US, European stocks dip as traders mull US rates outlook

US and European stocks dipped as dealers fretted that the Federal Reserve would push interest rates higher than expected and for longer as it battles high inflation. The euro moved up against the dollar as strong inflation data in France and Spain sparked concerns that the European Central Bank will...History says Fed can’t tame inflation without recession: report

Citing historical "disinflation" cases dating back to 1950 in major economies, the report concluded that central banks "are likely to be hard pressed to achieve their disinflationary goals without significant sacrifice in economic activity." The analysis, prepared by a team of academic and corporate economists, identified parallels between the current...Asian markets drop as traders contemplate higher-for-longer rates

All three main indexes in New York plunged at least two percent Tuesday, with forecast-beating purchasing managers index data showing the US economy remained in rude health despite almost a year of rate hikes and elevated inflation. The readings followed a massive surge in new jobs in January and a...Asian markets mixed, with rates set to go higher

With Wall Street closed Monday for Presidents' Day there were few catalysts for regional investors, with focus on the release later in the week of minutes from the Federal Reserve's most recent policy meeting. After data this month showed the jobs market continues to boom and prices continue to rise...Stocks steady, dollar higher on US rate-hike expectations

Stock markets largely steadied and the dollar rose with traders forecasting US interest rates to keep climbing following last week's blockbuster American jobs report. Oil prices extended gains after Iraqi Kurdistan suspended crude exports through Turkey as a precaution after a deadly earthquake rocked its northern neighbor and Syria.Markets take a hit as US jobs fan rate worries

optimism was dealt a heavy blow Friday by data showing more than half a million new jobs were created in the United States last month, nearly double the December figure and far more than the 188,000 expected. Government figures also showed unemployment fell to the lowest level since 1969. The...US sees surprise hiring surge as unemployment edges down

US job gains surged unexpectedly last month as unemployment slipped to its lowest rate in over five decades, government data showed. The world's biggest economy added 517,000 jobs in January after a five-month slowdown in hiring, as the jobless rate edged down to 3.4 percent, said the Labor Department in...UAE, Saudi, Bahrain up rates after Fed’s hike; Qatar keeps status quo

Hours after the US Federal Reserve upped its target interest rate by a quarter of a percentage point, many central banks in the GCC region followed suit, raising their respective interest rates. Saudi Arabia, the UAE and Bahrain hiked it by 25 basis points while the central bank of Qatar...ECB to hike rates again, but outlook brightens

Most analysts expect a 50-basis point hike in March but, with inflation starting to ease, there are already signs of a debate among policymakers about when to slow the pace. ECB board member Fabio Panetta, known for his dovish stance, said the bank should not commit to any particular hike...Key US inflation gauge slows in December while spending falls

