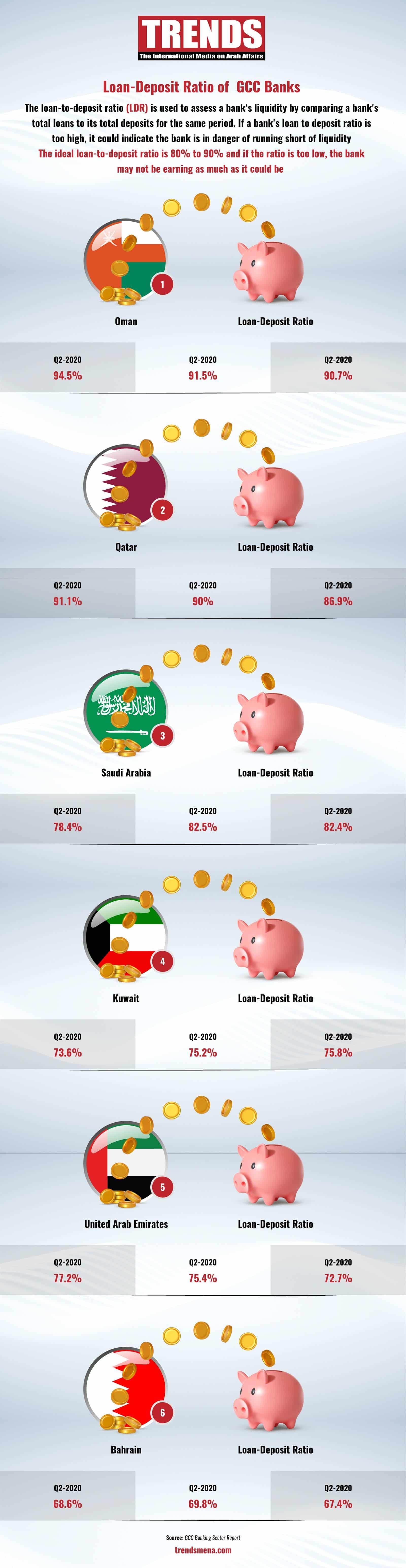

Dubai, UAE–The loan-to-deposit ratio (LDR) is used to assess a bank’s liquidity by comparing a bank’s total loans to its total deposits for the same period. The ideal loan-to-deposit ratio is 80- 90 percent. A loan-to-deposit ratio of 100 percent means a bank loaned one dollar to customers for every dollar received in deposits it received. TRENDS takes a look at the LDR of GCC banks in this infographic: