The war in Ukraine and related sanctions have triggered a sharp increase in commodity prices, which will add to the challenges facing countries in the Middle East and North Africa—particularly the region’s oil importers, according to an IMF report in May 2022.

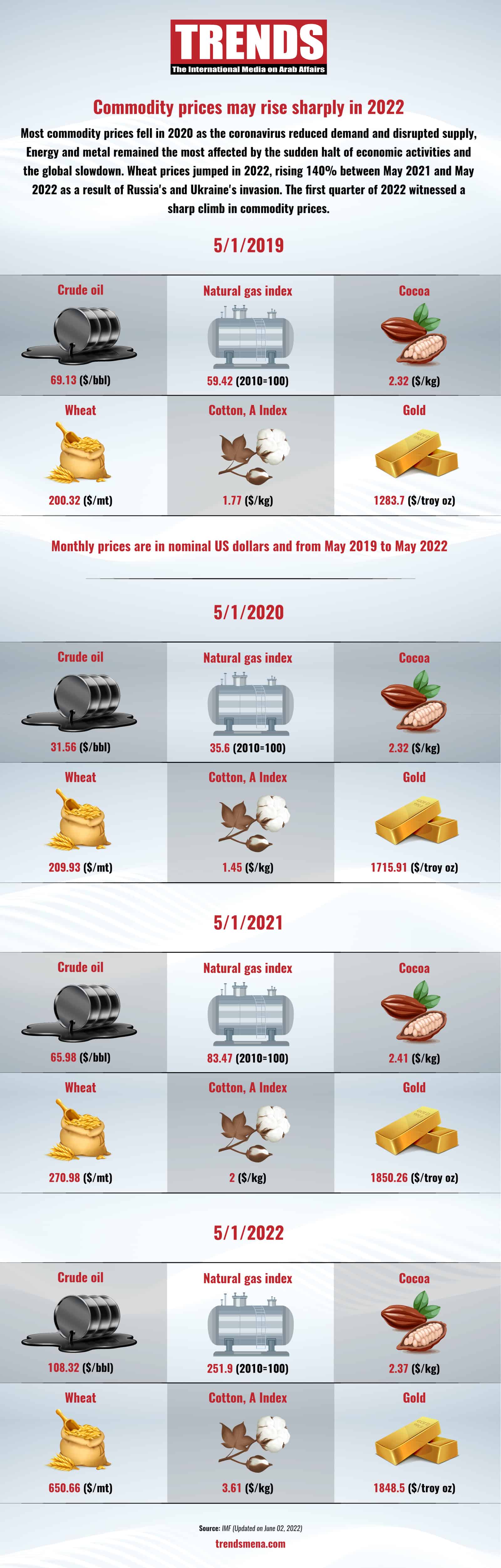

After leaping to a peak of $130 per barrel following Russia’s invasion, oil prices are expected to settle at an annual average of around $107 in 2022. Similarly, food prices are expected to increase by an additional 14 percent in 2022, after reaching historical highs in 2021.

The report said higher inflation is one of the most direct impacts of rising commodity prices. Food prices accounted for about 60 percent of last year’s increase in headline inflation in the Middle East and North Africa, excluding the countries of the Gulf Cooperation Council.

This surge in prices comes at a precarious time for the region’s recovery. In our Regional Economic Outlook, we revised up our forecast for growth in the Middle East and North Africa as a whole by 0.9 percentage points to 5 percent, but this reflects improved prospects for oil exporters helped by rising oil and gas prices.

The authors of the report said commodity price increases will also have a significant negative impact on oil importers’ external accounts.