Oil prices jump after Trump’s warning, stocks extend gains

Oil prices rallied Tuesday after Donald Trump urged Tehran residents to evacuate, stoking fresh fears of all-out war as Israel and Iran continued to pound each other with missiles.

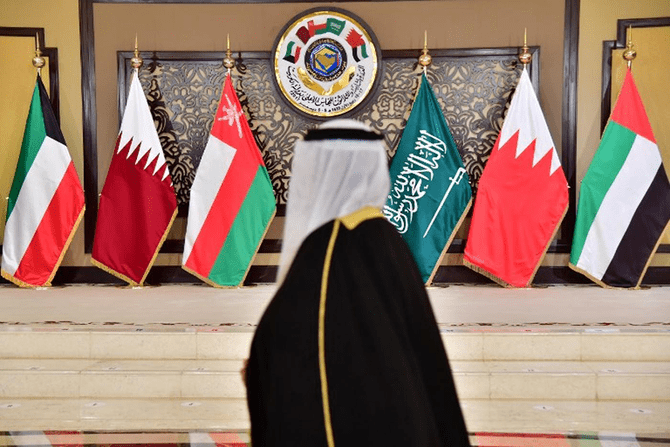

Can Gulf producers tame oil prices?

However, Gulf countries have an interest in acting in coordination — both within OPEC, and with Russia-led allies in the OPEC+ group — to avoid a price war and keep control over the market.Brent crude nears $140 per barrel, headed towards all-time high

Brent North Sea crude oil for May delivery reached $139.13 shortly after electronic trading opened around 2300 GMT on Sunday.Ukraine conflict fuels supply chain concerns

Since Russia invaded, almost 80,000 Ukrainians have returned to fight Russia, leaving industries short of labor.Aramco shares hit record high on the back of high oil prices

Saudi energy giant Aramco's shares rose to a record high on Wednesday amid a surge in global oil prices following Russia's invasion of Ukraine. The Gulf kingdom -- the world's top crude exporter -- has remained the firm's majority shareholder since a December 11, 2019 listing.Global and regional trade: The economic booster for GCC govts

The squeeze on real incomes within the region due to higher inflation may depress regional trade flows. The situation may worsen further if the global central banks' attempts to control rising consumer prices, which will ultimately dampen global economic activity.Oil and safe havens rally, ruble sinks on Russia sanctions

Oil prices and safe havens surged Monday while the ruble plunged after world powers imposed fresh sanctions on Russia over its invasion of Ukraine.Oil price break $100 on Russian ‘military operation’ in Ukraine

According to the UN, a full-scale Russian invasion on Ukraine would have a devastating global impact that would likely spark a new "refugee crisis", with traders fretting over supplies of key commodities including wheat and metals.Oil prices jump as unrest continues in Kazakhstan

Over the week, crude prices gained about 5 percent and on Friday Brent exceeded $83 per barrel.Omicron batters indices across MENA

Stock markets across the MENA region suffered losses on Sunday as dip in oil prices and mounting concern over ‘Omicron’ weighed heavily on investors’ minds.Energy prices may come down early next year

Consumption of natural gas rebounded fast — driven by industrial production — boosting demand at a time when supplies were relatively low. Energy supply, however, apparently reacted slowly to price signals due to factors like labor shortages, maintenance backlogs, longer lead times for new projects, and lackluster interest from investors...Moody’s revises Saudi Arabia’s outlook to stable

The agency predicted the Saudi economy will return to positive growth in 2021, and the current account level will return to surplus as the fiscal deficit shrinks in 2021, accompanied by a reduction in the level of debt in the medium term.Political stability spurs Kuwait’s economic recovery

In June, the government passed the budget for 2021-22, which projected spending of US$ 76 billion and a deficit of US$ 40 billion.Saudi index reaches new highs on oil price rise

The oil price rise is expected to raise the economic growth of Saudi Arabia and the UAE. The kingdom is expected to grow by 5.1 percent next year.$80 oil sparks mixed fortunes for world economy

Rising oil prices handed a major boost to producers but threaten the global recovery and stoke inflationary pressures because they lift manufacturing costs, which translates into higher consumer prices.Gulf region poised for higher growth in 2021: Expert

The economies of the region are recovering fast on the back of the rising oil prices and speedy vaccination programs, says Jean Claus, CEO of Euler Hermes Middle East$250bn GCC rail project on track after hiccups

The project linking the six GCC countries is expected to boost exports, diversify mode of transportation and reduce carbon emissions by cutting the need for trucks and cars.GCC equity markets shine in H1 2021

The growth was spurred by abundant liquidity created by easing monetary and fiscal policies besides a rebound in oil prices.US oil prices soar

At 1355 GMT a barrel of WTI, the main US contract, for October delivery was 5.0 percent higher at $65.26 dollarsDana Gas reports $139m net profit in H1

Dana Gas, the UAE-based energy producer, is out of woods with a big rise in its net profit to $139 million in the first half of this year.Oil prices rise amid growing demand from India, China

Brent crude oil futures were up $1.43, 1.93%, at $75.55 Prices had dropped early in the week by the collapse of output talks between the OPEC and allies including Russia, together known as OPEC+ Falling US inventories, and signs of strong Asian demand from both China and India pushed up...Macro drivers signal higher oil prices in 2022: BofA

Trends currently driving down oil prices will cease to be a problem in the second half of 2021 Weaker dollar, inflation and monetary easing will lead to higher oil prices in 2022 A new Bank of America Global Research report claims micro trends that are driving down oil prices, like...