RIYADH — Venture capital, no longer just a “gambling game” played by a small group of businessmen, is now utilized by nations aiming to develop their economies and become global commercial and financial hubs.

Under the auspices of this approach, the Kingdom of Saudi Arabia has embarked on plans to diversify its economy and reinvest oil revenues to transition into the post-fossil energy era.

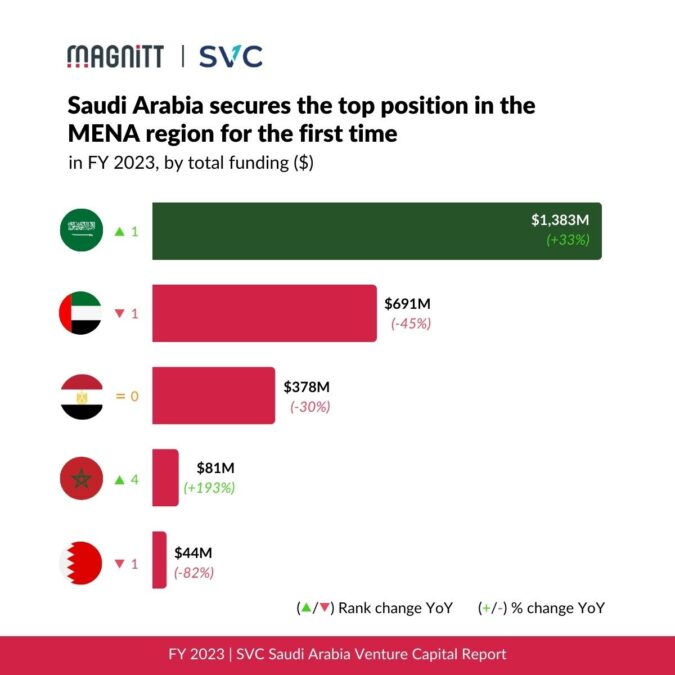

In recent years, the Kingdom has successfully delved into this sector, securing over half of the total venture investment in the Middle East and North Africa by 2023.

Venture capital is a type of financing that provides funding to early-stage startups with high growth potential in exchange for equity or an ownership stake.

A venture investor assumes the risk of investing in startups, hoping to realize substantial returns upon their success. Venture capitalists acquire shares in the companies they invest in as compensation for assuming these risks.

First in the region

According to the “MAGNiTT” platform, which specializes in reporting data on venture investment in emerging companies in the region, Saudi Arabia surpassed other MENA countries in terms of the total value of venture investments for the first time in 2023.

The report indicated that the Kingdom obtained the largest portion, 52 percent, of total venture investment in the region for 2023, an increase from 31 percent in 2022.

The Kingdom’s total venture investment grew by 33 percent in 2023 compared to the previous year.

As reported by the Saudi News Agency (SPA), this underscores the allure of the Saudi market, enhances its competitive landscape, and strengthens the Kingdom’s economic position as the largest economy in the MENA. It also highlights its global stature as a G20 nation and a member of the “BRICS” group, representing some of the largest and most powerful economic blocs in the world.

Nabil Koshak, CEO and member of the Board of Directors of the Saudi Venture Capital Company (SVC), discussed Saudi venture investment trends with the “Business” channel.

He explained that the activity in the venture investment sector aligns with the Kingdom’s Vision 2030, which emphasizes supporting small and medium-sized emerging companies to diversify the economy, create jobs, and achieve various development objectives. This has been facilitated by government-backed funds increasing their spending in this sector.

Koshak noted that a key factor contributing to the rise in venture capital investments, especially in the financial technology sector, is the ongoing updates to regulations and legislation, coupled with providing an experimental environment that offers startup companies both flexibility and financial support.

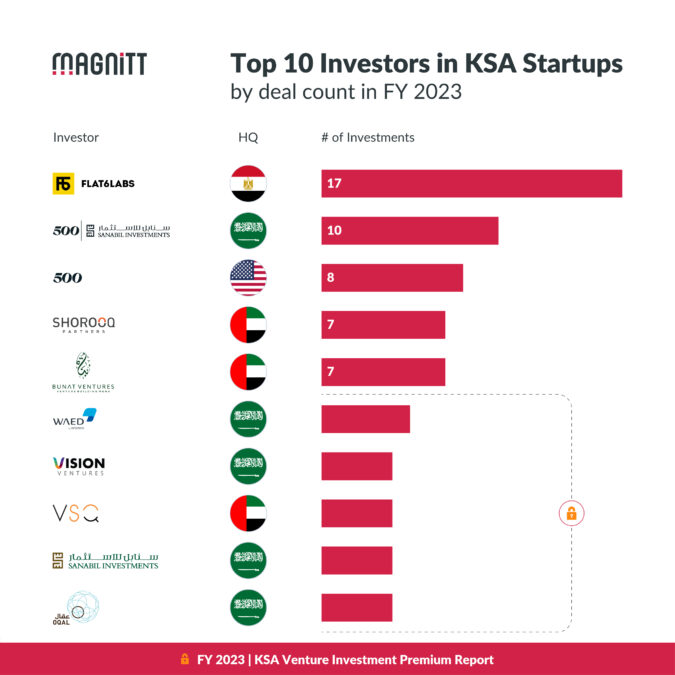

He highlighted the Saudi Venture Investment Company as a significant program that has developed local and regional fund managers while attracting international investors to emerging companies.

“Since its inception, the company has invested in over 53 investment funds, channeled its investments into more than 700 startup companies, and contributed to upwards of 1,220 investment rounds,” Koshak said.

“The size of the fund has surpassed $2.1 billion. We are committed to investing more than about one billion dollars in these funds, and we anticipate ongoing support for funds focused on investments in Saudi Arabia,” he added.

Saudi Venture Capital, established in 2018, is a government investment firm affiliated with the Small and Medium Enterprises Bank, one of the development banks under the National Development Fund.

The company’s goal is to stimulate and sustain financing for emerging companies and small and medium-sized enterprises, from pre-establishment to the initial public offering stage, by investing in funds and participating in startup ventures, with a total commitment of $2 billion.

The Saudi Venture Capital Company (SVC) announced its latest investment of $30 million in the third IMPACT46 fund last November. The company has recently started to invest in emerging companies at various stages within the Kingdom and the region.

Last September, SVC announced a $5 million investment in the Venture FinTech Fund, dedicated to funding early-stage financial technology startups.

According to Koshak, the primary focus of his company over the past three years has been on the financial technology sector. This is evidenced by their investments in two funds specializing in this area. “About 70 percent of the 53 funds we’ve invested in allocate a portion of their investments to financial technology, which brings the proportion of our investments in this sector to 35 percent of the total funds invested,” he stated.

Koshak forecasts that the education and health technology sectors, as well as investments in the environment and alternative energy, will be among the most active sectors for startup activity in the coming years.

He outlined the risks and rewards in the startup landscape, explaining, “50 percent of startup companies fail and exit the market, 30 percent of these companies double their capital, and 10 percent to 20 percent of startups manage to increase their capital up to 30 times. This substantial growth allows investment funds to be raised. Venture capital is employed to balance these risks and generate profits.”