects that the above factors, in addition to the supply chain issues, will lead the global inflation to pass the peaks we last saw in 2008, which has climbed to around 8 to 9% in Europe and the US.

He added that the inflation trends in the Middle East are similar; however, the increasing scale varies across countries. For example, inflation in the North African countries is probably higher than in other parts of the world, particularly where there’s a heavy dependency on food imports, such as Egypt, Tunisia, and Morocco, where inflation has climbed relatively high.

In the GCC, on the other hand, inflation is rising. However, it is generally lower than elsewhere. For example, it has climbed to just over 2% in Saudi Arabia, with the other countries falling in the middle.

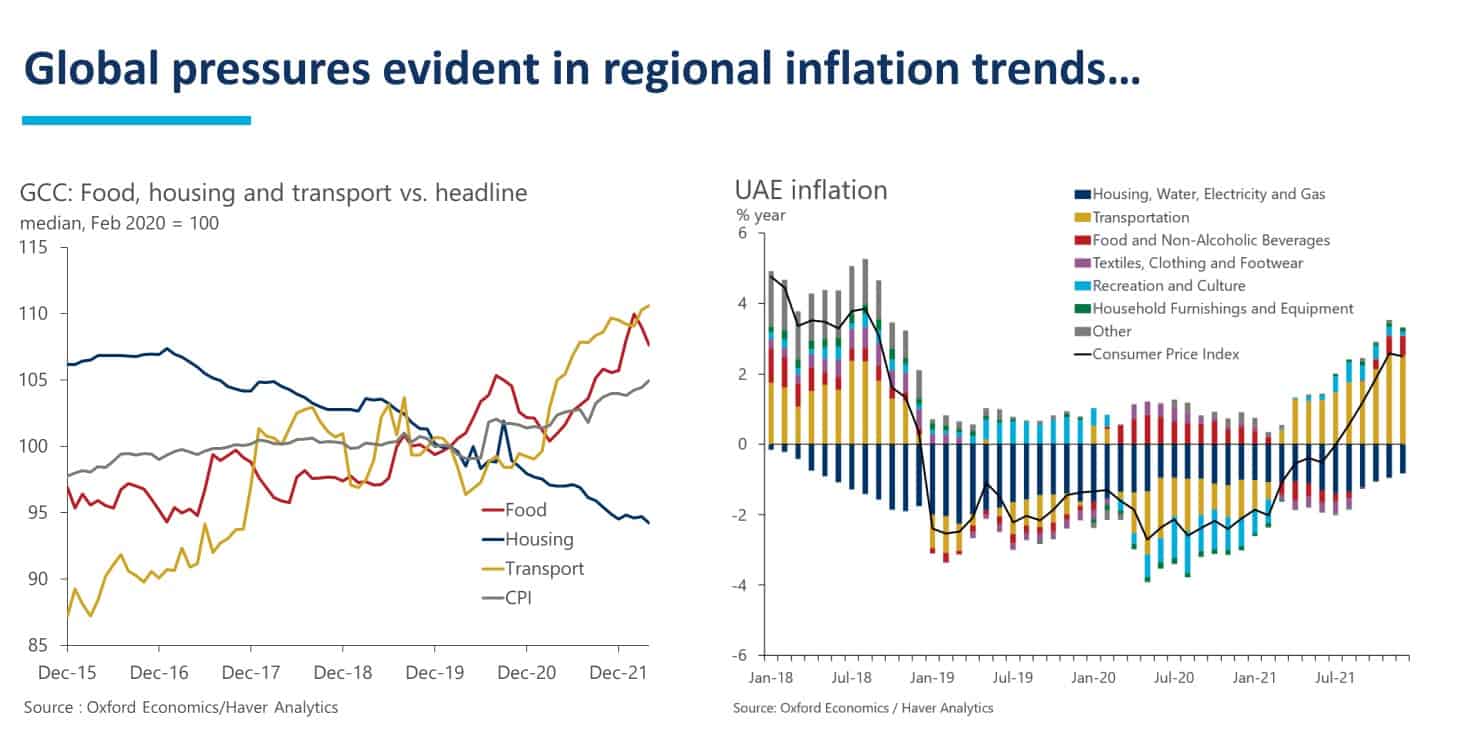

According to Livermore, if we look regionally, rising prices are becoming more broad-based and rising across the consumer basket.

“Looking at the GCC and the UAE, we can observe that transportation, recreation, activities, and food drive the most price increases. But, as previously stated, inflation in the GCC is still significantly lower than in the US; this may be owing to the strength of the US currency, which will affect some imported inflation into the GCC,” he said.

Livermore believes that some of the supply-side dynamics and commodity prices that have been supporting inflation will fade.

“Although oil prices are expected to exceed $110 per barrel by the end of the year, they are expected to decline to $96 or below by the end of 2023. In terms of non-energy amounts, food is expected to fall by 6% in 2023, metals by 15%, and all these aspects will contribute to part of the inflation rate falling very sharply throughout 2023 but remain above pre pandemic average ” he concluded.