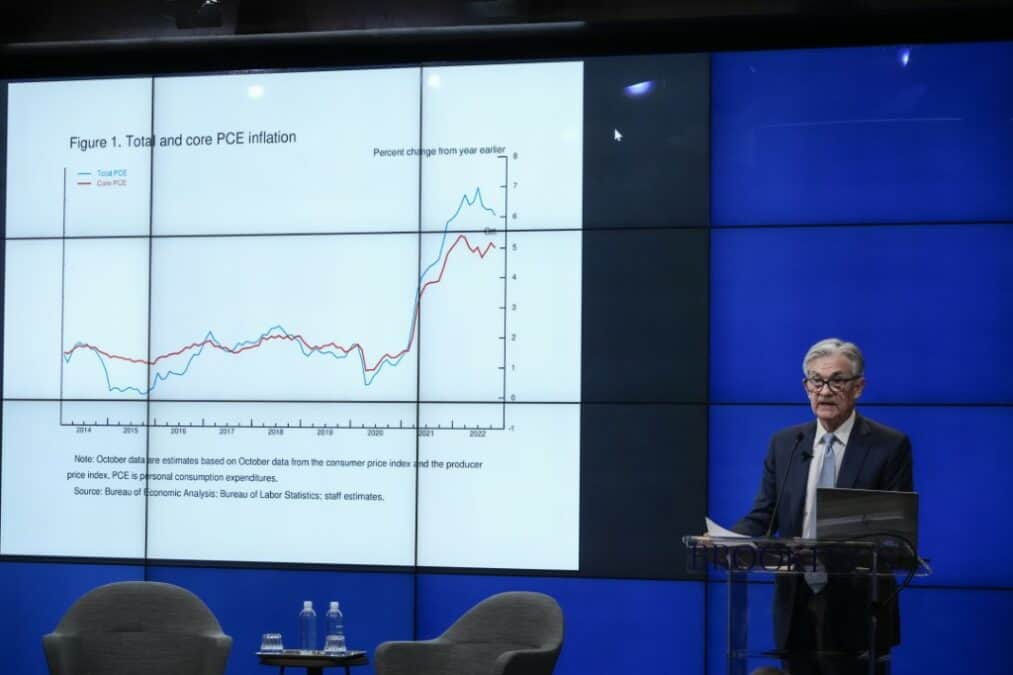

The tightening measures are showing effect, with the Fed's preferred inflation gauge, the personal consumption expenditures (PCE) price index rising 5.0 percent last month from a year ago, down from 5.5 percent in November, Commerce Department data showed on Friday. This extends a downward trend since mid-2022, when American households...Markets rise on better-than-expected US growth

Stock markets rose as US data showed the country grew at a slower pace in 2022 but finished the year on a stronger note. Shares in Paris, Frankfurt and London were higher in mid-afternoon trading. US gross domestic product rose at an annual rate of 2.9 percent in the fourth...US economy slows in 2022, may result in lower Fed rate hikes ahead

Household spending and business investment remained positive in the final quarter last year though they slowed, while inventories and net exports helped growth, said Rubeela Farooqi of High Frequency Economics.Iraq’s currency in flux as foreign transfers come under scrutiny

While the official exchange rate has been fixed at 1,470 Iraqi dinars against the dollar, the currency was trading at up to 1,600 to the greenback on local markets from mid-November, before settling at about 1,570 dinars, according to state media.US inflation falls to lowest level in over a year

Consumer inflation in the United States slipped in December to the lowest level in over a year, government data showed, signaling the worst of red-hot price increases may be over. Inflation has eased for a sixth consecutive month alongside the Federal Reserve's aggressive campaign, fueling hope for reprieve from steeply...Stocks mostly drop as traders track China, US rates

Major stock markets mostly dropped as warnings that US interest rates would continue to rise and remain elevated offset growing optimism over China's economic reopening after Covid lockdowns. Equities enjoyed a strong start to the new year thanks largely to Beijing's decision to throw off the shackles of its strict...Stocks mostly rise ahead of key US jobs data

Stock markets mostly advanced as traders awaited key US jobs data and after news of falling inflation in the eurozone. Global equities have enjoyed a largely solid start to the new year, though Wall Street slid on expectations that the Federal Reserve is in no rush to stop hiking US...US regulators warn banks over crypto risks

The joint statement comes after the sudden collapse of cryptocurrency platform FTX - worth $32 billion before it filed for bankruptcy in November - which sent chills across the sector. FTX's disgraced founder Sam Bankman-Fried has since been accused of committing one of the biggest financial frauds in US history,...World economy faces more pain in 2023 after a gloomy year

Economists expect Germany and another major eurozone economy, Italy, to fall into recession. Britain's economy is already shrinking. Rating agency S&P Global foresees stagnation for the eurozone in 2023. But the International Monetary Fund still expects the world economy to expand in 2023, with growth of 2.7 percent. The OECD...US Fed’s preferred inflation gauge eases in November

A key indicator of US inflation edged down from a year ago in November, according to government data, in welcome news to households grappling with soaring costs while spending slowed. This extends a downward inflation trend in recent months, though it is unlikely to bring quick relief from an aggressive...Asian markets join Wall Street advance as recession worries subdue

With dust settling after the Bank of Japan's surprise shift from ultra-loose monetary policy, investors embarked on a mini Santa rally ahead of the Christmas break, while the yen stabilised following its biggest jump in 24 years.Stocks sink globally as central banks hike rates, data fan recession fears

Global stocks sank as central banks hiked interest rates again and signaled they needed to go higher to tame inflation. Meanwhile, downbeat economic data out of China and the United States fanned recession fears. Both the Bank of England and the European Central Bank mirrored the Fed's half-point hike on...US industrial output decreases in November

