The total value of all acquisitions by Agthia Group last year exceeded AED2.3 billion ($630m), its CEO Alan Smith, said.

He added the group is planning a new acquisition in Egypt, with expansion plans in Saudi Arabia also.

Smith said that the Agthia aims to expand geographically in markets such as Egypt and Pakistan, noting its 60 percent acquisition of Abu Auf Group in Egypt.

He stated Agthia will invest nearly AED90 million in the next few months in Saudi Arabia to establish an industrial facility within the premises of Al Nabil Food Industries in Jeddah.

The planned acquisition is a part of Agthia’s long term strategy of highlighting its ability to finance more acquisitions, Smith said.

He noted Agthia has low debt levels and has a solid financial position, and its net debt compared to earnings before interest, taxes, depreciation and amortization is estimated at 2.4 times.

He also expects the group to benefit from the outcomes of its acquisitions in 2022, in line with its strategy.

“We have established the foundations of the group’s transformation towards a business model based on consumer products”, he said.

It could have a “significant impact on the group’s performance over the next 12 months,” Smith noted.

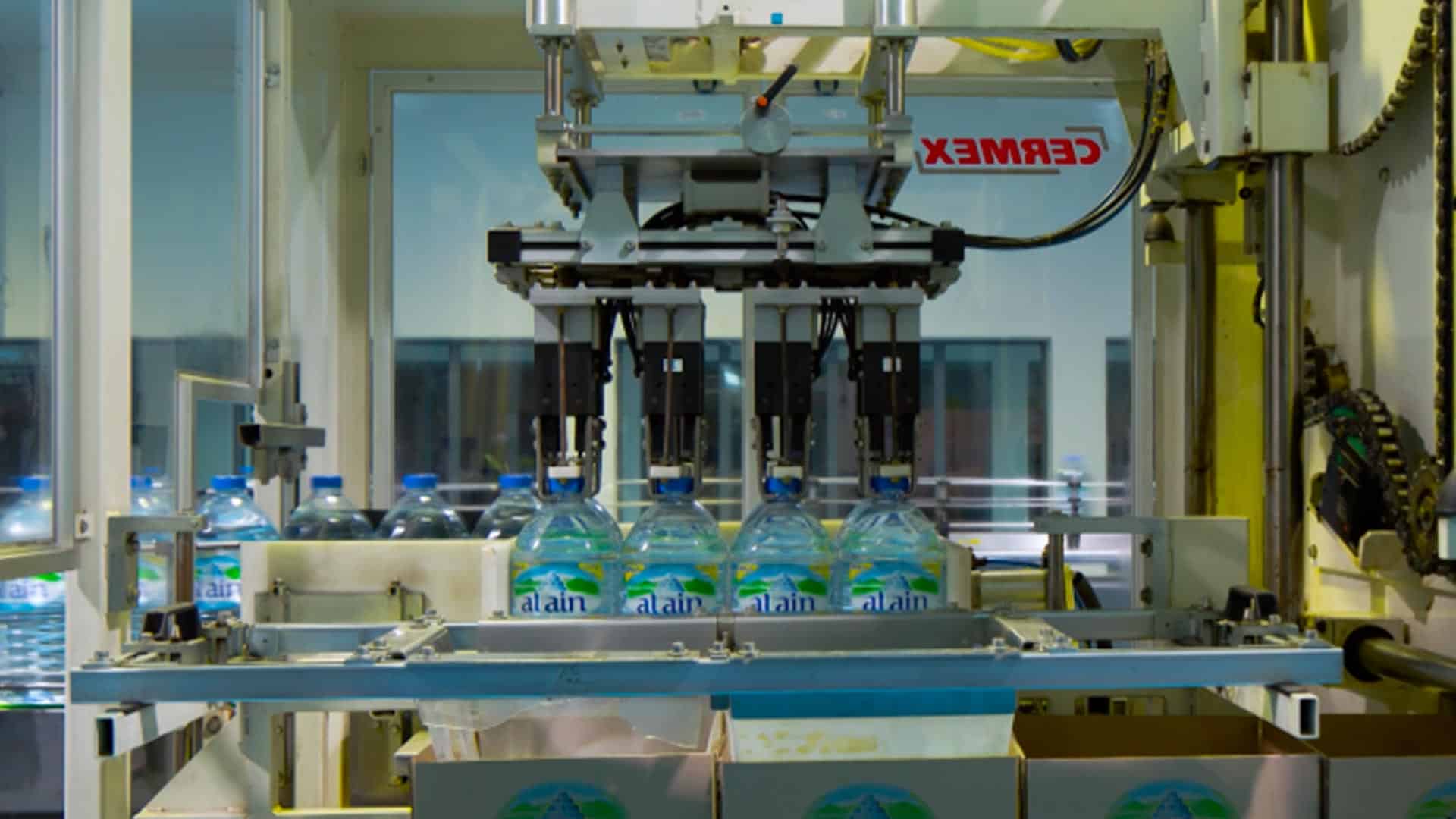

The group’s products are currently available in more than 45 markets in North America, Europe, Asia, North Africa and the Middle East.

Its exports contributions from the consumer and global business sectors to the group’s revenues increased by 84.5 percent and 4.9 percent, respectively.

In contrast, every quarter, the group’s consumer business sector has represented 73 percent of its total sales, valued at AED1.5 billion, he said in conclusion.