Industrial production in the US slumped in November with "broad based" decreases, the Federal Reserve said, as output for bigger-ticket consumer products and manufacturing fell. While tangled supply chains and surging costs which weighed on businesses are easing, in a boost to production, firms are now contending with weakening demand...Gulf central banks raise interest in line with Federal Reserve hike

Dubai, UAE--– The central banks of Saudi Arabia, Bahrain, and Qatar increased their interest rates following the US Federal Reserve Board’s announcement today to raise the Interest on Reserve Balances (IORB) by 50 basis points. The Saudi Central Bank, known as Sama, the Central Bank of Bahrain and Qatar Central...ECB mulls rate hike slowdown on ‘peak inflation’ hopes

As part of its monetary policy tightening, the ECB will on Thursday outline the next steps in its efforts to slim down the bank's massive balance sheet. It has already made changes to the terms of an ultra-cheap bank loan scheme, aimed at keeping credit flowing during the pandemic, in...US Fed poised for smaller rate hike with eye on wage growth

But the half-point jump analysts expect to see in the Fed's benchmark lending rate will still be a steep rise, as it struggles to cool demand in the United States to bring consumer costs down. Households in the world's biggest economy have been contending with red-hot prices.Equities boosted by China news before rate calls

Global stocks rose on China's slowing inflation and economic reopening, alongside hopes of less aggressive interest rate hikes next week. Sentiment brightened on China's decision to shift away from its nearly three-year zero-Covid strategy of lockdowns and mass testing that slammed the economy. After protests across the country, leaders have...World economy faces more pain in 2023 after a gloomy year

Economists expect Germany and another major eurozone economy, Italy, to fall into recession. Britain's economy is already shrinking. Rating agency S&P Global foresees stagnation for the eurozone in 2023. The coronavirus pandemic, meanwhile, remains a wildcard for the global economy.World equities extend gains on Fed rate optimism

Global stocks rose as Federal Reserve boss Jerome Powell flagged a moderation in interest rate hikes, while China signaled a softer approach to fighting Covid. Asian and European equities tacked higher as investors eyed news that eurozone unemployment fell to a record 6.5 percent in October. Oil prices climbed before...Fed report says US economic activity slows amid uncertainty

Washington, United States—US economic activity eased in recent weeks, while uncertainty and "increased pessimism" clouded the country's outlook amid high prices and rising interest rates, a report published by the Federal Reserve said Wednesday. The Fed's latest "beige book" survey of economic conditions comes as the US central bank pushes on...Nasdaq surges 3% as Fed Chair says could soon ease rate hikes

Stocks have risen over the last month, in part on expectations that the Fed would soon pivot on monetary policy. Powell's appearance had been viewed as a potential risk to equities if he had adopted a more hawkish tone. Major indices had been near flat prior to the Powell event,...Rate cuts may help in avoiding chronic recession

It is logical for the FRB to halt the wave of escalation of interest rates on the dollar, which was projected to witness a final round next December at a rate of 0.25 percent, due to the approaching winter season and the intensification of the cold wave in western Europea,...Stocks rise, dollar slips as Fed signals softer rate hike pace

Wednesday's much-anticipated minutes showed most US central bank chiefs felt smaller increases would "likely soon be appropriate" as the economy shows signs of weakness following almost a year of monetary tightening.World stocks rally but oil prices tumble

Global main stock markets rallied as investors fished for bargain shares and shrugged off losses elsewhere, but oil prices fell as concerns over the global economy persist. London stocks were lifted by official data showing UK retail sales rose 0.6 percent in October, rebounding from a 1.5-percent slump in September....GCC states raise interest rates after Federal Reserve’s hike

Most of the GCC states have raised their key interest rates in the wake of the Federal Reserve's decision to raise its key policy rate by three-quarters of a percentage point. The two largest economies of the region, the UAE and Saudi Arabia, both raised rates by 75 basis points.Global stocks rise on Fed optimism, zero-Covid China policy reports

Global stock markets rose as traders looked to the US Federal Reserve's interest rate decision hoping it will signal a more dovish approach to fighting inflation. The Fed is widely expected Wednesday to announce a fourth straight 75-basis-point rate hike leading to worries it will tip the world's top economy...Most markets up but China fear casts shadow

Most markets rose on hopes the Federal Reserve would soon slow its pace of interest rate hikes, though the mood was darkened over China after President Xi Jinping tightened his grip on power. The yen weakened against the dollar after a short rally after speculation Japanese authorities had stepped into...Pound sinks against dollar on UK political uncertainty

The British pound sank against the dollar on political uncertainty after the resignation of UK Prime Minister Liz Truss, while weak economic data added to the turmoil. The dollar strengthened also on expectations that the US Federal Reserve would press ahead with its program of bumper interest rate hikes to...Goldman Sachs Q3 profit at $3bn

The bank's revenues declined 12 percent to $12 billion.Equities, oil prices slide on recession fears

Stock markets and oil prices slumped as investors grow fearful that more big interest rate hikes will tip economies into deep recessions. The mood darkened also on the worsening Ukraine war and weaker demand expectations in China. Analysts said US consumer price index data released later this week will be...Trio win Nobel for banking’s role in economy, collapse prevention

Ex-Fed chief Ben Bernanke together with Douglas Diamond and Philip Dybvig were honoured for having "significantly improved our understanding of the role of banks in the economy, particularly during financial crises, as well as how to regulate financial markets".Markets sink as US jobs data fan rate hike bets

A brief rally across trading floors last week gave way to gloom as investors grow increasingly worried that central bank efforts to tame runaway prices will plunge the global economy into recession. Adding to the stress is the upcoming corporate earnings season, which many fear will show that companies are...US job gains slow, but not enough to ease inflation worries

President Joe Biden, who has seen his approval erode in the face of surging prices, cheered the data as a sign of "historic progress" in the economy, even while he said there is more work to do to help American families. But the central bank likely will want to see...Stocks fall, dollar boosted by US jobs data

Stocks mostly slid and the dollar surged after US jobs data showed only a timid slowdown in the labor market, setting the stage for further interest rate hikes. Equity markets have taken a battering as the US Federal Reserve has made it clear it intends to continue raising interest rates...Bringing down inflation will take time, more rate hikes: Fed officials

As US annual inflation has soared to the fastest in 40 years, the Fed has moved aggressively this year to tamp down demand, raising the interest rates five times, for a total of three percentage points. "Inflation remains stubbornly and unacceptably high, and data over the past few months show...Wall Street stocks shine amid hopes of US policy pivot

US equities posted gains for a second straight session amid hopes of a US monetary policy pivot, after a bruising September ended another losing quarter for Wall Street. Twitter surged on the revived chance of Elon Musk's takeover as the tech-rich Nasdaq Composite Index climbed 2.8 percent.Asian, European markets surge on interest rate hopes

Asian and European stocks rallied and the dollar dipped as weak US data sparked hopes the Federal Reserve could ease its interest-rate hiking plans. Frankfurt and Paris equities soared over three percent in value after similar stellar gains in Tokyo, while London won two percent. Central banks across the world...Pound hits record low against dollar on recession fears

Continuing with its slide against the dollar, the pound hit a record low on fears about the UK economy after the government presented a huge tax-cutting budget. Countries around the world are battling high inflation and seeking to curb it with interest rate hikes. But analysts fear such moves can...Dow drops to lowest level in two years as recession looms

Falling for the fourth straight session, Wall Street stocks finished lower on Friday as markets bet on the rising risk of a recession due to interest rate hikes. All three major indices tanked more than 1.5 percent, adding to the week's losses after Wednesday's big Fed rate increase spurred similar...Markets drop as Fed and European central banks hike rates

European markets were down in afternoon trades, with London's FTSE 100 shedding 0.5 percent after the Bank of England raised its rate again to combat inflation and signaled that the UK entered recession in the current quarter.GCC central banks up interest rates, tracking US Fed

Taking a cue from Federal Reserve, GCC central banks have raised interest rates, tracking a hike in the US Fed's benchmark rate. The US central bank announced its third consecutive interest rate increase of 0.75 percentage point, continuing the forceful action to tamp down inflation that has surged to the...

Federal Reserve

BYD logs record EV sales in 2025

It sold 2.26m EVs vs Tesla's 1.22 by Sept end.

Google to invest $6.4bn

The investment is its biggest-ever in Germany.

Pfizer poised to buy Metsera

The pharma giant improved its offer to $10bn.

Ozempic maker lowers outlook

The company posted tepid Q3 results.

Kimberly-Clark to buy Kenvue

The deal is valued at $48.7 billion.